Cover Story: How China Prevented a Local Bank Crisis From Snowballing

China’s mammoth banking sector will record its first formal bankruptcy case as regulators wind up the debt cleanup at troubled Baoshang Bank, a regional lender at the center of a sprawling financial empire once controlled by fallen tycoon Xiao Jianhua.

Inner Mongolia-based Baoshang will file for bankruptcy as it has been deep in insolvency, the People’s Bank of China (PBOC) said in its second-quarter monetary policy report issued Aug. 6. The equity of its original shareholders and unprotected creditors’ rights will be liquidated in accordance with law, the central bank said.

The decision makes Baoshang the first Chinese commercial bank to go bust in decades, a rare case as authorities have long been reluctant to allow lenders to fail. The midsized bank was placed under state custody in May 2019 in the first state bank seizure in nearly two decades.

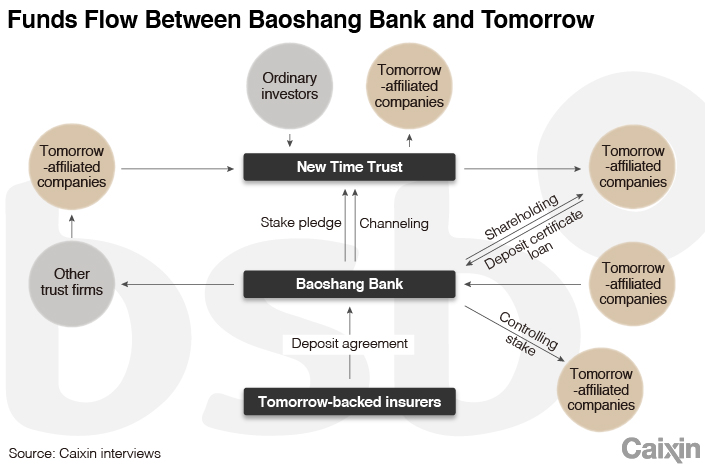

Baoshang was 89% owned by Tomorrow Holding, a private conglomerate built by Xiao, who fled to Hong Kong to avoid Chinese mainland authorities’ corruption crackdown and was placed under investigation in January 2017. As a central piece of an extensive funding web controlled by Tomorrow, Baoshang was used as a piggy bank by its largest shareholder to misappropriate billions of dollars, leaving the bank with a financial black hole of 220 billion yuan ($32 billion) and severe credit risks to its customers, according to regulators.

The Baoshang case triggered fears that its problems could spread through the financial system and that other small Chinese banks faced similar risks. The lender relied heavily on the interbank market, where banks borrow from each other, using funds borrowed there to bolster its liquidity, which allowed it to increase leverage. Regulators later injected hundreds of billions of yuan into the market to calm jitters.

The collapse of Baoshang reflects corporate governance failures in financial institutions that fed corruption and misconduct, sending a warning shot to many small and midsize banks, regulators said.

Under a government-led restructuring, parts of Baoshang’s good assets were taken over by newly formed Mengshang Bank and Hong Kong-listed Huishang Bank. State investors including a national deposit insurance fund managed by the central bank and the government of the Inner Mongolia autonomous region took part in the restructuring.

The state deployed about 170 billion yuan of public funds, including money from the national deposit insurance fund, the central bank’s relending and other liquidity tools to rescue Baoshang’s creditors.

Baoshang had about 4.73 million customers, including 4.67 million individuals and 63,600 corporate clients, when it was taken over, according to the PBOC.

As Baoshang moves toward liquidation, regulators are wrapping up a three-year effort to dismantle risky assets of Tomorrow, one of the highest-profile targets in the country’s crackdown on irregularities in the $45 trillion financial market.

Founded in 1999, Tomorrow grew into a sprawling conglomerate that controlled a vast number of financial institutions and listed businesses through complicated shareholding arrangements and numerous shell companies. Leveraging the murky ownerships and sometimes illegal transactions among connected parties, Tomorrow turned the financial institutions into fundraising vehicles to serve its capital needs.

Weeks before the announcement of the Baoshang liquidation, top financial regulators assumed control of nine financial institutions linked to Tomorrow. The simultaneous seizure was the most aggressive step taken by Chinese regulators to deal with risky financial institutions. But officials said the move won’t trigger systemic risks as careful assessments and efforts were made to restore market order after the Baoshang takeover.

Sources close to the matter said regulators took the unusually aggressive step of seizing the nine companies because Tomorrow failed to deal with the risks itself. In nearly three years since Xiao’s detention, authorities ordered the conglomerate to dispose of risky assets and recoup misappropriated capital, but the measures didn’t resolve the company’s problems, and new debt risks continued emerging, forcing regulators to take action, they said.

A regulatory official told Caixin that the move was made to protect investors’ interests. With a huge amount of funds misappropriated by large shareholders, financial companies controlled by Tomorrow would expose investors to unpredictable risks if the problems were not resolved, the official said.

|

$32 billion black hole

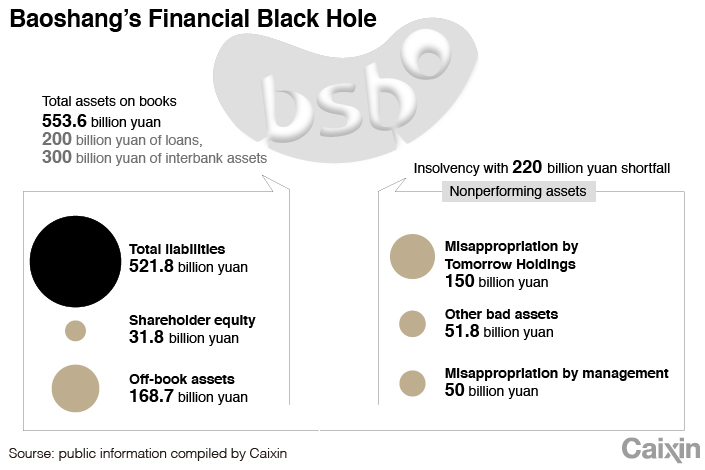

Baoshang had 553.6 billion yuan of total assets on its books with 521.8 billion yuan of liabilities when it was taken over by the state. It had only 200 billion yuan of outstanding loans but nearly 300 billion yuan of transactions with more than 700 partners on the interbank market. Shareholder equity totaled 31.8 billion yuan. Regulators’ inspection of the bank’s assets found a 220 billion yuan capital shortfall, mainly caused by bad loans to Tomorrow and its affiliates.

From 2005 to 2019, Tomorrow illegally borrowed 150 billion yuan from Baoshang through 209 shell companies in the form of 347 loans that all ended up becoming nonperforming. An additional 50 billion yuan was embezzled by the management, regulators found. The misappropriated funds have never been returned. The bank’s assets were gradually chipped away, resulting in severe financial and operational risks and violating the interests of other shareholders and all depositors, regulators said.

“Loans to Tomorrow-affiliated companies had always been the priority in Baoshang,” a former bank employee told Caixin.

Risk control was never fully applied for deals with Tomorrow. Almost all loans Baoshang extended to Tomorrow-related companies turned bad, and many of the borrowers were shell companies registered only for the borrowing, another Baoshang source said. The bank never pursued the defaulters and shouldered the extra financial costs itself, the source said.

In addition to borrowing from Baoshang, Tomorrow and affiliates also pledged stakes in the bank to other financial institutions for loans. For instance, between 2011 and 2017, Tomorrow-controlled trust firm New Times Trust Co. Ltd. issued hundreds of trust products backed by Baoshang stakes, raising tens of billions of yuan for Tomorrow-related companies. Baoshang’s stakes were often overvalued in New Times Trust’s products, a market source said.

“The valuation was not excessive but outrageous,” the person said. “It is like a Ponzi scheme.”

Since 2017, Tomorrow-affiliated companies have never repaid a penny to Baoshang, a regulatory official said.

To cope with the bank’s crisis, regulators originally planned to invite strategic investors to bring in new capital However, new investors were unwilling to take part, according to the central bank’s report. To restore investor confidence, authorities used public funds to support the Baoshang restructuring and protect individual depositors from losses.

|

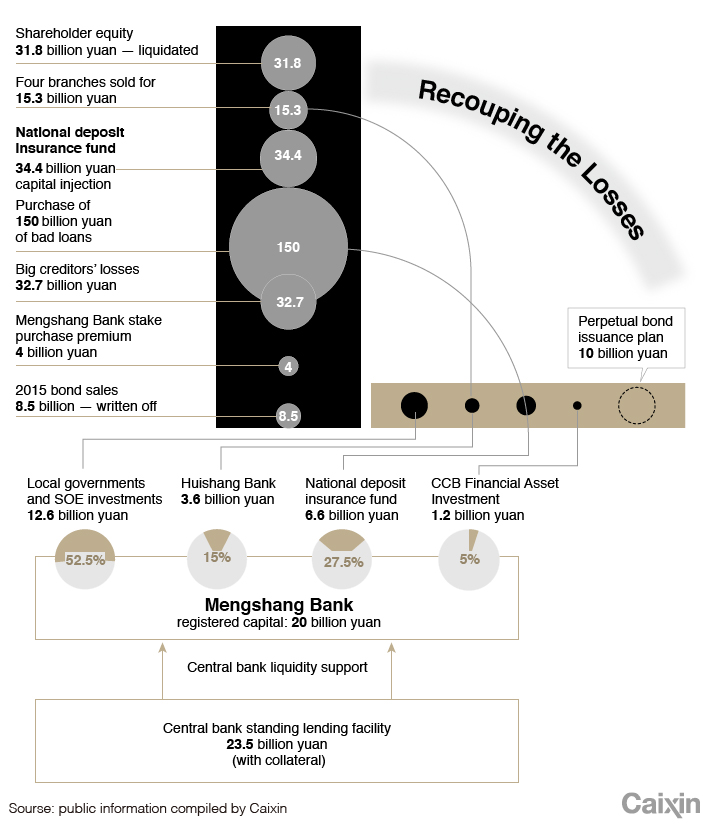

Under the restructuring plan, the new Mengshang Bank was set up to take over Baoshang’s Inner Mongolia-based operations and wealth management business. The central bank-backed national deposit insurance fund invested 6.6 billion yuan into Mengshang Bank for a 27.5% stake. The rest of the bank is held by Huishang Bank, CCB Financial Asset Investment Co. Ltd., local governments and several state-owned companies.

Meanwhile, Huishang Bank, which lost about 6 billion yuan on interbank transactions with Baoshang, took over Baoshang’s assets outside Inner Mongolian, including its branches in Beijing, Shenzhen, Chengdu and Ningbo. The national deposit insurance fund provided 34.4 billion yuan to Huishang Bank to help cover its losses, according to the bank.

The deposit insurance fund also acquired Baoshang’s 150 billion yuan of Tomorrow-related bad loans based on market value. In addition, the central bank provided 80 billion yuan of relending and 23.5 billion yuan of liquidity support through a standing lending facility, the central bank said.

Such actions allowed 90% of big creditors’ debts to be repaid, compared with less than 60% on average without state intervention, the PBOC said. Caixin learned that big creditors incurred total losses of about 30 billion yuan.'

|

Corporate governance failure

In November, authorities launched an investigation of Li Zhenxi, Baoshang’s chairman since 2008. A veteran of Baoshang, “Li was promoted all the way up by Xiao Jianhua,” a bank employee said.

Multiple sources told Caixin that investigators are probing Li for about 50 billion yuan of nonperforming loans that Baoshang made to companies linked to Li. Copying the financing tactic of Tomorrow, Li created a smaller web of companies under his own control to illegally borrow from Baoshang, they said.

|

| Li Zhenxi |

Under Li’s instruction, Baoshang acquired stakes in a number of smaller financial institutions to serve its funding needs, including a controlling stake in Sinatay Insurance and minority stakes in China Zheshang Bank, Hankou Bank, Changchun Rural Commercial Bank and Shanxi Houma Rural Commercial Bank. Baoshang also had more than 1 billion yuan of loan deals with CEFC China Energy Co., another troubled conglomerate targeted by the regulatory crackdown, Caixin learned.

“It was a mess inside Baoshang,” an official involved in the takeover told Caixin. “From top to bottom, the institution was completely rotten.”

Loan managers at Baoshang were fully aware of the risks of doing business with Tomorrow, but they never hesitated because no one would be held accountable for the bad loans. Instead, they got rewards from the deals, a former bank employee said.

Before the crisis, Baoshang offered above-market salaries to lure executives. Regulators found that between 2016 and 2018, the average annual pay of senior Baoshang executives was 5 million yuan. Li as the top man was paid 7 million yuan a year, compared with the 4 million yuan paycheck of Tian Huiyu, president of China Merchants Bank, China’s most profitable commercial bank.

Audits after Baoshang’s takeover found that the bank spent 300 million yuan to buy artwork and antiques from Li’s personal interests. However, most of the items were proved to be fabricated with actual values totaling 8 million yuan.

Caixin learned that regulators have pursued a number of Baoshang executives for violations and excessive payments. Some have been punished while others had major salary cuts.

“The fall of Baoshang was not the doing of one individual and did not come overnight,” Zhou Xuedong, former director of the central bank’s general office who headed the takeover team for Baoshang, wrote in a commentary piece. “In addition to failures in corporate governance, poor corporate culture was another important reason.”

Risk cleanup

The fall of Baoshang triggered an anti-graft storm that brought down at least six financial regulatory officials in Inner Mongolia. A broader-scale investigation is still underway, sources said.

In November, Liu Jinming, an official at the Inner Mongolia branch of the China Banking and Insurance Regulatory Commission (CBIRC), was placed under investigation on suspicion of corruption in connection with Baoshang. One month later, two other local CBIRC officials, Jia Qizhen and Chai Baoyu, came under investigation. In June, three retired local financial regulatory officials were probed.

Caixin learned that the officials were targeted for their roles in Baoshang’s violations. Liu is accused of illegal transactions involving multimillions of yuan with the bank, while Jia and Xue are being probed for accepting bribes from Li.

The takeover of Baoshang, the riskiest unit of Tomorrow, is widely seen as a milestone in the history of China’s financial system and in the extraordinary cleanup of Xiao’s risky financial empire.

The government’s efforts to break down Tomorrow were a key part of the crackdown on free-wheeling conglomerates stirring China’s financial market over the past few years. Tomorrow was the most complicated player, using a massive web of affiliates to control financial institutions and serve its own funding needs. Caixin learned that the total amount of funds misappropriated by Tomorrow and affiliates in Chinese financial institutions could top 500 billion yuan, and most of the losses will be difficult to recover.

Over the past three years, Tomorrow has been offloading assets under regulatory orders to recoup some losses. Assets sold include Hong-Kong listed Hengtou Securities Co. Ltd., Guangdong-based brokerage Lianxun Securities Co. Ltd., and regional lenders Bank of Weifang Co. Ltd. and Bank of Taian Co. Ltd. Some of the stakes were sold to state-owned enterprises.

But the measures were not enough to defuse risks, and regulators were concerned that the conglomerate was moving assets around among subsidiaries to seek temporary relief and might be brewing more long-term risks, people with knowledge said. Such concerns spurred regulators to take the aggressive move of seizing the nine Tomorrow-linked institutions in July to dispose of all of Tomorrow’s financial licenses. The nine companies’ businesses are deeply intertwined.

“They must be taken over together as they are all interconnected,” a regulatory official said. The companies were important vehicles for Tomorrow to raise funds through insurance and trust products.

The takeovers signaled the final chapter of China’s years-long effort to dismantle risks of the troubled conglomerates. Financial regulators will gradually shift their focus from cracking down on risks to sustaining control of risks, people close to the regulators said. Mechanisms to monitor and dispose of financial risks have been set up over the years, they said.

Contact reporter Han Wei (weihan@caixin.com) and editor Bob Simison (bobsimison@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR