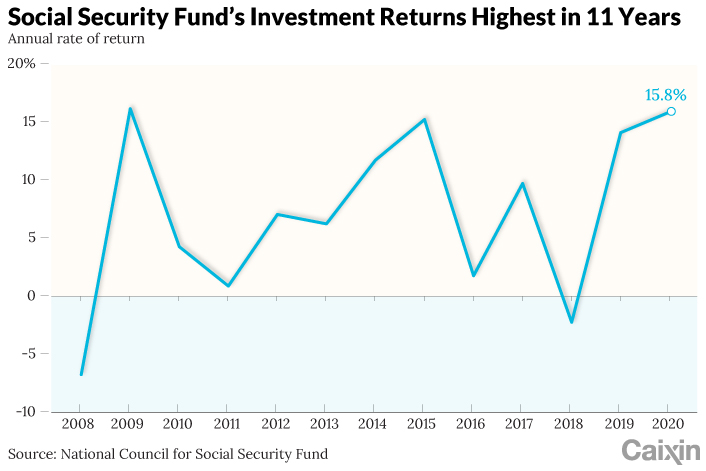

China’s Social Security Fund Posts Highest Return in 11 Years

China’s Social Security Fund (SSF) last year earned the highest return on investment since 2009, as the domestic stock market boomed and it poured funds into advanced manufacturing, strategic emerging industries, and technology innovation.

The fund reported earnings of 378.7 billion yuan ($58.4 billion) on its investments, 30% more than in 2019, the National Council for Social Security Fund (NCSSF), which runs the fund, said in its annual report (link in Chinese) published Wednesday. That represents a return of 15.84%, the highest in 11 years and almost double the annual average of 8.51% earned over the past two decades, according to fund figures. China’s benchmark stock gauge, the Shanghai Composite Index, jumped 13.9% last year.

|

Faced with the impact of the Covid-19 epidemic, the fund stuck to its strategy, gave full play to the “stabilizing” role of long-term funds in the domestic stock market, and worked hard to increase investment returns while preventing risks, the NCSSF said in the report. The fund improved the structure of its fixed-income portfolio, increased investment in equity funds, and seized opportunities to provide capital for new, emerging industries and to finance sustainable investment.

The NCSSF was set up in 2000 to manage and operate the social security reserve fund which is designed to supplement the state pension system administered by provincial-level governments. The fund itself started investing in 2001 (link in Chinese) and is under increasing pressure to boost returns as China’s rapidly aging population and the increase in retirees puts more pressure on the pension system’s finances.

The SSF makes its own investments in bank savings, trust loans, equity investments, equity investment funds, and indexed stock investments, and also entrusts funds to external financial institutions to invest in domestic and foreign stocks, bonds, securities investment funds, and other financial instruments.

The fund receives money through transfers from the government and is also allocated shares in state-owned enterprises (SOEs) — in 2017 the central government released a policy (link in Chinese) requiring the transfer of 10% of state-held equity in large and midsize SOEs to the reserve fund, allowing it to benefit from capital gains as the shares rise in value and to earn income from dividend payments.

Read more

Beijing Completes Equity Transfers Designed to Shore Up Stressed Pension System

At the end of 2020, the total assets of the SSF amounted to 2.9 trillion yuan, including 1 trillion yuan (34.7%) of directly invested assets and 1.9 trillion yuan (65.3%) of investment assets entrusted to external managers. Onshore assets accounted for 90.3% of the total assets, and offshore investment assets 9.7%.

Of the 378.7 billion yuan the fund made in 2020, realized gains amounted to 204.6 billion yuan, while the increase in the fair value of its trading assets amounted to 174.1 billion yuan.

Contact reporter Zhang Yukun (yukunzhang@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR