Weekend Long Read: PBOC Chief Yi Gang on How China Regulates Big Tech

Yi Gang, governor of the People’s Bank of China, spoke about China’s policy actions on fintech regulation, monopolies and data protection at a keynote speech on Oct. 7 at the Bank for International Settlements’ (BIS) conference on regulating Big Tech. Below is the transcript based on a video of his speech that has not been officially reviewed. It has been edited for length and clarity.

I’m glad to participate in the BIS conference on regulating Big Tech, and to share some of my observations about China’s experience in regulating Big Tech.

First, technical advances have helped promote fintech development in China.

In recent years, new technologies such as AI, big data, cloud computing, distributed ledgers, and e-commerce have been increasingly integrated into financial services and have accelerated financial innovation. New forms of businesses have emerged, such as mobile payments, fintech credit and robot advice. China hosts about 1 billion netizens, which lays a solid foundation for the adoption of fintech. At the end of 2020, five of the world’s top 20 internet platform companies were from China.

Financial innovation promotes the development of fintech and reduces the cost of financial services. Big Tech’s entry into the payment business helped accelerate the development of mobile payments, whose penetration rate has reached 86% in China. With a widespread application of QR codes, merchants do not need to purchase payment terminals, thus significantly reducing transaction costs. In China, the mobile and online payment fees are both less than 0.6%. Users can also enjoy customized financial products when making electronic payments.

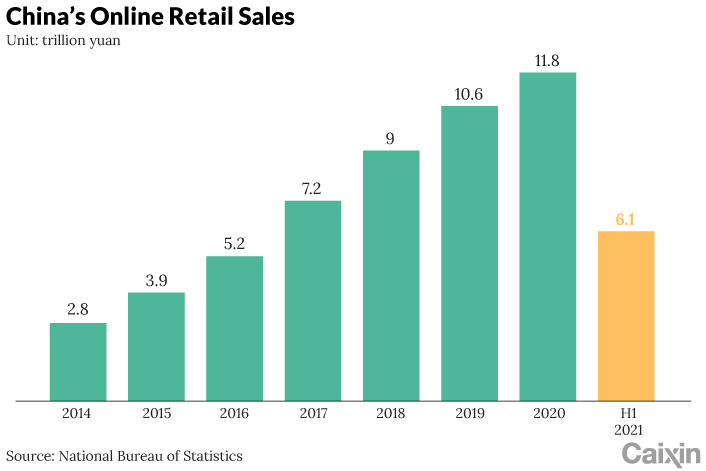

Fintech helps improve efficiency and financial services. Some Chinese big tech companies were among the first to create a smart mechanism to guarantee that sellers can get the proceeds and buyers get their purchased goods, which promoted online consumption. Online retail sale reached 12 trillion yuan ($1.9 trillion) in 2020, up 11% on a year-on-year basis.

|

Some big tech firms have provided internet-based consumer credit and loans for individuals running small businesses. Some used big data to get a fuller picture of borrowers and a more accurate estimate of the probability of default, thus, improving the efficiency of financial activities, while keeping the probability of default at a lower level.

Fintech can also promote financial inclusion. Because of low marginal costs, fintech companies can serve underserved customers that are not covered by traditional banks. Empowered by digital technologies, the whole procedure of credit approval and risk control can become digital, making collateral requirements less necessary.

As a result, the financial needs of small and micro businesses are better served, as they usually borrow a small amount, but need the money urgently. At the end of July, the number of small and micro businesses with loans from Chinese banks has reached over 38 million. Micro loans for poverty relief totaled more than 710 billion yuan and are generally sustainable.

|

Second, fintech’s development creates new regulatory challenges.

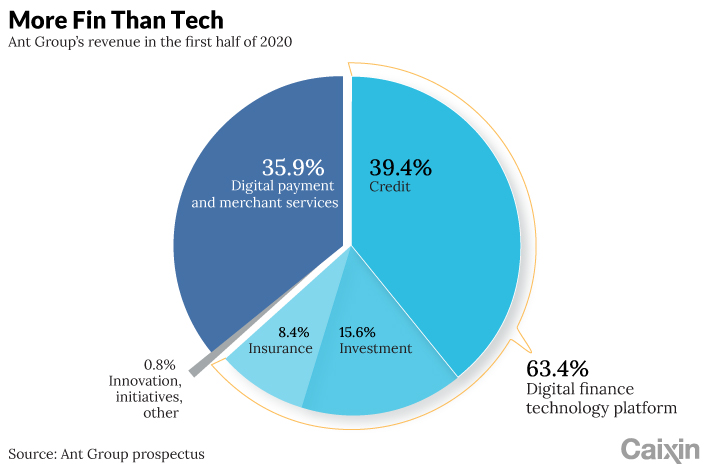

First, some fintech companies have been running unlicensed financial businesses. Top platform companies in China have acquired massive amounts of data from users through e-commerce, payment and search engine services regarding consumers’ identities, transactions, consumption and social connections. These firms then analyzed users’ creditworthiness and cooperated with financial institutions under the guise of supporting lending activities. This actually constitutes a personal credit information business, but has been conducted without proper permission. Some platform companies provided wealth management, credit and insurance services on the same platform, increasing the possibility of cross-product and cross-sector risk contagion.

Second, noncompliance in the payment business deserves attention. In the past, nonbank payment service providers affiliated to platform companies could directly link with hundreds of commercial banks and open accounts with them, which made settlement finality a serious issue and could cause systemic risks. Platform companies invested the funds of customers and payment reserves into various financial assets. They also misled customers by listing credit products including quasi-credit lines as payment options.

|

Third, monopoly has tipped the level playing field. The winner-takes-all nature of platform companies could lead to market monopolies and compromise innovation efficiency. Some platform companies seized market share through cross-subsidization and adopted anti-competitive policies after gaining a dominant position. These anti-competitive practices include blocking competitors from making use of their platforms to provide services, and making barcode payments only available to apps of the same company group.

Fourth, personal privacy and information security are threatened. Chinese consumers usually need to surrender personal information in exchange for the financial services of platform companies. Excessive collection, or even abuse of consumer information, hurts consumers’ information security and privacy.

Fifth, platform companies also pose a challenge to the banking industry. On the one hand, Chinese banks traditionally have the advantages in outlets, consumer information and funding sources, which have been increasingly challenged. The rapid development of innovative online financial products has diverted banks’ deposits. On the other hand, there are about 4,000 small and midsize banks in China. With limited resources, these small and midsize banks have no choice but to rely on platform companies for technology to handle consumer service, credit analysis and risk control. This could undermine their competitiveness and ability to gain customers.

Read more

In Depth: The Rectification and Remaking of Ant Group

Third, China’s regulatory response to challenges of big tech companies.

To address the above challenges, China has continued to fill regulatory gaps and take measures with a view to level the playing field.

In this process, we have the following two points to make. First, we have continued to strengthen policy transparency and predictability, protect property rights and intellectual property rights, protect consumers’ privacy and promote fair competition. Second, following a market-oriented and law-based approach that is also in line with international norms, we have endeavored to create a sound business environment, promote higher-level opening-up and strengthen international cooperation.

The purpose of these measures is threefold. First, financial activities must be licensed. Second, firewalls should be set up to prevent the spread of financial risks across sectors and industries. Third, improper connections between financial information and commercial information should be severed to prevent the “data-network-financial activity” loop.

Some measures can be summarized as cutting direct links. For payments, the People’s Bank of China in 2016 required nonbank payment service providers to cut direct links with commercial banks and to conduct clearing services via legitimate clearing institutions. This was the first direct link to be severed. Since the end of last year, nonbank payment service providers have been barred from listing consumer credit products as payment options. This was the second direct link to be cut. Going forward, we will earnestly implement the measures to strengthen regulations for payment businesses.

On the prudential regulation front, we established a financial holding company management system in September 2020. Platform companies in the financial business are required to set up a financial holding company and to bring all subsidiaries engaged in financial activities under its umbrella. This would help separate financial businesses from technology services. In some sense, it is also a cut of a direct link. Going forward, we have asked financial holding companies to consolidate their balance sheets and strengthen prudential regulation.

Financial activities must be conducted by licensed entities. Platform companies in the financial business should follow the principle of “same business, same rules.” Recently, the People’s Bank of China has asked platform companies to carve out their personal credit information business and provide credit information services to financial institutions through licensed credit information agencies. The purpose of this is to cut the direct link between personal credit services with financial institutions. This could help break the data monopoly and encourage the sharing of information. Going forward, we will continue to improve rules and ask all financial services, such as personal information businesses, to be licensed.

On strengthening anti-monopoly rules and promoting fair competition, to address unfair competition in the payments industry, we have asked platform companies to give consumers more choices for their method of payment, which will help create space for small and midsize enterprises. Going forward, we will continue to cooperate with antitrust authorities to curb the power of monopolies and actively deal with algorithm discrimination and other new forms of anti-competitive behavior.

On data protection and consumer rights, since 2016, China has issued the Cybersecurity Law, the Data Security Law and the Personal Information Protection Law to address irregularities in the collection of information. Financial institutions have been urged to legally collect, use and store information in strict accordance with the principle of “minimum necessary,” in order to protect personal privacy and the right of consumers to know how the data is collected and used. The People’s Bank of China recently issued an administrative guideline for the credit information business, which regulates the credit information industry. Going forward, we will explore to define data ownership in a more accurate manner, facilitate data transactions and promote fair use of data under the premise of safeguarding personal privacy and data security.

Read more

Chart of The Day: China’s Fintech Players Await Their Fate

In conclusion, the booming digital economy has had a far-reaching impact on economic and social development, the means of production, people’s daily lives and global governance. In the era of digital economy, finance and technology are becoming more integrated globally. As “technology for good” is an intrinsic requirement, how we can increase our capacity to innovate while preventing the negative effects of fintech is a common challenge faced by us all.

We are willing to participate in international rule-making for digitalization. We are also willing to strengthen cooperation with international organizations such as the BIS and other jurisdictions on anti-monopoly, financial regulation and data protection to mitigate regulatory arbitrage and cross-border contagion of financial risk.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.