Pricey Pork, Fruit Keep Consumer Inflation High

China’s consumer inflation remained elevated in June as growth in both fruit and pork prices continued to hit multi-year highs, while factory inflation stalled amid a further drop in raw material prices, official data showed Wednesday.

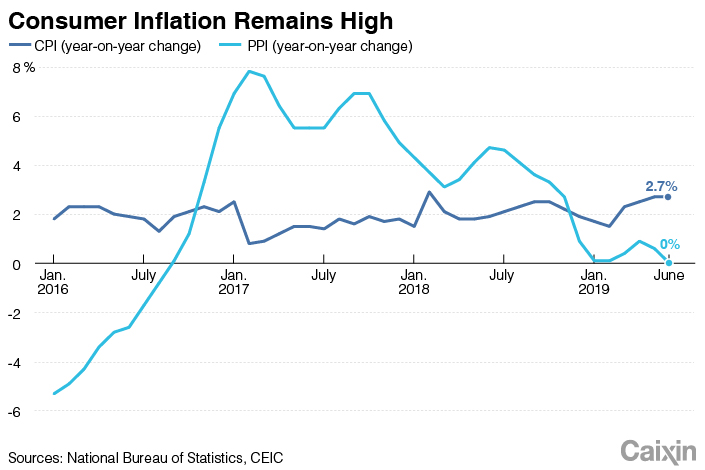

The consumer price index (CPI), which measures the prices of a select basket of consumer goods and services, rose 2.7% year-on-year in June, the same growth as the month before, which had marked the highest level since February 2018, according to data (link in Chinese) from the National Bureau of Statistics (NBS). The reading met the median forecast from a Bloomberg News survey of economists.

The producer price index (PPI), which tracks the prices of goods circulated among manufacturers and mining companies, posted zero year-on-year growth in June, down from a 0.6% increase in the previous month, NBS data showed (link in Chinese). The reading missed the economists’ median forecast of a 0.2% increase and marked the lowest since August 2016.

|

|

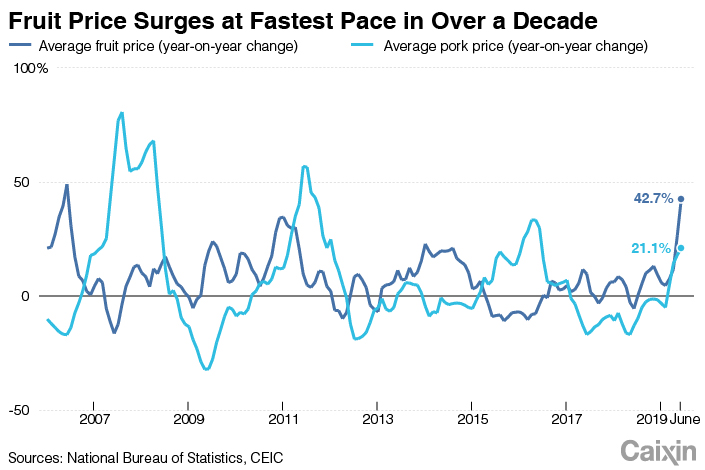

The average price of fresh fruit soared 42.7% year-on-year in June, more than one-and-a-half times the growth of 26.7% in the previous month and hitting the highest level since June 2006, NBS data showed. NBS official Dong Yaxiu attributed (link in Chinese) the sharp rise chiefly to a low comparison base a year earlier and heavy rains in southern China, which hit the fruit harvest and interfered with transporting the harvest.

The average price of pork rose 21.1% year-on-year last month amid the fallout from the country’s ongoing African swine fever outbreak. The price increase is up from an 18.2% rise in May, hitting the highest level since June 2016.

“With pig stocks still tumbling we think increases in consumer prices will start to accelerate again before long,” economists with research firm Capital Economics said in a note. A further rise in CPI growth will not prevent China’s central bank from loosening monetary policy as supply disruptions are chiefly to blame, they added.

Although year-on-year growth in the CPI is expected to rise above 3% in some of the coming months, the upward pressure is likely to ease as the effect of a low comparison base will possibly fade in August, economists with investment bank China International Capital Corp. Ltd. said in a note, adding that year-on-year growth in the nonfood CPI has dropped for months.

Last month’s drop in PPI growth year-on-year was mainly due to continuously falling oil prices and last year’s high comparison base, economists with Nomura International (Hong Kong) Ltd. said in a note.

The PPI fell 0.3% month-on-month in June, down from a 0.2% rise in May, NBS data showed. This reflects weaker domestic demand, Nomura economists said.

Contact Reporters Liu Jiefei (jiefeiliu@caixin.com) and Lin Jinbing (jinbinglin@caixin.com)