CX Daily: How the Global Semiconductor Industry Turned Into a Free-for-All

Chips /

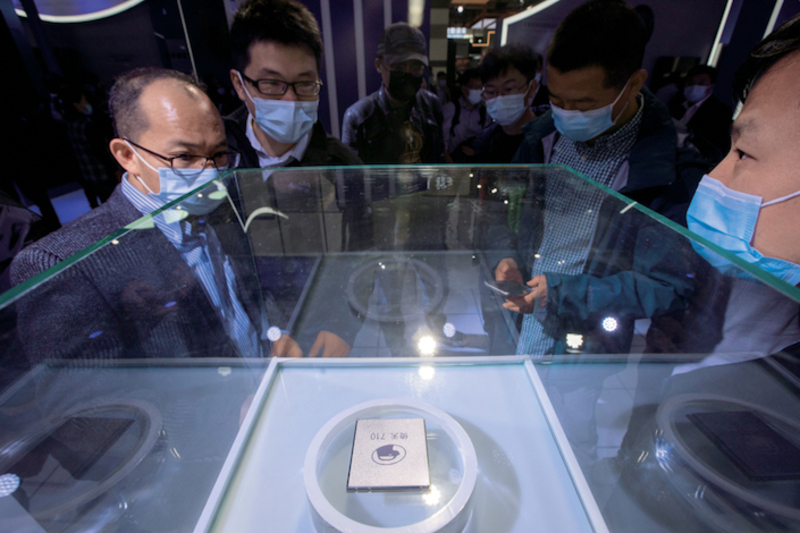

Cover Story: How the global semiconductor industry turned into a free-for-all

The global semiconductor industry is getting increasingly crowded as newcomers pour in from all fronts seeking to gain a foothold in advanced chips to power new technologies.

The rise of artificial intelligence (AI) has fueled demand for high-capacity chips as tech companies and device makers race to deliver smarter services and products. The global chip shortage throughout 2021 prompted many of them to rely more on themselves.

Cloud service giants Amazon and Alibaba Cloud released processors developed in-house late last year that will be used to power servers in data centers. The cloud unit of Tencent Holdings in early November said it started trial production of its own AI chip. In December, ByteDance, owner of short-video app TikTok, also announced progress in its own AI chip development as the company steps into the cloud market.

Covid-19 /

China wages two-front war with omicron and delta on eve of Winter Olympics

A city in China’s central province of Henan was the latest to report new local cases of the omicron variant of Covid-19 Monday as the country battles multiple flare-ups of the highly transmissible delta and omicron variants.

Posing a challenge to Beijing, which is scheduled to host the Winter Olympics next month, the emergence of local omicron cases in the northern port city of Tianjin over the weekend and the rise of delta infections in the provinces of Henan and Shaanxi have put local authorities on high alert, forcing them to beef up travel restrictions and mass testing.

Port city neighboring Beijing scrambles to contain first local omicron flare-up

FINANCE & ECONOMY

Wang Bin. Photo: VCG

Corruption /

Corruption probe of China Life’s chairman was no surprise, sources say

The investigation by China’s top anti-graft authority into the chairman of state-owned China Life Insurance (Group) Co., came as no surprise, people with knowledge of the matter told Caixin, as the financial veteran’s past colleagues have fallen to corruption probes in recent years.

Wang Bin, China Life’s chairman and Communist Party committee secretary, is under investigation on suspicion of serious violations of law and party discipline, the Central Commission for Discipline Inspection (CCDI) said Saturday. Such violations usually refer to corruption.

The Wang investigation is one of the latest in China’s years-long campaign to stamp out corruption, including in the financial system. Late last year, authorities launched a new round of inspections of the country’s 25 major financial institutions and regulatory agencies, which included China Life.

Wealth management /

Zhongzhi Enterprise Group consolidates wealth management units

Chinese investment conglomerate Zhongzhi Enterprise Group will consolidate its four wealth management units into one and keep only one independent fund sales license.

The consolidation is at the request of regulators as part of China’s efforts to tighten oversight of the nation’s $13 trillion asset-management industry.

PE /

Private equity tycoon Wang Chaoyong released on bail

Wang Chaoyong, the private equity tycoon who was detained by police Nov. 30, was released on bail Thursday, Caixin learned from sources with knowledge of the matter.

On Friday, the founding chairman and CEO of Chinaequity Investment Co. Ltd., posted a series of 10 social media updates, relating to news of his company, according to the sources.

Quick hits /

China venture funding hits record $131 billion despite crackdown

Opinion: Why 2021 was a great year for the opening-up of China’s financial markets

BUSINESS & TECH

Xiaomi has been the top smartphone seller in India for the past four years.

Xiaomi /

Xiaomi ordered to pay India $87.8 million of import taxes

Xiaomi Corp. objected to a demand by the Indian government that the company’s local unit pay 6.53 billion rupees ($87.8 million) of import taxes the Chinese smartphone giant allegedly evaded over more than three years.

Xiaomi imported cellphones and parts without including in the transaction value the royalties and license fees paid by Xiaomi India to Qualcomm USA and to Beijing Xiaomi Mobile Software Co. Ltd., India’s Finance Ministry said Jan. 5 in a statement. The India Finance Ministry issued notices to Xiaomi demanding payment of 6.53 billion rupees for the period between April 2017 and June 2020.

India has previously taken tax-related actions against Chinese technology companies. The country’s tax authorities conducted raids at local offices of two foreign mobile phone companies Dec. 21, the authorities said. Local media identified them as Oppo and Xiaomi.

Delisting /

Real estate marketplace Fangdd faces Nasdaq delisting

The dwindling share price of Nasdaq-traded Fangdd Network Group Ltd. led to a delisting warning after the online real estate marketplace reported sharp losses amid China’s property market turbulence.

The warning was issued after the shares closed below $1 for 30 consecutive business days through Jan. 3, Fangdd said in a Friday statement issued before trading began.

Huawei /

Huawei’s carrier chief also takes over enterprise group in latest reshuffle

Huawei Technologies Co. Ltd. appointed the president of its carrier group to also head its enterprise group, Caixin learned, in the latest management change for a company reporting shrinking revenue amid U.S. sanctions.

Ding Yun, 53, will replace Peng Zhongyang as head of the enterprise business group, according to an internal announcement on Huawei’s bulletin system.

Tutoring /

China’s biggest private tutor laid off 60,000 staff in 2021 amid education crackdown

New Oriental Education & Technology Group Inc., China’s largest private tutoring company, laid off 60,000 staff last year, according to its founder, as wide-ranging education reforms turned the industry on its head.

New Oriental also had to pay out nearly 20 billion yuan ($3.13 billion) in severance packages, fees for early lease termination, and returned tuition payments, according to founder Yu Minhong.

Quick hits /

China’s first privately owned high-speed rail starts operation

In-Depth Analysis: Western tech firms will expand in Southeast Asia

GALLERY

More omicron cases spring up in China

Recommended newsletter for you /

China Green Bulletin Premium - Subscribe to join the Caixin green community and stay up to date with the most exclusive insights on ESG, energy and carbon. Sign up here.

Thanks for reading. If you haven’t already, click here to subscribe.

- MOST POPULAR