Caixin Explains: How Evergrande’s Hui Ka Yan Blew Up a $43 Billion Fortune

With the benefit of hindsight, the year 2017 could turn out to be the beginning of the end for China Evergrande Group, the property empire of entrepreneur Hui Ka Yan whose financial crisis and imminent implosion is shaking global markets. Hui, also known as Xu Jiayin, was on a roll and appeared indomitable, but corporate history is littered with examples of how hubris leads to nemesis.

On paper, Evergrande was booming. Its profit attributable to shareholders that year of 24.4 billion yuan ($3.8 billion) was the highest it had ever been and 160% more than the average of the previous three years. Its Hong Kong stock price had risen to a record HK$31.55 ($4.04) in October 2017, a sixfold increase from a year earlier.

Hui was the company’s biggest shareholder, with a 77.2% stake at the end of 2017, and the surging share price propelled him from No. 10 to No. 1 on the Hurun China Rich List, which estimated his net worth at $43 billion. Guangzhou Evergrande F.C., the soccer club he bought out in 2010, won the Chinese Super League for the seventh year in a row, a feat no other club had achieved since the league was established in 2004.

China was in the middle of an unprecedented housing boom fueled by easy money and expectations that prices could only go one way — up. Hui appeared so confident in the market’s prospects that Evergrande continued borrowing vast sums of money to expand its business. He pursued his debt-fueled strategy even though regulators had already flagged their concerns in late 2016 and started to impose controls on financing to the real estate industry as part of a broader campaign to stamp out speculation and cool the bubble.

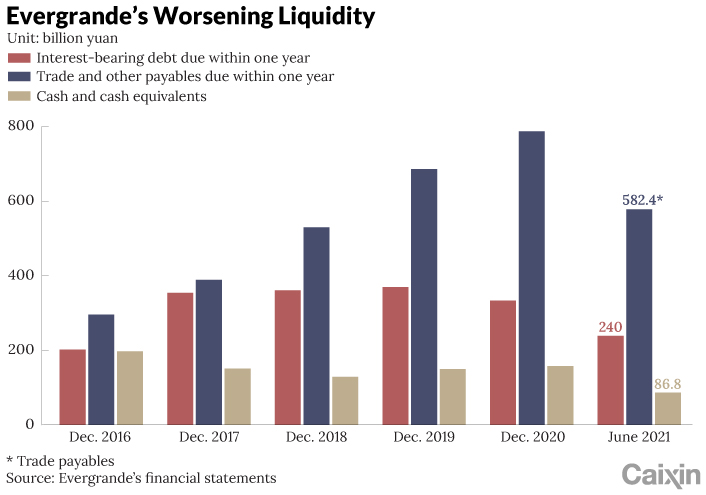

At the end of 2017, the group’s total borrowings were 37% higher than a year earlier. But digging into the numbers, it was clear that the company was increasingly dependent on short-term debt — borrowings with a maturity less than one year had risen by 76%.

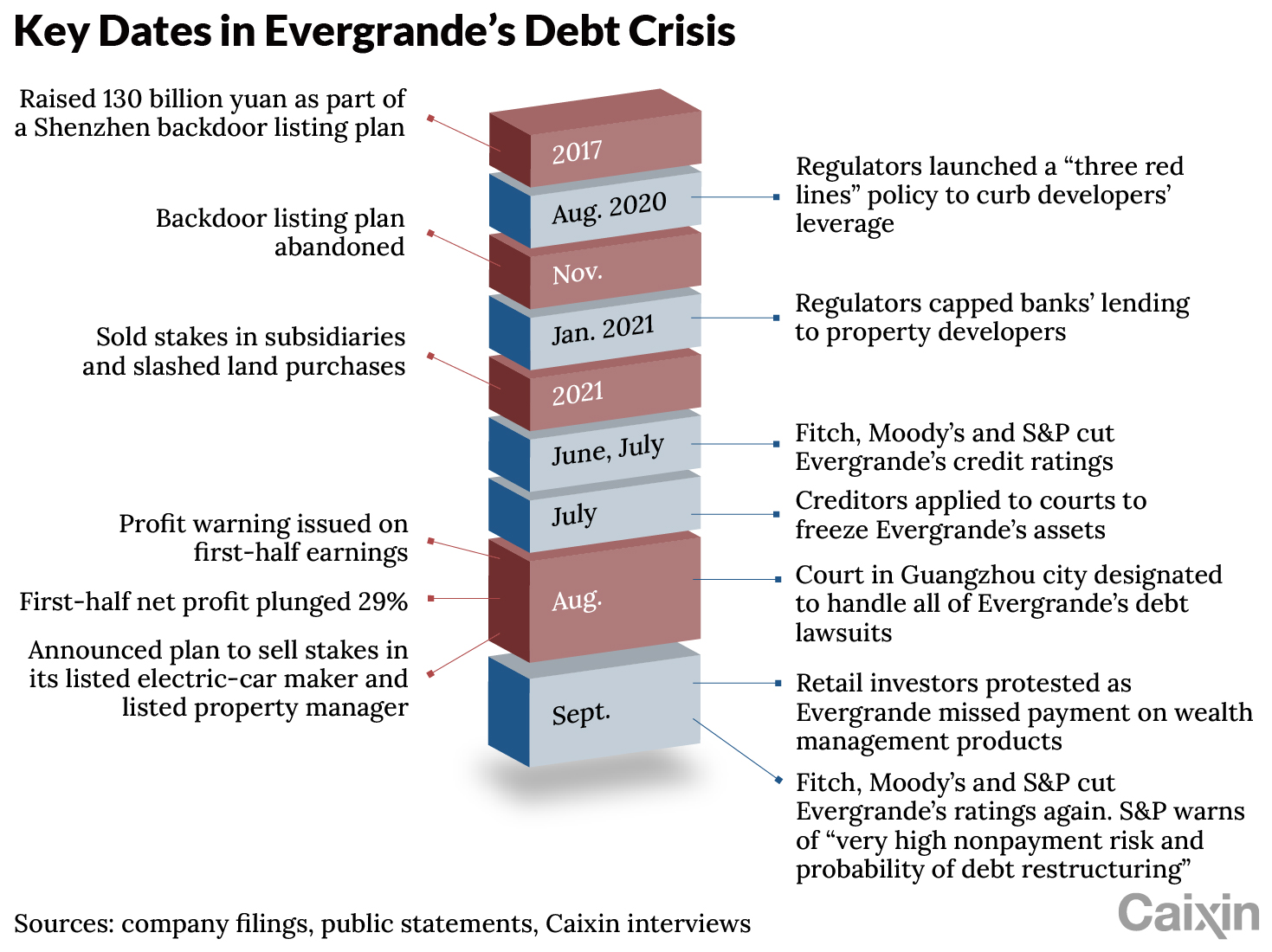

It also raised 130 billion yuan from strategic equity investors that year to fund a backdoor listing in which the property assets held in a subsidiary, Hengda Real Estate Group Co. Ltd., were to be injected into Shenzhen-listed Shenzhen Special Economic Zone Real Estate & Properties Group Co. Ltd. But that fundraising event came with a catch — investors were given the right to demand Evergrande buy back the stake if the listing didn’t take place by early 2021. It was widely seen as an exercise in off-balance-sheet borrowing.

|

Hui admitted making strategic mistakes that year at an internal meeting earlier this month to discuss the current crisis, an executive at Evergrande’s wealth management arm who attended the meeting told Caixin.

Plans for the backdoor listing in Shenzhen were stymied as regulators tightened the squeeze on fundraising, which included a moratorium on property developers going public on Chinese mainland bourses. Evergrande finally gave up and terminated the plan last year, losing crucial access to funding to repay its strategic investors.

This failure proved a major setback in the group’s efforts to shore up its finances. In 2020, faced with a continued increase in property developers’ debt, financial regulators intensified their campaign to control leverage in the industry. They drew up a policy known as the “three red lines” that limited developers’ ability to take on more borrowing by linking increases to meeting three debt ratios. The policy severely damaged Evergrande’s funding access as it was not able to add new interest-bearing debt because it crossed all three lines.

“Evergrande underestimated the state’s firm position,” Chen Xin, a finance professor at Shanghai Jiaotong University said in an online speech (link in Chinese) in November. Some analysts said the group misread the regulatory environment. In the past, controls on real estate borrowings were relaxed when downward pressure emerged on the economy, but this time was different. As the momentum of GDP growth waned in 2019 and 2020, policymakers made it clear they were not going to resort to easing up on the property sector to stimulate the economy. Instead, they continued to emphasize the priority of defusing the risks the industry posed to the financial system.

With borrowing channels inaccessible, Hui tried to restore liquidity and reduce the group’s debt by slashing land purchases, cutting home prices, issuing commercial paper to suppliers and putting assets up for sale. But he had little success and Evergrande’s liquidity position continued to deteriorate. It missed payments due to suppliers and couldn’t repay millions of yuan of maturing wealth management products sold to employees and other investors.

Read more

Cover Story: How Evergrande Could Turn Into ‘China’s Lehman Brothers’

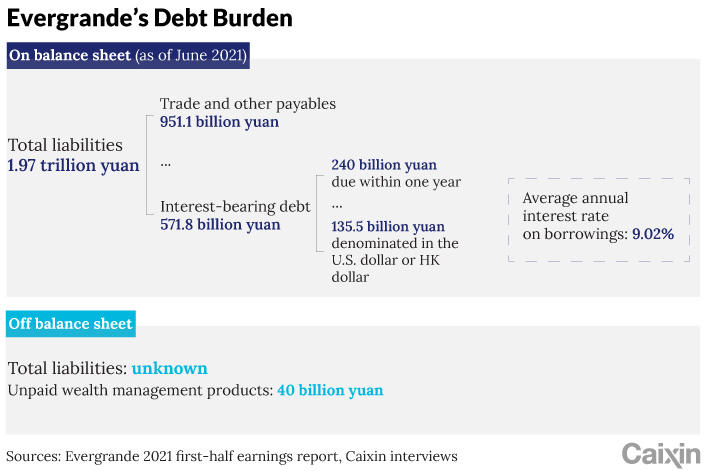

At the end of June, Evergrande’s total liabilities reached 1.97 trillion yuan, including 571.8 billion yuan in interest-bearing debt, according to its half-year earnings report. Its total liabilities accounted for 2.4% of the entire real estate industry in 2019. It also has an unknown amount of off-balance-sheet hidden debt.

As Evergrande’s problems mounted, shareholders smelled blood and started to sell stock. At the start of 2021, its shares were trading at over HK$14 but by the end of June they were down to HK$10. By the time Evergrande issued its first-half profit warning on Aug. 25, they had dropped to HK$4.56 and slumped to a close of HK$2.27 on Tuesday as its financial crisis showed no signs of being resolved and defaults on its bonds and bank loans appeared inevitable.

|

A rags-to-riches story

Hui is among a long line of entrepreneurs who jumped on the property boom and made their fortunes. Some have already been humbled, including Wang Jianlin, who was top of Hurun’s China Rich List just two years before Hui.

But Hui could become the biggest casualty yet. Born in 1958 in Central China’s Henan province, Hui’s life is a typical rags-to-riches story that reflects the outsize role property has taken in China’s rapid economic growth over the past two decades, and how reckless some entrepreneurs were in playing the too-big-to-fail game.

After graduating from Wuhan Iron and Steel Institute in 1982, Hui began working in a state-owned iron and steel company. A decade later he joined a privately owned trading company in Shenzhen, an emerging business hub in southern China that became a hotbed for reform, attracting young people from all over the country looking for opportunity and fortune.

He entered the property sector and started his own business called Evergrande in 1996 just before China embarked on groundbreaking reforms to the property market that ushered in a golden era for the industry. In 1998, the government abolished its decades-old public housing system (福利分房), under which people were allocated an apartment by their employer, and allowed the masses to buy their own homes by taking out a mortgage.

The huge demand unleashed by the reforms led to a gold rush for developers including Evergrande who took full advantage of the liberalization. The company expanded rapidly over the following decade and went public in Hong Kong in 2009. Like many of its rivals, Evergrande’s expansion was fueled by debt as it consumed vast amounts of money to build and sell millions of properties quickly, a model known as “high leverage and high turnover” (高杠杆,高周转).

|

In 2013, Evergrande rose to third place in a league table of top 100 property firms (link in Chinese) compiled by Fang Holdings Ltd., a property data provider, based on a series of gauges including sales and profitability. In 2017, it became No.1.

Pumped up by his success in property development, Hui’s ambitions extended beyond building tower blocks of apartments. Evergrande diversified business into bottled water, tourism, health care, finance and soccer. He first brought in Marcello Lippi and then Luiz Felipe Scolari, two World Cup-winning managers, to coach his soccer club, Guangzhou Evergrande. They both took the team to international glory, winning the AFC Champions League in 2013 under Lippi and in 2015 under Scolari.

In 2019, the group announced it was entering the electric vehicle market and vowed to (link in Chinese) build the largest new-energy car maker in the world, challenging Tesla as an industry leader. Evergrande’s health care services arm, which was listed separately in Hong Kong, was renamed China Evergrande New Energy Vehicle Group Ltd. (Evergrande Vehicle) and the company claimed to have poured some 47.4 billion yuan into developing electric cars, although not a single vehicle has so far rolled off its production lines.

Read more

Caixin’s coverage about Evergrande’s debt crisis

Evergrande has gone from boom to bust in just four years and is now fighting to stay alive. The company’s shares have collapsed and dealing with its $300 billion mountain of liabilities will take months if not years. Evergrande Vehicle’s shares have slumped by around 96% from their peak in February, its first-half loss almost doubled year-on-year to 4.8 billion yuan, and it’s searching for new investors. The soccer club dropped Evergrande from its name early this year, its star players are heading for the exits, and there is growing speculation that it is looking for a bailout.

The collapse in Evergrande’s share price has made a massive dent in Hui’s personal fortune, with the value of his 76.8% stake now worth just HK$23 billion as of close of business on Tuesday.

Hui had already slipped to 5th place on Hurun’s China Rich List for 2020 and when the next list is published, likely in October, he may not even make it into the top 20.

Wang Jing contributed to this report.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR