CX Daily: China's High-Tech Board Names First Batch of Potential Listers

In depth: China’s whopping tax and fee cut package surprised even insiders

The hefty 2 trillion yuan ($300 billion) in estimated annual tax and fee cuts unveiled in March beat the expectations of market observers and even some officials like Miao Wei, China's Minister of Industry and Information Technology, who said in early March that he had expected a VAT cut of 1% or 2% rather than 3% for manufacturers.

Wang Tao, UBS head of China economic research, noted that the total cut to taxes, fees and company social insurance contributions could be worth as much as 2% of GDP and could help companies, particularly manufacturers.

While some economists say the government looks set to tolerate economic cooling, others argue that job creation must be a top priority given the unmitigated employment pressure, significant structural problems and other factors now and in the future.

Some observers say that current tax-cutting measures may be not that effective, given that the real burden on Chinese companies was not VAT, which could be passed on to consumers, but corporate income tax. Check out our deep dive on the prospects of coming measures.

FINANCE & ECONOMICS

|

Photo: VCG |

Here are the first companies hoping to list on China's high-tech board

China’s new high-tech board revealed the first batch of listing applications it’s received, including high-tech companies like semiconductor company Amlogic, imaging technology firm Raytrontek, and carbon-nanotube maker Cnano Technology along with robotics, lithium battery and biotech companies.

This comes on the heels of two lists of 48 candidates for the review and advisory committees for listing on the high-tech board published by the Shanghai Stock Exchange. Some 30 to 40 members will be selected for the listing committee, while 40 to 60 will be named to the advisory committee, according to rules of the new board.

More high-tech board /

New board, new way to exit for existing shareholders

The existing shareholders of companies set to be listed on the new Nasdaq-style high-tech board will have a new way to exit their investments called “nonpublic transfers,” the Shanghai exchange said.

Under the nonpublic transfer model, shareholders with a stake in a company before its IPO can sell their stock over the counter to qualified institutional investors after a lockup period, according to the bourse.

This will particularly benefit private equity and venture capital firms — typical investors of high-tech companies — as it allows them to bypass the current strict rules governing share sales by pre-IPO investors.

Mobile payments /

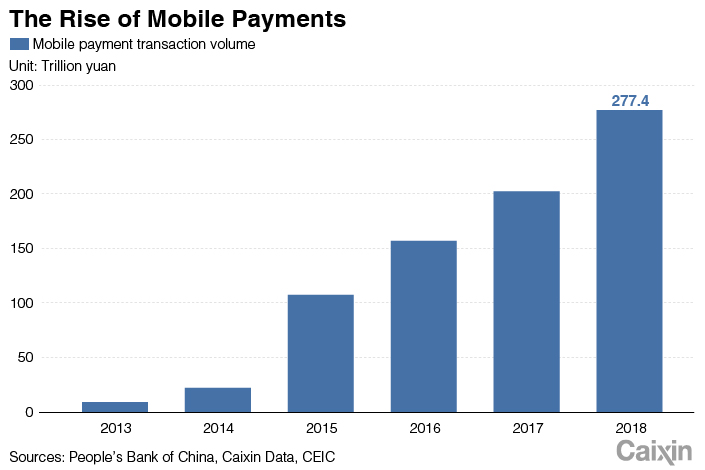

China’s mobile payment transaction volume hit $41.51 trillion in 2018 |

The total number of transactions made via mobile payment platforms surged to 60.53 billion last year, up from 1.67 billion back in 2013, official reports show.

Personal finance /

Urban Chinese more inclined to save than spend

China’s urban residents were more inclined to save or invest their money than to spend it in the Q1 2019, according to quarterly figures from China's central bank.

Of the 20,000 depositors across 50 cities surveyed by the PBOC in the most recent quarter, 25.9% said they were more inclined to spend, down 2.8 percentage points from the previous quarter, while 45% said they were more inclined to save, up 0.9 percentage point, and 29.2% were more inclined to invest, up 1.9 percentage points.

Leadership /

New boss at China’s No. 2 bank

Liu Guiping (刘桂平) is replacing Wang Zuji (王祖继) as president of China Construction Bank Corp., China’s second-largest bank by assets. Wang, 60, is retiring.

Liu, 52, built his career at the Agricultural Bank of China Ltd., another of China’s “Big Four” state-owned banks, where he worked for 25 years. In 2014, he became a vice general manager at China Investment Corp., the country's sovereign wealth fund, and in 2016, he took up a vice mayorship in Chongqing, in an early example of the trend of bankers being sent out to provincial posts to beef up financial regulation.

Check out our full roundup of leadership changes in finance and corporate as well as corruption cases.

Quick hits /

Opinion: China can do more to face the new wave of globalization

BUSINESS & TECH

|

A Model S on display at a Telsa dealership in Shanghai on March 7. Photo: IC |

Electric car maker Tesla Inc. sued a former engineer who left the company to join rival Chinese startup Xpeng Motors, accusing him of stealing trade secrets, including source code.

The defendant, Guangzhi Cao, worked for Tesla in Silicon Valley for its “elite” Autopilot team before returning to China to work for Xpeng, according to the lawsuit filed in California. Tesla filed the lawsuit a day after suing four other employees and a company over similar allegations. The accusation marks at least the third similar lawsuit by a major Western company implicating Xpeng.

Electric cars /

Nio denies reports of mass layoffs, inflated sales figures

Chinese electric carmaker Nio denied reports from people claiming to be employees that the company falsified sales data by making internal purchases and that it was conducting massive layoffs. Nio said the rumors “lacked factual basis.”

The Chinese rival of Tesla delivered 13,964 of its ES8 model cars as of the end of February, the company said in a statement Friday. Employee purchases of the car accounted for only 2% of the sales, Nio said.

Jiangsu explosion /

Contamination fears after east China chemical blast kills 47

Following an explosion at a chemical plant in eastern China that killed at least 47 people and seriously injured 90, there were fears of chemical contamination in the area from the chemical benzene, a known carcinogen, which some say caused the explosion, along with sulfur dioxide and nitrous oxide in the air and the nearby river.

The blast occurred Thursday afternoon at a plant run by Tianjiayi Chemical Co. Ltd., at an industrial park in the coastal city of Yancheng in Jiangsu. The province produces much of China’s output of agricultural chemicals. The province's environment bureau said Friday that measures had been taken to prevent chemicals from contaminating the river near the plant. Nearly 3,000 people were evacuated, according to officials.

Sharing economy /

Historic carmaker enters new-energy ride-hailing business

Chongqing Changan Automobile, one of China's oldest carmakers, will establish a new joint venture with founding shareholders that include car manufacturers FAW and Dongfeng Motor and affiliates of business giants Tencent, Alibaba and Suning, the company announced Friday, to invest in ride-hailing businesses operated with new-energy vehicles.

The new company will most likely be named Nanjing Lingxing Equity Investment Partnership Enterprise, according to an official announcement. It's widely suspected that the new joint venture could easily form its own new-energy ride-hailing fleet in China.

Biotech /

Money-losing vaccine maker aims to soothe skeptics with Hong Kong IPO

Biotech firm CanSino Biologics Inc. will become the Chinese mainland's first money-losing vaccine maker to list in Hong Kong when its shares make their trading debut next week, with a potential to raise as much as HK$1.25 billion ($160 million).

CanSino made headlines in 2017 when China’s regulator approved its vaccine for the deadly Ebola virus that ravaged parts of Western Africa in 2014 and 2015. But analysts said CanSino’s Ebola vaccine will have a limited market and most of its other products are still in early development stages, suggesting the company is likely to continue posting losses. Zhongtai Securities gave the company a “neutral” rating.

Thanks for reading. If you haven't already, click here to get this briefing.

- 1In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 2China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 3In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas