Four Things to Know About How Loans Now Get Priced in China

China launched its revamped national loan prime rates (LPRs) Tuesday, with the one-year rate coming in at 4.25%, more or less matching market expectations.

The new national LPRs serve as the cornerstone of a revamped system for setting interest rates for bank loans. It is part of the central bank’s long-held goal to liberalize interest rates by giving the market more influence over borrowing costs. The new rate regime is seen by some analysts as an effort to boost the economy amid the U.S.-China trade war by lowering borrowing costs for businesses.

The change is important because the previous system, based on the central bank’s benchmark rates, could be manipulated by commercial banks, some of which had been cooperating to create an implicit floor on lending rates to protect their own lending margins. The central bank has since banned this practice.

The People’s Bank of China (PBOC) has ordered commercial banks to begin setting loan rates based on the new LPRs, rather than the benchmark lending rates as a reference.

One immediate goal is to lower borrowing costs for companies. At a press conference (link in Chinese) Tuesday, Zhou Liang, a vice chairman of the China Banking and Insurance Regulatory Commission (CBIRC), said he believes the changes to the loan pricing mechanism will make it less difficult for small firms and private companies to get bank loans if they improve the transmission of monetary policy, though by how much will be up to the market.

Here are four things to know about the new loan pricing system.

How the new national LPRs are set

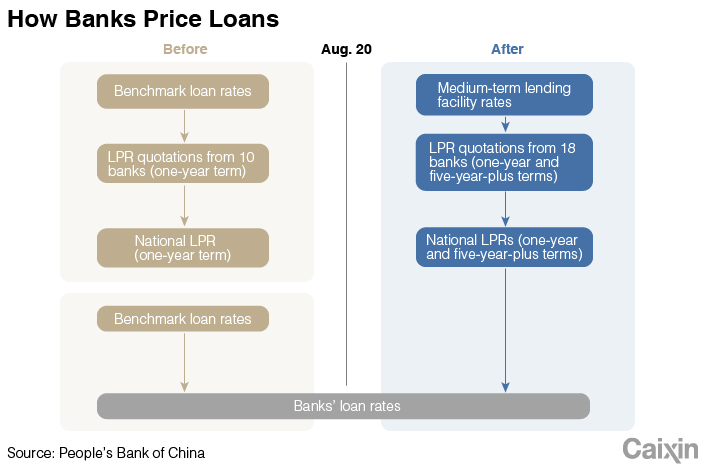

In October 2013, the PBOC’s National Interbank Funding Center launched a national one-year LPR based on the one-year rates that 10 major commercial banks charge their most creditworthy borrowers. It was a move toward creating a more market-oriented lending rate system.

However, despite some fluctuation, that national one-year LPR has remained largely unchanged since October 2015, data from the center show. It has stayed near 4.3% — almost the same as the one-year benchmark lending rate of 4.35%. Moreover, banks seldom used the national LPR as a reference for their own loan rates.

With the goal of making the national LPR more market-oriented, the PBOC published a plan Saturday to revamp how the LPR gets set, and directed banks to begin using it as a reference for their new loans starting Tuesday.

|

The new national LPRs, including one for five-year-plus loans, are set by averaging the LPR quotations submitted by 18 commercial banks, after discarding the lowest and the highest quotes.

The central bank has added eight small and midsize banks, including two foreign-funded banks and two online banks, to the list of 10 nationwide banks that had been allowed to submit quotations for the national one-year LPR under the old regime. The new LPRs are published on the 20th of every month.

The LPRs that commercial banks submit should be linked to the interest rates of the open market operations undertaken by the central bank, chiefly the medium-term lending facility (MLF), a kind of policy lending tool that the PBOC uses to manage liquidity in the financial system. That leaves the central bank with a way to steer borrowing costs for the economy.

What the central bank wants

The central bank wants to liberalize the way commercial banks set interest rates and wants to cut loan rates for companies, which economists from investment bank UBS Group AG described as killing two birds with one stone.

As China’s economic growth has slowed amid an escalating U.S. trade war and sluggish domestic demand, regulators want to boost the economy by lowering borrowing costs for companies, particularly private firms and small and midsize enterprises (SMEs). The focus on helping them is an alternative to the old standbys of using short-term monetary stimulus and easing property market curbs to juice growth. Policymakers have ruled out those options.

All that said, the central bank wants to lower corporate borrowing costs without resorting to cutting its benchmark interest rates, which PBOC Governor Yi Gang described last month as being at an appropriate level.

Instead, it has found an alternative to cutting rates without actually cutting benchmark rates. PBOC Deputy Governor Liu Guoqiang said at the Tuesday press conference that it was helping to cut loan rates through “market-oriented reform.” Analysts from research firm Capital Economics Ltd. and elsewhere described the move as a “quasi-rate cut” because the MLF, which the new LPRs are based on, has a one-year rate of 3.3% — much lower than the one-year benchmark lending rate of 4.35%.

The revamped LPRs will reflect market rates to a greater extent than they did under the previous system, Liu said. They will better reflect funding costs, risk premiums, and the credit supply.

At the same time, they will still leave the central bank with a lever to influence lending rates. By linking LPR quotations to MLF rates, the PBOC will be able to affect the interest rates that banks charge, Ma Jun, a member of the PBOC’s monetary policy committee, said in an interview (link in Chinese) with state-run China National Radio. “In the future, if policy interest rates decline, the (actual) loan rates will decline accordingly.”

How the change will affect borrowers

Analysts are still watching what the PBOC will do next to try to reduce borrowing costs.

Some analysts think the new LPRs will only have “marginal” impact on actual lending rates. “A decline of only a few basis points is small and, unlike a benchmark lending rate cut, it will only feed through to borrowing costs on new loans, not outstanding ones,” economists from Capital Economics said in a note.

A report by Guotai Junan Securities Co. Ltd. said one can’t consider it a “quasi-rate cut” unless the one-year national LPR falls lower than 90% of the official benchmark rate — or below 3.915% — the implicit floor on some commercial banks’ loan rates.

As the system is more market oriented, actual loan rates will vary depending on the type of borrower. Economists from UBS said “the new LPR system may benefit more large companies that have stronger bargaining power vis-à-vis the banks than SMEs.”

That said, banks may need to do some “national service” by lowering their average loan rates, but then might try to make up for their lower profits by increasing the price of riskier loans to private firms and SMEs, according to economists at Nomura International (Hong Kong) Ltd.

Some analysts expect that the PBOC will “soon” cut the MLF rates as its next move to lower loan rates.

How the new national LPRs could affect lenders

Economists expect that the reform will cut into commercial banks’ lending margins. A report by Moody’s Investors Service said the narrower margins on loans will encourage banks to agree to riskier loans, which will reduce the quality of their assets.

An analyst at Zhongtai Securities Co. Ltd. said the reform will have more of an impact on banks with low bargaining power than those with high bargaining power. The Moody’s report expects that “banks with large loan exposures due for re-pricing in the near-term will be more immediately exposed.”

The pressure on banks will finally be transmitted to borrowers, some analysts said. Wang Yifeng, the chief banking analyst of Everbright Securities Co. Ltd., said smaller borrowers could benefit from lower rates in the short term due to direction from policymakers, but based on the assumption that banks price loans in a totally market-oriented way, the quality firms should be the ones that benefit from lower rates.

Peng Qinqin contributed to this report.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)