China’s Total NEV Subsidies Jumped Tenfold Even as Government Slashed Per Unit Handouts

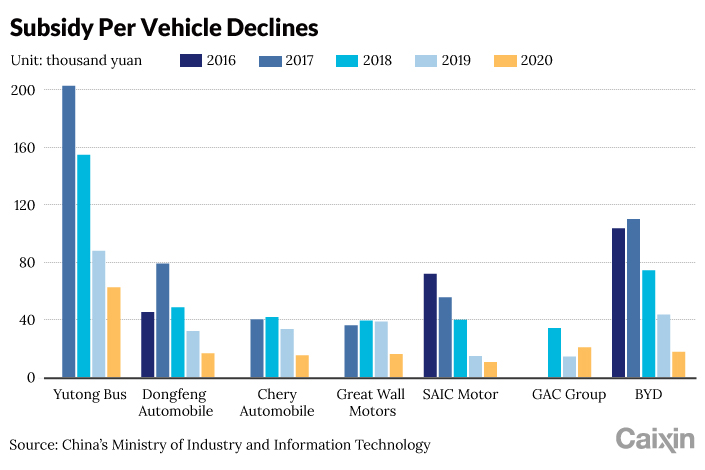

Over the last few years, government subsidies for new-energy vehicles (NEVs) have declined by as much as four-fifths per vehicle, as Beijing looks to wean the industry off the handouts that helped it get off the ground.

However, the dramatic takeoff of sales means that the government paid out over 10 times as much in 2020 compared with 2016.

The country’s Ministry of Industry and Information Technology disclosed Monday the subsidies received by carmakers over the five-year period. According to the data (link in Chinese), China gave out 32.9 billion yuan ($5.09 billion) in total to subsidize electric car production.

In China, NEVs include battery-only electric vehicles, vehicles powered by hydrogen fuel cells and hybrid vehicles that are powered by both traditional fossil fuels and plug-in rechargeable batteries.

The biggest recipient of government cash over the period was NEV-maker BYD Co. Ltd. (002594.SZ), which was handed nearly 4 billion yuan for its sales of around 155,000 vehicles over the five years. However, the subsidy per unit declined from over 103,600 yuan in 2016 to 17,450 yuan last year.

Nasdaq-listed Li Auto, a far smaller NEV-focused player with just 9,858 units sold, also saw its subsidies decrease. Its handout per unit went from 9,878 yuan in 2019 to 6,988 yuan the following year.

Bus-maker Yutong Bus Co. Ltd. (600066.SH), which received 1 billion yuan of subsidies in total, was given almost 203,000 yuan per vehicle in 2017 but only about 62,400 yuan in 2020.

|

Industry leader Tesla Inc. only began to receive subsidies in 2020, receiving about 21,000 yuan for each of the over 101,000 Model Y cars it sold, amounting to 2.12 billion yuan in total last year. Alibaba-backed Xpeng also got its first subsidy in 2020 and received around 23,000 yuan per car, coming to 249 million yuan in total.

Even though per unit subsidies have dropped, the total handout has rocketed, going from 864 million yuan in 2016 to 10.5 billion yuan in 2020. Sales of NEVs eligible for subsidies went from just 7,278 to over 580,000 by the end of the period.

The government was keen to develop China’s NEV sector for several reasons, including improving the country’s air pollution problem and getting a leg-up in a developing technology. But in 2017 Beijing decided to trim handouts to put the industry on a more sustainable track, with the original goal of phasing out all subsidies by 2020.

After the government announced the biggest cut to NEV subsidies in five years in March 2019, sales declined for the first time since 2017 in July, with analysts offering gloomy predictions for the market.

To mitigate this damage, Beijing extended its subsidies and tax breaks. The current goal is to phase out all NEV incentives by the end of 2023, instead of the original target of 2020. Subsidies will be cut 10% year-on-year in 2021, 20% next year, and 30% in 2022, according to a notice (link in Chinese) released in April 2020.

Contact reporter Manyun Zou (manyunzou@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR