China Business Digest: Ant Group’s Hong Kong IPO Approved; Pakistan Lifts TikTok Ban

|

|

|

|

China’s securities regulator has approved Ant Group’s blockbuster plan to list in Hong Kong. Meanwhile, Pakistan has lifted its ban on TikTok on the condition that the short video app complies with societal norms and laws. And e-scooter maker Ninebot will soon list on the Chinese mainland by selling Chinese depositary receipts.

— By Timmy Shen (hongmingshen@caixin.com)

** TOP STORIES OF THE DAY

Ant Group wins approval to list in Hong Kong

Chinese financial titan Ant Group Co. Ltd., which owns and operates Alipay, has won the China securities regulator’s approval (link Chinese) to list on the Hong Kong Stock Exchange. Ant Group applied in August for a dual listing in Hong Kong and Shanghai.

Pakistan lifts bans on TikTok

Pakistan has lifted a ban (link in Chinese) on short video app TikTok on the condition that its content will be moderated in accordance with the societal norms and laws of the country.

Separately, a TikTok executive has denied U.S. accusations that it shares information with its Beijing-based parent and has ties to the Chinese government.

China denies it might detain Americans

China’s Ministry of Foreign Affairs denied Monday that it would detain U.S. citizens in China, after the Wall Street Journal reported that Beijing had warned Washington it might do so. Zhao Lijian, a spokesman for the foreign ministry, said (link in Chinese) that it was the U.S. that was mistreating Chinese students in the North American country.

Ninebot to sell CDRs on the Chinese mainland

Electric-scooter maker Ninebot Ltd. has become the first to offer Chinese depositary receipts (CDRs) on the Chinese mainland stock markets. CDRs are a new type of equity security created in 2018 to allow overseas-incorporated firms to list on a mainland bourse.

SDIC Power to list in London

Shanghai-listed state-owned power generator SDIC Power Holdings Co. Ltd. has received approval from the U.K. regulator for its secondary listing prospectus. Trading of its global depositary receipts will begin in London on Thursday, the company said.

Central SOEs book milder revenue drop

The total revenue of China’s centrally administered nonfinancial state-owned enterprises amounted to 21.1 trillion yuan ($3.2 trillion) in the first three quarters of this year, a 4.6% year-on-year decline that is milder than the first half’s 7.8% drop, a regulatory official said (link in Chinese) Tuesday.

|

** OTHER STORIES MAKING THE HEADLINES

• The central bank’s operations office in Beijing has issued draft guidelines (link in Chinese) in an attempt to better prevent real estate in the capital from being used to launder money and finance terrorism.

• Leisure expenditures such as spending on hotels and restaurants remained a significant drag on growth in the third quarter in China, even as the recovery gained momentum. (Bloomberg)

• Chinese smartphone-maker Xiaomi Corp. has unveiled wireless fast charging technology that can top-up a 4,000 mAh battery in 19 minutes.

• At the end of September, China had about 370.4 million live hogs, a 20.7% year-on-year increase, as live hog production has gradually recovered from the African swine fever outbreak in the past two years, official data (link in Chinese) showed.

• More than 160 million 5G smartphones are expected to be sold in China this year, accounting for about 67.7% of the global total, according to a report by research firm IDC.

** ON THE CORONAVIRUS

• China’s national disease control authority has isolated active coronaviruses from packaging used to store imported frozen fish, strengthening the theory that Covid-19 can spread through international chilled-food supply chains.

Read more

Caixin’s coronavirus coverage

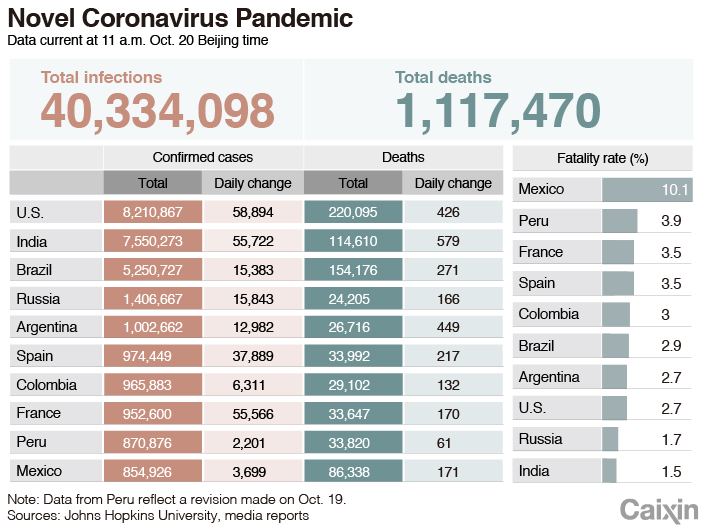

• As of Tuesday morning Beijing time, the number of coronavirus infections globally exceeded 40.3 million, with the death toll surpassing 1.1 million, according to data compiled by Johns Hopkins University.

** AND FINALLY

Substitute meat lovers in Hong Kong and Singapore can enjoy Impossible Foods Inc.’s faux beef burgers starting Tuesday, the company said. The American brand has made a foray into Asian grocery stories as it seeks to enter the Chinese mainland market, pending regulatory approval.

|

** LOOKING AHEAD

Third-quarter financial results

Oct. 21: China Unicom

Oct. 22: China Telecom

Contact reporter Timmy Shen (hongmingshen@caixin.com) and editors Yang Ge (geyang@caixin.com) and Michael Bellart (michaelbellart@caixin.com)

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

- PODCAST

- MOST POPULAR