China Manufacturing Recovery Picks Up Speed, Caixin PMI Shows

China’s economic recovery kept up its momentum last month as manufacturing activity achieved its fastest growth in a decade, a Caixin-sponsored survey showed.

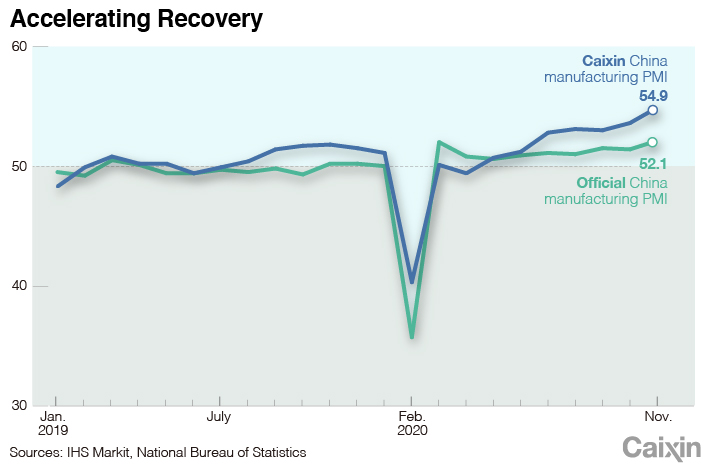

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose to 54.9 in November from 53.6 the previous month, according to a report released Tuesday. Last month’s reading was the highest since November 2010.

A number above 50 indicates an expansion in activity, while a reading below that signals a contraction. The November reading marked the seventh consecutive month of expansion.

|

The breakdown of the Caixin PMI showed that the economic recovery picked up steam in both the supply and demand sides, as the gauges for total new orders and output hit 10-year highs.

Overseas demand accelerated in November as export orders increased for the fourth month in a row. “As production overseas was subdued by uncertainties brought by the pandemic, Chinese enterprises saw an increase in export orders,” said Wang Zhe, senior economist at Caixin Insight Group. “But the improvement in overseas orders was slightly weaker than that of domestic demand.”

China’s export sector has improved for several months. In October, Chinese goods exports rose 11.4% year-on-year in dollar terms, the quickest expansion since March 2019.

Manufacturers have added staff and inventory to meet the strong market demand. Employment, which had dragged down manufacturing recovery for several months, also rose at a faster pace in November after staying just marginally above 50 for two months. The employment subindex hit the highest level since May 2011.

Manufacturers’ purchasing quantity, and stocks of purchases and finished goods all grew faster in November than the previous month.

Inflation pressure picked up as both input and output prices grew at faster rates. “Respondents said a sharp rise in the prices of raw materials, especially metals, was a major reason behind the price hike,” Wang said.

Manufacturers maintained a positive business outlook for the next 12 months, according to the survey. “Optimism was linked to planned company expansions, supportive state policies and hopes that global conditions will rebound once the pandemic ends,” London-based data analytics firm IHS Markit Ltd. said in the Tuesday report.

China’s official manufacturing PMI, released on Monday, rose to 52.1 in November from 51.4 the previous month. The official PMI polls a larger proportion of big companies and state-owned enterprises than the Caixin PMI, which is compiled by IHS Markit.

Many analysts estimated that China’s economic recovery would stay on track in the fourth quarter and into next year. In a Monday note, economists at Nomura International (Hong Kong) Ltd. forecasted year-on-year GDP growth of 5.7% for the fourth quarter, up from actual growth of 4.9% in the third quarter.

“We expect China’s GDP growth to rebound to 8.2% in 2021, led by exports and domestic consumption,” Wang Tao, head of China economic research at UBS Investment Bank AG, said in an opinion piece published last week.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR