China’s Deleveraging Gathers Pace as Debt-to-GDP Ratio Falls Again

China’s total nonfinancial debt as a percentage of GDP has declined for the third straight quarter, the first time that’s happened since the 2008 Global Financial Crisis, data published in a study by a state-backed think tank show.

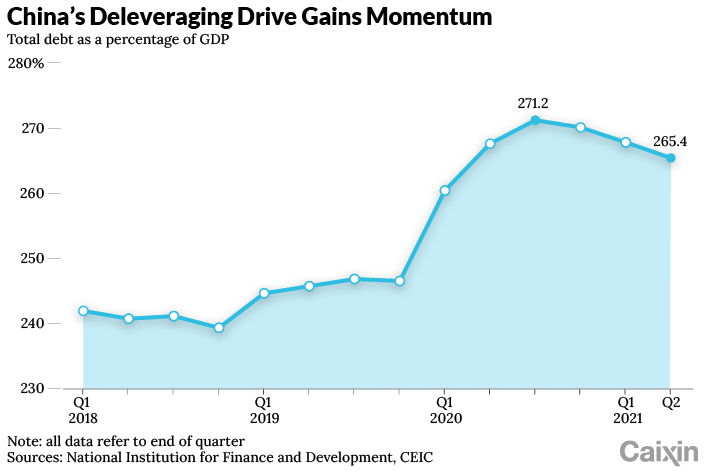

China’s overall leverage ratio, which measures outstanding debt in the real economy against nominal GDP, fell to 265.4% at the end of June, 2.6 percentage points lower than at the end of March and 5.8 percentage points down from the record high of 271.2% at the end of September, according to a report (link in Chinese) released Friday by the National Institution for Finance and Development (NIFD).

Nevertheless, the report warned of the potential negative fallout from the reduction in the leverage ratio including a weakening of companies’ willingness to invest, a slowdown of the post-pandemic recovery in the economy and a greater risk of default among indebted local government financing vehicles.

|

“China achieved a ‘beautiful deleveraging’ in the first half of the year: fast nominal GDP growth led to a decline in the leverage ratio, while the price level, measured by the consumer price index, remained low,” the report’s authors wrote.

The term “beautiful deleveraging” was coined by Ray Dalio, the billionaire founder and co-chairman of global hedge fund giant Bridgewater Associates LP. The key to achieving it lies in striking the right balance between the four levers available to the government — austerity, debt defaults and restructuring, printing money and redistributing wealth — so that there’s enough stimulation to ensure nominal growth is above nominal interest rates but not too much stimulation that will lead to accelerating inflation, a devalued currency and another debt bubble.

China’s nominal GDP, which measures output without taking inflation into account, grew 13.6% year-on-year in the second quarter, and increased 13.5% from the previous quarter, the highest quarter-on-quarter growth rate for an April-June period since 2012. But debt rose at a much slower pace — the second quarter saw debt rise 2.2% from the previous quarter, largely in line with the same period in 2019 before the pandemic, according to the report.

The increase in debt came from the government sector, with nonfinancial corporate leverage and household leverage ratios both declining, according to the NIFD report.

But even the increase in government leverage was subdued, edging up just 0.1% in the second quarter from the first quarter to 44.6% and kept in check by slower issuance of local government debt. In the first half of the year, local governments sold around 42% of their total annual bond quota, less than the normal 60% rate, according to the report. Local governments raised a large amount of funds through the issue of special-purpose bonds last year that cut their demand for funds this year. Beijing has also called for better oversight of local authority budgets and spending, and is seeking tighter monitoring of their debt.

Read more

In Depth: Record Local Government Debt Is Back in Policymakers’ Crosshairs

The leverage ratio of nonfinancial companies fell by 2.6 percentage points to 158.8% from the end of the first quarter, the fourth straight quarterly decline as their appetite for loans moderated, even though sales and profits in the corporate sector overall have recovered sharply this year after being hit by the Covid-19 epidemic in 2020, the report said. It attributed the decline partly to China’s prudent and more targeted monetary policy that’s seen the central bank refrain from injecting too much liquidity into the financial system. Other factors include a slow pace of lending to upstream industries other than those in the manufacturing and infrastructure sectors, and an accumulation of funds on corporate balance sheets last year that has led to a slowdown in demand for new financing that’s also been fuelled by a reluctance to make new investments.

The report warned that the deleveraging campaign may push companies to use their profits to repay debt rather than spend the money on new investments, which could trigger an economic slowdown.

Household leverage, the ratio of household debt to GDP, slid to 62% at the end of June, down 0.1 percentage points from the end of March. The growth rates of both mortgages and short-term consumer loans and their ratios to GDP have declined since late last year, and only the ratio of individual business loans to GDP increased.

The report expects annual nominal GDP growth to reach 13.5% for the full year and the country’s overall leverage ratio to fall to around 263% by the end of year, with the leverage of nonfinancial companies falling by 9 to 10 percentage points this year to about 153%, and that of households and governments both rising by 0.5 to 1 percentage points.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR