Major City Land Sales Break Record as Local Governments Fill Budget Gaps

Land sales in major Chinese cities hit a record high in 2019 as officials struggled to fill budget gaps left by tax and fee cuts that have bitten into their fiscal revenue.

Land sales revenue in 50 cities last year grew to a record 4.2 trillion yuan ($601.6 billion) as of Dec. 26, marking a jump of 17.6% from the same period in 2018, according to data provided by a research center of Hong Kong-based Centaline Property Agency Ltd.

“It is the first time that the land sales revenue of the 50 cities surpassed 4 trillion yuan,” said Zhang Dawei, chief analyst at the Centaline research center.

In China, selling land is a major source of revenue for local governments. Technically, developers pay a fee in exchange for the rights to use a piece of state-owned property for a certain number of years.

The figure for the entirety of 2018 was 3.74 trillion yuan, accounting for 61% of land sales revenue nationwide, the data show.

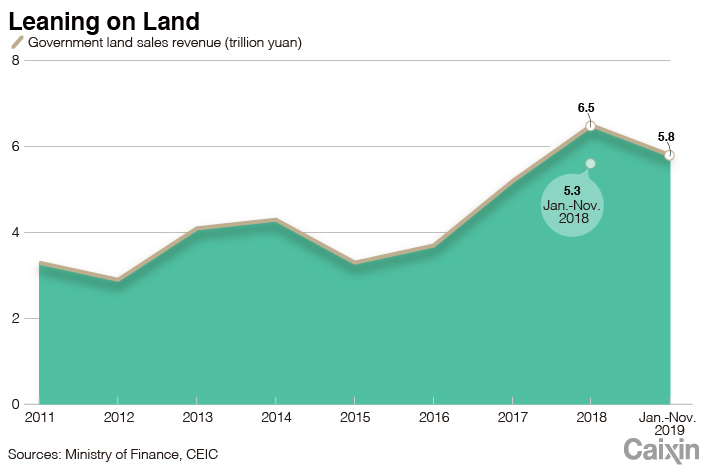

Altogether, local governments in China raised 5.8 trillion yuan through land sales in the first 11 months of 2019, according to data from the Ministry of Finance (link in Chinese). That marked an increase of 8.1% year-on-year and the fifth straight month of acceleration. It is widely expected that land sales revenue for the entire country could break a record in 2019.

|

The increased land sales came after the government imposed tax and fee cuts expected to be worth more than 2 trillion yuan in 2019 in an effort to shore up flagging economic growth. In the wake of the cuts, however, some local governments found it difficult to make ends meet because they had to boost investment spending as a stimulus at the same time. In 2019, local governments as a whole were likely to collect less revenue than what they planned at the beginning of the year, Finance Minister Liu Kun said in a report (link in Chinese) last week.

Read more

In Depth: China’s Whopping Tax and Fee Cut Package Surprised Even Insiders

To deal with the situation, they resorted to multiple sources of revenue, such as selling assets like factories, and creaming off more profits from state-owned enterprises.

Although tighter restrictions on property developers’ financing channels have chilled China’s property and land markets, local governments still want to sell more land to shore up their fiscal revenues, according to a recent report by Huachuang Securities Co. Ltd.

Over the last few months, several local governments have loosened restrictions on land markets to encourage developers to buy, Centaline’s Zhang said.

Some local governments have also sold land for less. In 2019, the eastern city of Hangzhou sold land with 32.5% more floor space as of Dec. 26 than that of the land it sold in the same period the previous year. Nonetheless, its revenue from land sales grew only 11.5% year-on-year, according to Centaline’s data. The story was the same in the southern metropolis of Guangzhou, where the combined floor space of the land sold grew 53.6%, yet revenue from land sales rose only 8.1%.

“Some top developers with a lot of cash are bargaining with local governments to get cheap quality land on the market,” another Huachuang Securities report said in September.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.