China Business Digest: ChiNext Set to Debut First Batch of Registration-Based IPOs Aug. 24; Alibaba and Xiaomi Get into Hang Seng Index

|

|

|

|

The latest indicators are showing China’s economy continues to steam ahead, but employment remains a headache. Meantime, Nasdaq-listed video streaming giant iQiyi says it’s being probed by the U.S. securities regulator. Shenzhen’s ChiNext board is set to debut its first batch of 18 registration-based IPO stocks Aug. 24. Alibaba Group Holding Ltd. and Xiaomi Corp. will be included in Hong Kong’s Hang Seng Index Sept. 7.

— By Tang Ziyi (ziyitang@caixin.com)

** TOP STORIES OF THE DAY

China’s economic recovery forges ahead, but job market remains weak

China continued to recover from the fallout of the Covid-19 pandemic in July as major economic indicators for investment and consumption improved from the previous month. But the nation’s labor market remained weak, official data showed Friday.

The country added 6.71 million urban jobs in the first seven months, down 1.96 million year-on-year.

IQiyi discloses SEC probe

Shares of Nasdaq-listed video streamer iQiyi Inc. plunged in after-hours trading after it announced in its latest quarterly financial report that the U.S. securities regulator had launched an investigation into its financial and operating records.

IQiyi reported 7.4 billion yuan ($1.1 billion) of revenue for the second quarter, a 4% rise year-on-year, according to the report released on Thursday. Its net loss narrowed to 1.4 billion yuan from 2.3 billion yuan in the same period last year. Its parent Baidu Inc. on Thursday posted a 1% year-on-year drop in second-quarter revenue as advertising sales weakened.

ChiNext set to debut first batch of registration-based IPOs Aug. 24

The first batch of companies registered for listing on Shenzhen’s Nasdaq-style ChiNext board under a revamped initial public offering (IPO) system will make their debuts Aug. 24, the Shenzhen Stock Exchange said Friday. As of the end of Friday, 18 companies have completed IPOs. They raised a total of more than 20 billion yuan ($2.89 billion), nearly 30% more than originally planned amid overwhelming investor demand.

Alibaba and Xiaomi get into Hong Kong’s benchmark index

Chinese tech giants Alibaba Group Holding Ltd. and Xiaomi Corp., as well as Wuxi Biologics Cayman Inc. will be included in Hong Kong’s Hang Seng Index Sept. 7. The move could affect tens of billions of dollars in pension fund assets and exchange-traded funds that track the index.

Ant Group picks advisers to move a step closer to blockbuster IPO

CICC and CSC Financial will advise on domestic listing of Ant Group, as the parent of Alipay gets set to raise as much as $30 billion with concurrent listings in Shanghai and Hong Kong. Ant Group’s directors, senior management and shareholders with at least a 5% stake will be advised to fully understand related law and regulations on listing on Shanghai’s Nasdaq-like STAR Market and the responsibilities concerning information disclosure.

China approves coal merger to create new mining giant

China approved a merger of two coal mining companies to create (link in Chinese) a new giant in the world’s top producer and consumer of the fuel. Yankuang Group Co. Ltd. and fellow mining company Shandong Energy Group Co. will combine into Shandong Energy Company Ltd. The merger is among the latest steps by Beijing to concentrate coal production in large, efficient enterprises to better regulate and streamline the industry.

Real estate platform KE Holdings soars in U.S. trading debut

Shares of real estate agency KE Holdings Inc., which is backed by Tencent Holdings Ltd. and SoftBank Group Corp., jumped nearly 90% in their New York trading debut on Thursday after the company raised $2.1 billion — the most by any Chinese company in the U.S. this year.

China-U.S. freight rates take to the skies

Ocean shipping rates between China and the U.S. have soared in the last three months as Chinese exporters and their American customers race to stock up on goods over concerns about potential new tariffs during a season that is already one of the industry’s busiest.

Hong Kong’s police credit union shifts assets to Chinese banks

Hong Kong Police Credit Union said it has been withdrawing most of its assets and investments from foreign banks, or shifting them to Chinese banks since late May. The credit union said it expects the economic situation in Hong Kong would continue to fluctuate in the second half of this year due to social unrest, the Covid-19 pandemic and China-U.S. tensions.

China to expand digital currency trials in top economic hubs

China plans to expand a pilot program for its state-backed digital currency in several regions, including North China’s Beijing-Tianjin-Hebei region, East China’s Yangtze River Delta and South China’s Guangdong-Hong Kong-Macao Greater Bay Area, within three years, according to a plan published Friday by the Ministry of Commerce.

P2P platforms have more than 800 billion yuan in unpaid debts

China’s peer-to-peer (P2P) lending platforms still owe more than 800 billion yuan to investors, Guo Shuqing, chairman of the banking watchdog, said in an interview with state-run broadcaster CCTV. The number of functioning P2P platforms has fallen to 29 from some 6,000 a few years ago amid a regulatory crackdown, Guo said.

Guizhou officials seek to reassure bond investors amid mounting debt concern

The debt-ridden government of Guizhou, one of China’s poorest provinces, is making efforts to restore confidence among bond investors by pledging supportive policies and zero defaults as the debt overhang rises to an officially alarming level in the southwestern Chinese province.

First Capital denies merger with Capital Securities

Shenzhen-listed brokerage First Capital Securities Co. Ltd. denied news reports saying it would merge with smaller rival Capital Securities Co. Ltd., according to a company filing (link in Chinese) on Thursday night. First Capital said no such merger is planned for at least the next three months.

|

** OTHER STORIES MAKING THE HEADLINES

• The U.S.-China Business Council found that nearly 70% of member companies said they are optimistic about the five-year business outlook in China.

• China’s Huawei Technologies Co. Ltd. and ZTE Corp. are set to be excluded from India’s plans to roll out its 5G wireless networks as relations between the two countries hit a four-decade low following deadly border clashes. (Bloomberg)

• Chinese internet giant NetEase Inc. reported better-than-expected results for the second quarter, boosted by strong growth in online gaming and music.

• E-commerce giant JD.com Inc. said its logistic arm will acquire a controlling stake in express delivery company Kuayue-Express Group Co. Ltd. for 3 billion yuan.

** ON THE CORONAVIRUS

• On Thursday, the Chinese mainland reported 30 new Covid-19 cases with symptoms (link in Chinese), including 22 imported cases and eight locally transmitted ones, according to China’s top health body. The local cases were all in the Xinjiang Uygur autonomous region.

• Beijing’s Xinfadi wholesale market will reopen to wholesalers on Saturday, two months after it was shut down in response to a cluster of infections there that led to an outbreak in the Chinese capital, local authorities announced (link in Chinese) at a Thursday press conference.

Read more

Caixin’s coverage of the new coronavirus

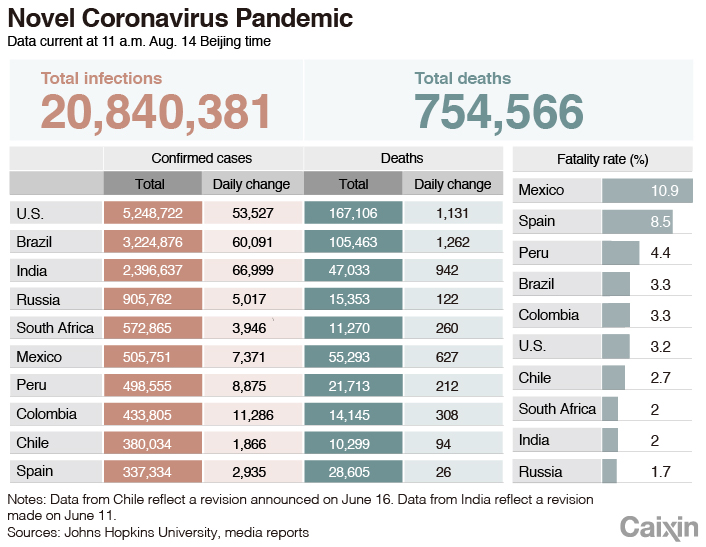

• As of Friday evening Beijing time, the number of coronavirus infections globally surpassed 20.9 million, with the death toll passing 760,000, according to data compiled by Johns Hopkins University.

** AND FINALLY

China’s state media has been urging people to reduce food waste by asking restaurants to offer smaller portions and host banquets less frequently. Most recently, CCTV hit out at the livestreaming culture known by the Korean word “mukbang” — where hosts consume large amounts of food while interacting with viewers — accusing it of being wasteful.

|

A host eats crayfish at the Jingjiang Amusement Park in Shanghai on June 6, when the first Shanghai Nightlife Festival officially kicked off. |

** LOOKING AHEAD

Release of second-quarter financial results:

Aug. 17: JD.com

Aug. 20: Alibaba

Aug. 21: Meituan Dianping and Pinduoduo

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editors Yang Ge (geyang@caixin.com) and Joshua Dummer (joshuadummer@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas