In Depth: Is the Next Global Recession in Sight?

As the Chinese proverb says: The moon waxes only to wane, and water surges only to overflow.

After nearly 10 years of steady expansion, the world economy faces growing concerns of a looming recession. There are plenty of reasons to worry as major economies including those of China, Britain and Germany are struggling with downward pressures or entering a contraction, underlining mounting uncertainties in a world rattled by growing protectionism and mounting trade barriers.

Analysts say the question is not whether there will be another recession, but when.

Economists often define a global recession as when global annual growth falls below 2.5%. For a single economy, contraction that lasts two consecutive quarters is seen as an indicator of recession.

Under such a standard, the world has suffered four waves of recession every eight to nine years since 1975. The International Monetary Fund (IMF) in July predicted the global economy would grow 3.2% in 2019, well above the recession redline.

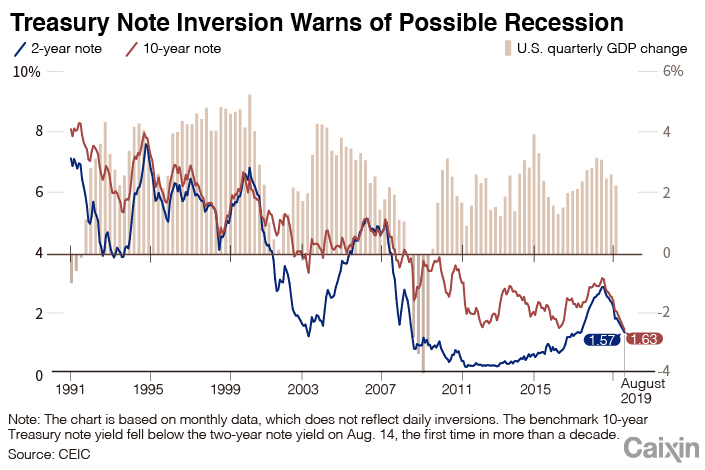

But some alarming signs have appeared. In the United States, which accounts 24% of global GDP, a sharp drop for long-term Treasury yields sparked fears that the good days are heading to an end after the economy enjoyed 40 straight quarters of growth through the end of June.

|

On Aug. 14, the yield on the 10-year Treasury temporarily fell below the yield on the 2-year Treasury for the first time since 2007, a phenomenon known as an “inverted yield curve.” The inversion of the yield curve suggests growing pessimism on the near future and is seen as a strong indicator of an impending downturn, although it often happens months or years before a recession starts. Since 1955, the yield curve has inverted before every U.S. recession.

Wall Street investors were spooked. The Dow Jones Industrial Average plunged 800 points on Aug. 15, the biggest daily drop this year.

America’s economic growth slowed to 2.1% in the second quarter from 3.1% the previous quarter but was still far from a contraction. As analysts debate how far the U.S. is from the next recession, market expectations are turning gloomy.

Standard & Poor's said in an Aug. 15 report that there is a 30% to 35% chance for the U.S. economy to go into recession in the next 12 months, while JPMorgan Chase & Co. put the probability at 40%. Jeffrey Gundlach, founder and CEO of the $140 billion bond-focused investment firm DoubleLine, warned that the possibility of a U.S. recession before the 2020 election is as high as 75%.

U.S. consumption and employment have remained strong, supporting the economy. But a high level of consumer debt will restrain growth, said Xing Ziqiang, chief China economist of Morgan Stanley.

Apart from the financial market indicators, economists are also looking at the American RV market for signs of a weakening economy. Shipments of recreational vehicles were down 20.3% during the first eight months this year after falling 4.1% in 2018. RV sales recorded an eight-year winning streak through 2017. Multiyear drops in RV shipments have preceded the last three recessions.

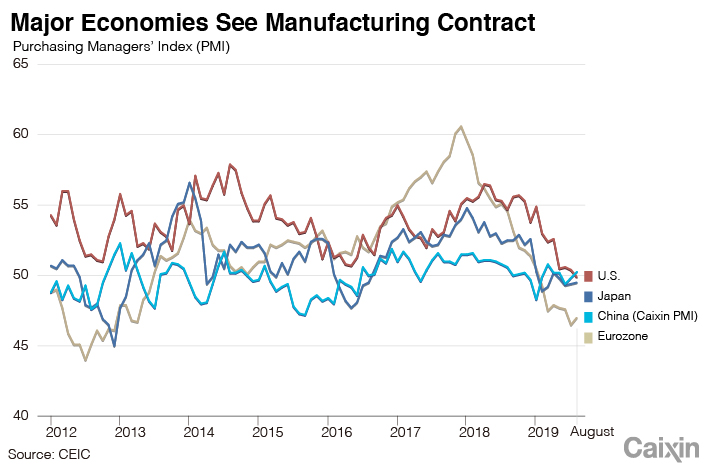

Worrying signs for the U.S. economy underscore the troubles facing the world. Several key economic indicators tracked by Morgan Stanley have touched multi-year lows recently. The global purchasing managers index (PMI), a leading indicator of economic health, touched a three-year low in June, while the PMI focusing on manufacturing slid to a seven-year low in July. Global trade volume slumped to a seven-year low in June, and global real GDP growth is forecast to slow to a six-year-low in the third quarter.

In Europe, leading economies are struggling on the verge of economic contraction. The German economy, which narrowly avoided a recession last year, contracted 0.1% in the second quarter and is expected to continue the trend in the next quarter. The U.K., rattled by Brexit turmoil, booked its slowest quarterly growth since 2012.

The European Commission in May predicted 1.8% growth for the Eurozone this year and a slowdown to 1.2% next year.

In Asia, China has been locked in a bitter trade war with the U.S. for more than a year, escalating a slowdown of growth in the world’s second-largest economy. Although China maintained GDP growth of 6.2% in the second quarter, the rate is the slowest in nearly three decades, and weakening momentum is increasingly visible.

|

China has moved cautiously with stimulus policies and while avoiding property market easing. Photo: VCG |

Neighboring Japan and South Korea also have been embroiled in a trade dispute since early July when Japan placed controls on exports to South Korea of certain chemical materials used to make high-tech products. The spat between the two countries, which account for a combined 10% of the world economy, adds more pressure on global trade damaged by the Sino-U.S. tariff war.

Emerging markets are also affected. Mexico last week adjusted its second-quarter growth to zero, following a contraction of 0.3% the previous quarter.

Global policymakers have taken moves to counter the downturn. The U.S. Federal Reserve on July 31 announced its first interest-rate cut in 10 years, following monetary authorities in a dozen countries including Australia, Russia and India.

But room for monetary policy easing is narrow for most countries after a decade of low interest rates and slow growth, economists said. Governments will have to use fiscal policy to lead the fight against the next recession, they said.

A greater challenge is the changing attitude toward global cooperation. Increasingly inward-looking policies and growing protectionism will make it impossible for countries to move in concert as they did in response to the 2008 financial crisis, analysts said.

Rising tensions between the world’s two largest economies have already taken a toll on the global economy, casting a shadow over business confidence and long-term investment. In a recent research note, Morgan Stanley warned that if trade tensions escalate further, the world “will enter into a global recession in three quarters.”

|

‘Shoot itself in the foot’

If the next recession is on its way, the trade war will give it a boost.

An IMF report in April warned that a 25% tariff by the U.S. and China on each other’s products will drag down America’s growth by 0.3 to 0.6 percentage points, and China’s by 0.5 to 1.5 percentage points.

President Donald Trump threatened Aug. 23 to raise tariff rates on $550 billion of annual Chinese goods by 5 percentage points to 30% or 15%, following Beijing’s announcement of new taxes on $75 billion of annual American imports.

The economic benefits of Trump’s 2018 tax cut, which were expected to increase America’s growth by 1.1 percentage points in 2018 and 2019, have largely been erased by damage from the trade war, economists said.

The trade war’s costs for businesses are not limited to extra tax charges. More importantly, it weakens business confidence and forces American companies to delay investment plans amid market uncertainty, analysts said.

With Trump’s trade war, the U.S. would “shoot itself in the foot,” several economists interviewed by Caixin said.

For China, a lasting trade war is also hurting an economy that was already under downturn pressures. UBS Group AG in mid-August revised its China growth forecast for 2019 down by 0.1 percentage point to 6.1% and for 2020 down by 0.3 percentage point to 5.8%, citing weakening exports, trade uncertainties and a slowing domestic property market.

Lu Ting, chief China economist of Nomura Securities Co. Ltd., said that 25% U.S. tariffs on $300 billion of Chinese goods by the end of 2019 will slow China’s growth by 0.4 percentage points because of slumping exports and manufacturing investment.

A Morgan Stanley survey of 250 multinational companies showed that the escalating trade war is hurting business confidence on China and pushing corporations to consider relocation.

The uncertainties have accelerated a trend of business exodus from China, which started among labor-intensive industries over the past few years amid the country’s rising labor costs. But the trade tensions are forcing some higher-end manufacturers of electronics and machinery to shift away from China, posing business transfer risks to the country, said Zhang Ming, a researcher at the Chinese Academy of Social Sciences, a state-backed think tank in Beijing.

Damage from the China-U.S. trade friction won’t be limited to the two countries.

As the global economy moves toward the end of a long expansion, business investment in many countries has slowed amid uncertainties, said Nouriel Roubini, a prominent American economist and a professor at New York University's Stern School of Business. He argued that recession has already begun in many sectors including manufacturing and technology.

Major indicators of most countries are pointing to slowdown, according to Jim O’Neill, a former chairman of Goldman Sachs Asset Management and a former U.K. Treasury official. “Without an end of the trade war, these trends will be difficult to reverse,” he said.

Preparing for hard times

Businesses and investors have been preparing for economic winter by cost-cutting and shifting to safe-haven assets such as gold and Swiss Francs. UBS last week suggested that global investors “underweight” assets in key stock markets, the first such warning since the Eurozone crisis in 2012. Global banks including Deutsche Bank AG, HSBC and BNP Paribas SA have recently announced job cuts, citing various reasons.

For policymakers, the common weapons used in previous downturns may have less power for the next one as leeway for monetary policy to take effect is narrowing. The current slowdown is caused by weakening demand instead of lack of credit, economists said.

The Fed currently has room to cut rates by 2 to 2.25 percentage points, nearly half the extent of rate cuts in its previous downturn policy maneuvers. Meanwhile, the country faces greater inflation concerns because of the tariff war with China, analysts said.

The European Central Bank has already kept benchmark rates negative.

Mainstream economists have argued that policymakers should adjust their toolkits to use fiscal measures and structural reform to tackle the coming downturn. But most developed economies have long been cautious in applying fiscal stimulus because of concerns about surging deficits and inflation risks.

Former U.S. Treasury Secretary Lawrence Summers said the European and American central banks should acknowledge that they are out of measures and force governments to adopt fiscal policies or stop recklessly adding tariffs.

In the face of the growing downturn pressures, Chinese regulators are also carefully balancing short-term easing policies and long-term stability, said Nomura’s Lu.

Chinese policymakers have signaled plans to bolster the economy through more fiscal loosening instead of monetary easing, while keeping the property market under check. But authorities have so far remained cautious on fiscal loosening with a moderate pace of government bond issuance.

Yu Yongding, a member of the Chinese Academy of Social Sciences, said earlier that China should adopt more expansive fiscal policies to increase investment in infrastructure and public services but keep local governments’ borrowing from banks under control to avoid debt risks such as those that followed the 2008 stimulus.

But there are also debates on how much room China has for fiscal expansion. The government set its 2019 budget deficit at 2.8% of GDP, lower than the 3% level for alarm by international standards. Official data showed that China’s overall government debt ratio stood at 37% of GDP in 2018, well below the European Union’s 60% and lower than most major economies.

But analysts said the figures could be underestimated because of different statistical methods and the exclusion of massive hidden debts of Chinese local governments. The IMF said in an August report that China’s broader government debt ratio could have reached 72.7% in 2018.

Analysts said the more effective way for China to address economic challenges will be to continue reforming the economy, including easing controls on foreign investment, protecting market competition and liberalizing the yuan’s exchange rate.

“The focus of domestic policy is reform and opening-up, not stimulus,” said Wang Han, chief economist of Industrial Securities.

Contact reporter Han Wei (weihan@caixin.com)

- PODCAST

- MOST POPULAR