CX Daily: Who Gets What In HNA’s Complex Bankruptcy Restructuring

HNA /

In Depth: Who gets what in HNA’s complex bankruptcy restructuring

HNA Group Co. Ltd. has finally secured strategic investors for its core airline and airport businesses, and has proposed a restructuring plan for the 321 subsidiaries under its umbrella to their more than 60,000 creditors, moving a key step forward in its nearly eight-month bankruptcy restructuring.

Liaoning Fangda Group Industrial Co. Ltd., a little-known steelmaker, emerged as a dark horse to rescue the conglomerate’s flagship airline unit by injecting 41 billion yuan ($6.3 billion) to help it repay its debts. A Hainan government-owned company will take over a chunk of its airport assets.

Following years of highly leveraged global expansion, HNA was struggling to pay its more than 1 trillion yuan in debt after the government tightened financing rules and oversight for overseas asset purchases in 2017.

Power /

Regional Chinese utilities get nod to raise prices in hope of easing outages

Electric utilities in a handful of Chinese provinces are raising power prices after a nod from the nation’s top economic planner, which is grappling with the contribution of record-high coal prices and withering stockpiles to a worsening power crunch.

Coal-fired power plants in Ningxia, Shanghai, Shandong, Guangdong and parts of Inner Mongolia have increased their fixed rates charged to grid operators by 10%, the maximum allowed under national regulations, a Caixin analysis shows.

FINANCE & ECONOMY

|

Construction cranes perch on buildings under construction in October 2020 in Changzhou, East China’s Jiangsu province. Photo: VCG |

Property /

Banks told to protect homebuyers amid developers’ debt crises

China’s financial regulators signaled moves to slightly ease real estate lending restrictions at two recent meetings that have called on financial institutions to help protect homebuyers, industry insiders and analysts say.

In a Wednesday meeting (link in Chinese) convened by the People’s Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission, regulators asked banks to join state departments and local governments’ efforts to ensure the stable and healthy development of the property market and to protect homebuyers’ interests.

PMI /

Power shortages take the juice out of China’s manufacturing, Caixin PMI shows

Activity in China’s manufacturing sector held steady in September from the previous month, a Caixin-sponsored survey showed, as a power shortage and rising raw material prices dampened factory production.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose to 50 in September from 49.2 the previous month, according to the survey report released Thursday. A number above 50 signals an expansion in activity, while a reading below that indicates a contraction.

Morgan Stanley /

Morgan Stanley’s top Asia executive Christianson to retire

Wei Sun Christianson, Morgan Stanley’s most senior female executive in Asia, will retire at the end of this year after serving the Wall Street bank for nearly two decades.

Christianson, 65, has been Morgan Stanley’s China CEO since 2006 and its Asia-Pacific co-chief executive since 2011. After Christianson’s departure, Gokul Laroia, the bank’s other Asia-Pacific co-CEO, will become the sole CEO of the region, according to a memo from the bank.

Christianson will remain as an advisory director of Morgan Stanley.

Quick hits /

Charts of the Day: China tops global outbound investment table for first time

China keeps cash engine running in ninth day of injections

BUSINESS & TECH

|

CATL has stepped up its efforts to secure a global supply of key battery ingredients. |

Batteries /

CATL acquires Canadian lithium miner in $297 million deal

Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest maker of electric-vehicle batteries, agreed to acquire Canada’s Millennial Lithium Corp. for C$376.8 million ($297.3 million), outbidding rival Ganfeng Lithium in the latest foray to expand access to a key battery-making mineral.

Ningde, Fujian-based CATL will pay C$3.85 per common share of Millennial in cash, representing a premium of about 29% over Millennial’s 20-day average closing price in Vancouver trading, according to a statement from Millennial Lithium.

CATL’s offer beat archrival Ganfeng, one of China’s largest battery makers. Ganfeng in July proposed to pay C$353 million to acquire Vancouver-based Millennial.

Algorithms /

China proposes three-year plan to regulate algorithms

China’s top regulators published a three-year plan to regulate algorithms, furthering efforts to tighten their oversight of online businesses.

The plan establishes three main goals for algorithms: establish a sound governance mechanism, build a monitoring system to detect security risks and handle violations, and ensure their “correct, fair and transparent” use, according to a guideline (link in Chinese) released Wednesday.

Corruption /

Corrupt Beijing housing official had $2 million in cash stashed in his home

Millions of yuan in cash was found in the home of a former municipal official in Beijing, who recently received a prison term for bribery. It is the latest case in China’s campaign against corruption to feature a lower-level official taking extremely large bribes.

The cash was hidden under the ex-official’s bed and inside his closet and bed drawers. The man said he didn’t know how much he took and was surprised by the total, according to a statement published by the country’s top graft watchdog, the Central Commission for Discipline Inspection (CCDI).

Quick hits /

China’s solar panel makers may be next victim of coal-starved power grid

Beijing Winter Olympics to allow spectators, but only those in China

Hong Kong firms start flagging China risks in U.S. filings

ESG /

Caixin ESG Biweekly: Province tries to balance its energy past with an industrial future

GALLERY

|

Honoring China’s fallen heroes |

CULTURE & ARTS

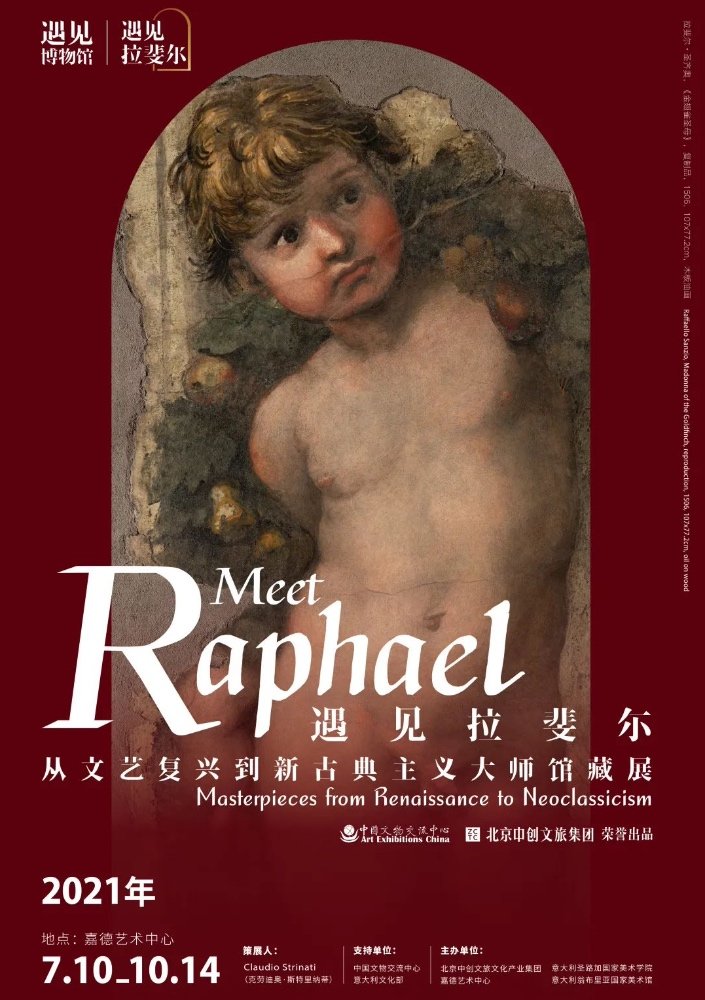

|

Exhibitions in October: Meet Dunhuang at the Palace Museum, and immerse yourself in the paintings of Van Gogh |

Thanks for reading. If you haven’t already, click here to subscribe.

- PODCAST

- MOST POPULAR