Update: Weak Data Point to Mounting Pressures on China’s Economy

China’s economic activity faced mounting downward pressure in November, official data showed Friday, adding to concerns that the world’s second-largest economy will slow further.

Lackluster infrastructure investment, a cooling property market and weak consumption suggest policymakers may make more efforts to bolster the economy.

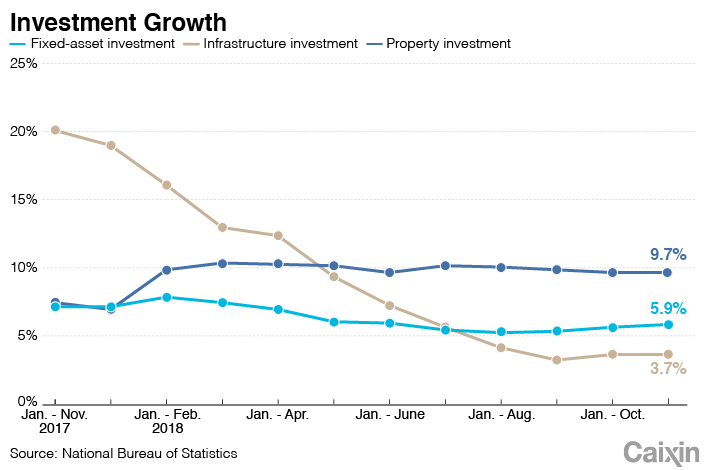

Government-driven infrastructure investment, which includes spending on roads, railways and some other public facilities, rose 3.7% year-on-year in the first 11 months of 2018, according to data released by the National Bureau of Statistics (NBS). The reading is unchanged from that of the first 10 months, which marked the first growth pickup this year.

The figure comes as local governments have nearly used up their bond-issuance quotas. Previously, they had accelerated bond sales and fiscal spending to inject more funds into the infrastructure sector, after Beijing called for bolstering the slowing economy amid an ongoing trade war with the U.S.

|

According to NBS data, fixed-asset investment excluding rural households — a key driver of domestic demand that includes infrastructure investment — rose 5.9% year-on-year in the first 11 months of the year, up from an increase of 5.7% over the first 10 months.

The uptick was mainly driven by manufacturing investment, which grew 9.5% in the January-November period, faster than a rise of 9.1% in the first 10 months.

The property sector continued to cool. Investment in real estate development rose 9.7% year-on-year in the first 11 months of the year, unchanged from the first 10 months.

However, “the contraction of floor space sold continued,” which “appeared to weigh on both funding sources and land purchases,” analysts with Nomura International (Hong Kong) said in a note, analyzing related NBS data.

“Faced with a shortage of funding, property developers continued to ramp up new-home starts to meet presales requirements,” they said.

The weak housing sales momentum will eventually drag on housing starts and construction activity, Louis Kuijs, head of Asia economics at research firm Oxford Economics, said in a note.

Sluggish sentiment

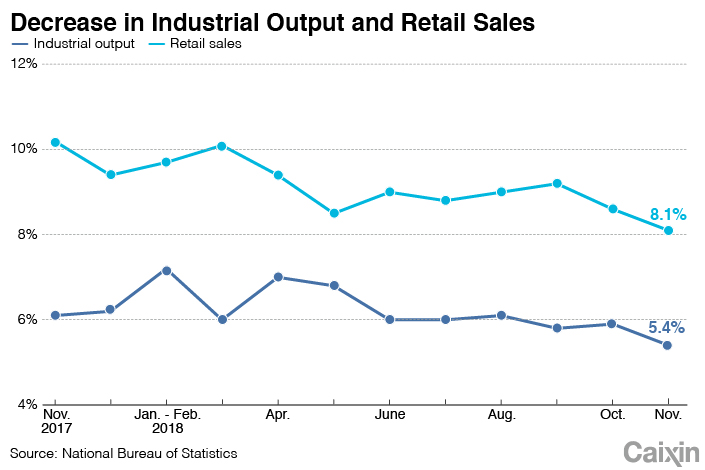

Year-on-year growth in retail sales, which include spending by governments, businesses and households, slid to 8.1% in November, from 8.6% in October, NBS data showed.

The individual income tax cuts could give households a bit more pocket money, but weak retail sales growth in the past two months suggest this is still insufficient, Nomura analysts said. “We maintain our overall bearish consumption outlook given already high household debt levels and sluggish income growth.”

Year-on-year growth in value-added industrial output, which measures production at factories, mines and utilities, dropped to 5.4% in November from October’s 5.9%.

|

“There was a notable drag from the auto sector, which weakened further in terms of sales and output,” Aakanksha Bhat, an economist with HSBC Global Research, said in a note. “Softer consumer sentiment, fast changing consumption habits and stricter policy regulations all likely continued to weigh on auto sales and production.”

Overall, multiple economists are pessimistic about the outlook of China’s economy, and expect this to lead to further policy easing.

In addition to traditional measures, such as reserve requirement ratio cuts and increasing infrastructure spending, Nomura analysts expected game-changing policies like substantial cuts to the value-added tax, yuan depreciation and deregulation in big cities’ property sectors to help the economy bottom out.

The imperative not to “overdo” easing measures continues to contain policy easing, Kuijs said, adding that Thursday’s Politburo meeting did not suggest a change in the overall stance. Besides, the recent truce to the Sino-U.S. trade war is positive, but underlying tensions with the U.S. imply headwinds and risks for China’s economy, he said.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas