In Depth: Former Policy Bank Chief Used Personnel Shifts, Strong-Arm Tactics to Funnel Loans

A man being probed for corruption during his tenure as chairman of policy lender China Development Bank (CDB) allegedly used his position to help two former highflying conglomerates obtain billions of dollars in dubious credit that helped to fuel their meteoric rises, sources close to the matter told Caixin.

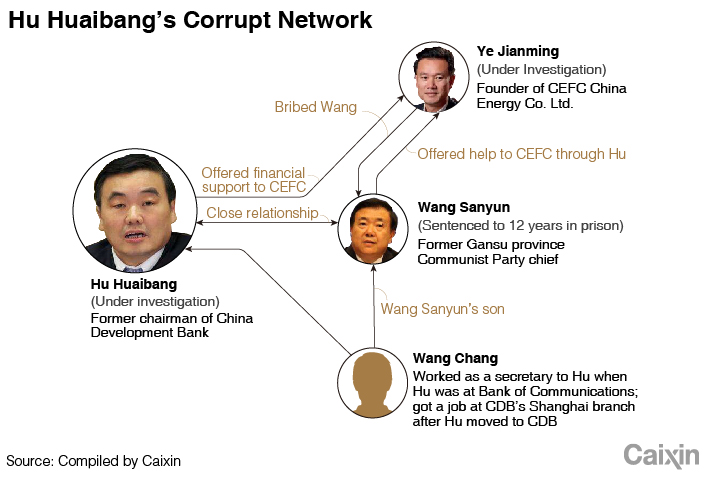

Hu Huaibang, who retired as CDB chairman in September, would resort to tactics that included removing, transferring or simply overruling underlings who opposed his efforts to funnel huge amounts of letters of credit to CEFC China Energy Co. Ltd., the fallen energy and financial conglomerate controlled by secretive tycoon Ye Jianming. Ye himself has also been under investigation since last year.

Hu’s efforts also helped to fuel the meteoric rise of HNA Group Co. Ltd. which went on a multibillion-dollar global buying spree but is now selling many of its purchases to pay down massive debt.

Hu was recently placed under investigation for alleged “serious violations of (Communist Party) discipline and law” — a euphemism for corruption, the Central Commission for Discipline Inspection, the party’s top anti-graft agency, said in a statement (link in Chinese) on July 31.

The probe into Hu and his role in making dubious loans to CEFC and HNA marks the latest chapter in China’s sweeping campaign to clean up corruption at regulatory agencies and companies

Hu, 63, allegedly helped CEFC’s Ye during the conglomerate’s years-long credit-driven expansion, Caixin has learned. That expansion saw the little-known conglomerate amass a wide array of assets in Europe, the Middle East, Central Asia and Africa.

Prosecutors said that during his five years as CDB chairman, Hu helped a CEFC subsidiary obtain a $4.8 billion credit line from the policy bank’s Hainan branch, state broadcaster China Central Television (CCTV) reported on Oct. 11.

|

Hu Huaibang. Photo: IC Photo |

CDB’s lending to CEFC was the result of collusion by people inside and outside the policy bank, rather than a case of unilateral fraud by the company, a source close to CDB told Caixin.

CDB was a crucial creditor to CEFC. As of September 2017, the bank had granted 42.1 billion yuan ($6.1 billion) of credit lines to CEFC Shanghai International Group Ltd., CEFC’s main business subsidiary, which accounted for 68.3% of the total bank credit the company had obtained, according to a bond prospectus it released in early 2018.

In a 2017 interview with Caixin, Ye said that CDB’s support distinguished CEFC from other privately owned companies, underscoring that the company’s goal was “to serve the state’s strategy.” However, CDB’s relationship with the conglomerate exposed it to heightened risks as CEFC deals with a debt crisis in the wake of Ye’s downfall.

Hu helped Ye at the instruction of Wang Sanyun, a former Gansu province party chief who was sentenced in April to 12 years in prison for taking 66.9 million yuan, according to the CCTV report.

Wang Chang, Wang Sanyun’s son, worked as a secretary to Hu for more than one year when Hu was chairman of Bank of Communications Co. Ltd., one of China’s “Big Five” state-owned commercial lenders; and after Hu joined CDB, the young Wang got a job at the policy lender’s Shanghai branch, sources with knowledge of the matter told Caixin.

|

Many green lights

Hu is suspected of regularly greasing the wheels within the bank he led to make sure that CEFC got the money it needed to facilitate its rapid expansion. His tactics included removing officials who questioned such lending. He was also adept at quieting internal noise that emerged over questionable loans, including billions of yuan that CDB issued to CEFC in letters of credit — a short-term financing instrument for traders.

Sources from CEFC said the company mainly relied on such letters of credit to obtain bank loans to support its business expansion. Many private companies used such practices to raise funds around 2009 when commodity and property markets were booming, CEFC founder Ye said in a 2017 interview with Caixin.

Read more

A special report on the investigation casting a shadow on mysterious tycoon Ye Jianming

Zheng Xudong, a former head of CDB’s credit review department, didn’t approve of CEFC’s financing through letters of credit and considered related trade deals fake, a CDB source told Caixin. But he was soon removed from the position, the source added, paving the way for CEFC to obtain tens of billions of yuan in credit lines from the policy lender.

“CDB rarely touched on trade finance previously, especially for such enormous credit lines,” the source said. The source added that in 2014, CEFC Shanghai was given a line of 14 billion yuan in letters of credit from CDB, and the amount rose to 30 billion yuan the next year.

To make sure Ye got the loans he wanted, Hu engineered major personnel changes within the bank, involving more than 50 people, a former senior CDB executive told Caixin. The shuffling included key positions such as directors of the loan committee, the credit review department, the risk management department and the loan management department.

“From the beginning to the end of the loan review process, it was Hu’s own people,” a person from CDB told Caixin. The source added that the whole process under Hu — from credit approval to final lending — fundamentally changed the systems that had been in place at the bank for years.

One of Hu’s main accomplices was bank Vice President Wang Yongsheng, sources told Caixin. Wang was not only director of the loan review committee, but was also in charge of the credit review, risk management, loan management and two project appraisal departments — all core for conducting the bank’s business.

After Wang Yongsheng came under investigation in January 2015, another man — Executive Vice President Zhou Qingyu — took over all of his positions except for the project appraisals. That meant core business functions remained under just one person’s supervision.

The loan review committee is generally the highest review body for a bank’s loan projects. But unlike other banks, CDB’s credit review department is above the loan review committee, bringing together experts familiar with different industries for professional review. Opinions are then sent to the loan review committee, which is composed of bank staffers from different departments, to provide a check-and-balance, a person from the CDB said.

To help CEFC pass evaluations from CDB’s Hainan branch, Hu adjusted the lender’s project risk review mechanisms, Caixin learned from insiders. He allowed all branches to report loan projects directly to the loan review committee rather than subject them to the credit review department, thus removing a major risk assessment step. “This way, there was no department commenting on whether or not the project was suitable from a professional perspective,” a CDB insider said.

Despite the steps Hu took to make sure CEFC’s loans were approved, many people inside the policy lender knew those projects carried risk, and several members of the loan review committee expressed reservations, insiders said. But such loans were still passed by force.

Lending to HNA

In addition to CEFC, controversies have also emerged surrounding CDB’s loans to embattled HNA, one of the highest-profile among a group of Chinese conglomerates that accumulated billions of dollars in assets both at home and abroad in recent years. Many of those conglomerates have been forced to sell off assets since Beijing warned in mid-2017 of financial risks created by their massive accumulated debt.

In late 2012, before Hu’s arrival, CDB raised HNA’s credit line to 100 billion yuan. During his tenure at the policy bank from 2013 to 2018, its loans to HNA grew quickly, a source in CDB told Caixin. The source added that such loans have amounted to nearly 80 billion yuan, more than half of which are now overdue.

At the end of 2017 and in the first half of 2018, Executive Vice President Zhou met with department heads at CDB with an agenda of rescuing HNA, Caixin has learned. At that time, more than 10 department heads argued the difficulty of supporting HNA due to its financial woes and chaotic internal management. Despite that, Zhou — then Hu’s right-hand man — told the central bank and other related authorities that HNA was simply facing liquidity issues. As a result, CDB continued to issue loans to the embattled group, the CDB source said.

Zhou even asked the policy bank’s treasury and financial market department to buy bonds issued by HNA, but the department did not agree, the source said.

HNA has been selling off assets over the last two years to lighten its debt burden, including ones in its newer areas like finance and technology. Earlier this year, it sold its stake in the Guangdong province-based brokerage Lianxun Securities Co. Ltd. At the end of last year, it was reportedly looking to sell Ingram Micro Inc., the U.S. computer component distributor it acquired in 2016.

Stacking the deck

When things started going bad for some loans, Hu would install people he trusted to lead core departments to try to mask the situation. “The huge changes in personnel were mainly emergency cover-up measures to stave off internal disputes,” a CDB source familiar with the matter said.

During his tenure, Hu also added dozens of new senior positions, a way of attracting more supporters. “Many of these positions were just meal tickets and nominal postings,” another insider said.

Several employees from CDB told Caixin that Hu often promoted people at the bank who had been recommended by his favored cohorts, including his wife and son.

“The people that Hu used were basically relevant to his interests,” one employee said. “The obvious ones are those that were transferred more than twice.” According to the staffer, favored personnel would often flip between working at the headquarters and at provincial branches. “Internally, people felt very strange about this, because it violated the usual employment practices.”

Hu also won over colleagues in other ways. Even if an employee was punished, for example, he could still keep his position or even get a promotion if he found the right person to intercede with Hu on his behalf, insiders said.

In one case in 2014, a Communist Party corruption investigation team discovered that CDB’s Tianjin branch head Guo Lin had allegedly taken bribes of 500,000 yuan in cash, and the head of CDB’s market development and equity investment department surnamed Fan had received a bribe of two jade bracelets worth 500,000 yuan. But the two men were never punished after handing over these “gifts,” insiders said.

The bank’s internal supervision bureau proposed demoting Fan. But someone lobbied Hu on his behalf and the matter was swept under the rug, they said. After Hu resigned, Guo was investigated and expelled from the Communist Party in February for violations of party discipline during his tenure in Tianjin.

Hu knew how to control employees and use them from his time serving as chief of the discipline inspection committee at the China Banking Regulatory Commission, China’s former banking regulator that was merged with the insurance regulator last year, a CDB employee said. “Hu Huaibang protected many people but harmed more.” the employee said.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas