CX Daily: How China Avoided the Domino Effect of a Local Bank Crisis

Banking /

Cover Story: How China prevented a local bank crisis from snowballing

China’s mammoth banking sector will record its first formal bankruptcy case as regulators wind up the debt cleanup at troubled Baoshang Bank, a regional lender at the center of a sprawling financial empire once controlled by fallen tycoon Xiao Jianhua.

Under a government-led restructuring, parts of Baoshang’s good assets were taken over by newly formed Mengshang Bank and Hong Kong-listed Huishang Bank. State investors including a national deposit insurance fund managed by the central bank and the government of the Inner Mongolia autonomous region took part in the restructuring.

As Baoshang moves toward liquidation, regulators are wrapping up a three-year effort to dismantle risky assets of Tomorrow Holding, one of the highest-profile targets in the country’s crackdown on irregularities in the $45 trillion financial market.

FINANCE & ECONOMICS

Fintech /

Ant Group picks advisers to move a step closer to blockbuster IPO

Ant Group, the fintech arm of Chinese e-commerce giant Alibaba Group Holding, submitted an advisory filing with China’s securities regulator for its highly anticipated blockbuster initial public offering.

CICC and CSC Financial will act as advisers on the company’s domestic listing, according to a filing published Friday on the official website of Zhejiang Regulatory Bureau of the China Securities Regulatory Commission. Shanghai-based law firm Fangda Partners and accounting firm Ernst & Young Hua Ming LLP will also participate in the advisory work.

Ant Group’s directors, senior management and shareholders with at least a 5% stake will be advised to fully understand related law and regulations on listing on Shanghai’s Nasdaq-like STAR Market and the responsibilities concerning information disclosure.

Yuan /

China wants to make the yuan easier to use in cross-border trade, investment

China’s central bank said it will further remove restrictions on using the yuan across borders and will continue opening domestic financial markets in Beijing’s effort to enable the yuan to better compete with other major currencies.

The People’s Bank of China (PBOC) said (link in Chinese) it will insist on a market-oriented method to facilitate trade and investment and further expand access to foreign investors who use the yuan to invest in Chinese bonds and stocks, according to its latest annual RMB Internationalization Report, which was released Friday. The report touted that the cross-border use of the yuan sustained rapid growth last year even as economic growth slowed. However, the internationalization of the yuan still has a long way to go given the currency’s small share in the global market.

PBOC: Yuan plays positive role in global monetary system

Regulator /

Securities watchdog’s new draft rules target dodgy third-party trading platforms

China’s securities watchdog issued draft regulations aimed at tightening control over how brokerages should use third-party platforms, following a spate of private data leaks and concerns that some apps may be operating illegally.

The draft rules (link in Chinese) released Friday by the China Securities Regulatory Commission (CSRC) stipulate that securities firms must “guarantee technical security” by running their own information systems and ensuring third-party platform operators cannot get their hands on clients’ data. They bar the platforms from offering similar services to those provided by securities firms, such as finding investors and receiving trading instructions, and require brokerages to clearly inform investors when they are using services on third-party platforms. The commission is soliciting public feedback on the regulations until Sept. 15.

Editorial /

Editorial: More fiscal reform needed to get a handle on local government budgets

"In a turbulent year, China’s fiscal policy, and especially the relationships between the central and local governments, has come under scrutiny," Caixin editors say in an editorial.

"Under the impact of the coronavirus pandemic and China’s ongoing economic recovery, the role of fiscal policy is weighing heavily, and we need to act decisively and focus on concrete results," the editorial argues. "The measures we take will only work if we accelerate the refinement of the fiscal relationship between central and local governments, develop tax categories for local entities, rationally delineate central and local duties and responsibilities, and strengthen local fiscal capacity in a practical way."

Quick hits /

ChiNext set to debut first batch of registration-based IPOs Aug. 24

BUSINESS & TECH

|

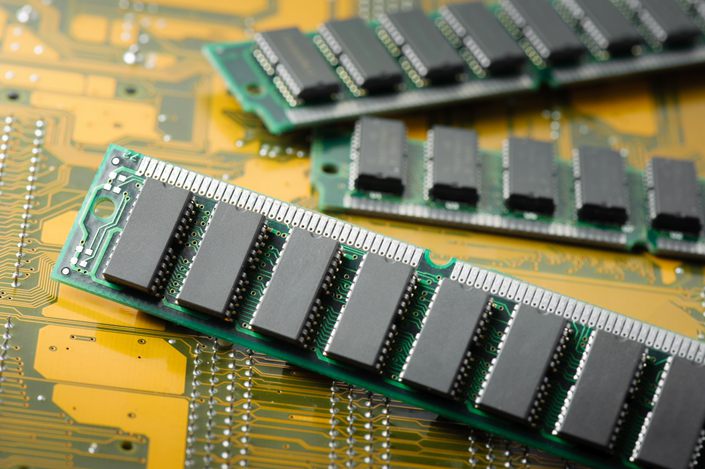

China made a major breakthrough in its quest to become more self-reliant in the semiconductor industry when ChangXin’s DRAM chips reached the market. Photo: IC Photo |

Chips /

In Depth: China creates new memory chip champ, but will customers come?

When an $8 billion factory in Eastern China’s Anhui province recently revealed it had found customers for its dynamic random access memory (DRAM) chips, high-tech boosters from across the country broke out the champagne.

Four years after its founding, ChangXin Memory Technologies Inc. had finally come of age by becoming China’s first-ever company to design and produce the chips that are a central component of most computing devices.

As tensions between China and the U.S. continue to grow by the day, many are predicting a technology “cold war” that could leave ChangXin as one of the Chinese companies in position to benefit the most. But more than government support is needed to make products the market wants, and the company needs to prove its chips are dependable and competitive with those already out there, industry experts said.

TikTok /

Trump orders sale of TikTok’s U.S. assets within 90 days

President Donald Trump Friday ordered the Chinese owner of the popular music video app TikTok to sell its U.S. assets, citing national security concerns and delivering the latest salvo in his standoff with Beijing.

Trump’s decision came after an investigation by the Committee on Foreign Investment in the U.S., which reviews acquisitions of American businesses by overseas investors for national security concerns. ByteDance Ltd. bought the app Musical.ly in 2017 and merged it with TikTok. Trump said in the order released Friday night, which has a 90-day deadline, that ByteDance “might take action that threatens to impair the national security of the United States.”

Microsoft weighs buying TikTok’s U.K. services too, reports

Supply chains /

China’s loss may become India’s gain in shifting supply chains

India’s latest set of incentives to entice businesses moving away from China seem to be working, with companies from Samsung Electronics Co. to Apple Inc.’s assembly partners showing interest in investing in the South Asian nation.

Prime Minister Narendra Modi’s government in March announced incentives that make niche businesses — electronics manufacturers — eligible for a payment of 4% to 6% of their incremental sales over the next five years. A result: About two dozen companies pledged $1.5 billion of investments to set up mobile-phone factories in the country.

Besides Samsung, those that have shown interest are Hon Hai Precision Industry Co., known as Foxconn, Wistron Corp. and Pegatron Corp. India has also extended similar incentives to pharmaceutical businesses and plans to cover more sectors, which may include automobiles, textiles and food processing under the program.

Smartphones /

Xiaomi introduces four new executives onto its partners board as company focuses on AI and IoT

Xiaomi Chairman and CEO Lei Jun expanded the number of senior executives on the company’s partners board with four new appointments. The partners team is seen as having tremendous influence over the company’s future direction, development and culture.

In a letter to his staff, Lei, whose company Xiaomi ranked 422nd on the Fortune Global 500 list for 2020, announced the appointment of four senior executives onto its elite management team, according to a transcript published Sunday on Xiaomi’s public WeChat account. The newly appointed partners include Xiaomi President Wang Xiang, Xiaomi Senior Vice President Chew Shouzi, Xiaomi Vice President Zhang Feng and Xiaomi Vice President Lu Weibing, who joined the company during the period between July 2015 and January 2019.

Quick hits /

Shenzhen boasts world’s biggest 5G network

JD.com, Trip.com tie up as domestic travel comes back to life

China Evergrande shares slump as virus, discounts slash profit

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas