Banking Regulator Denies Sweeping Plan to Force Mergers

China’s banking regulator has denied it is considering a sweeping wave of mergers involving problematic small and midsize banks, saying it will not take a “one-size-fits-all” approach to tackling the risks facing the world’s biggest banking system.

Bloomberg reported Thursday that Chinese financial regulators are discussing a plan to merge or restructure troubled banks with less than 100 billion yuan ($14.3 billion) of assets as part of intensifying efforts to buttress small lenders.

Zhou Liang, a vice chairman of the China Banking and Insurance Regulatory Commission, told Caixin on Sunday the regulator would instruct some small banks to shrink their interbank businesses and those outside their registered region and industry. But he said it would be impossible to take the kind of comprehensive measures reported.

To defuse risks on small and midsize banks, the regulator will not take one-size-fits-all measures or give a hardline order for banks with less than 100 billion yuan of assets to merge, Zhou said.

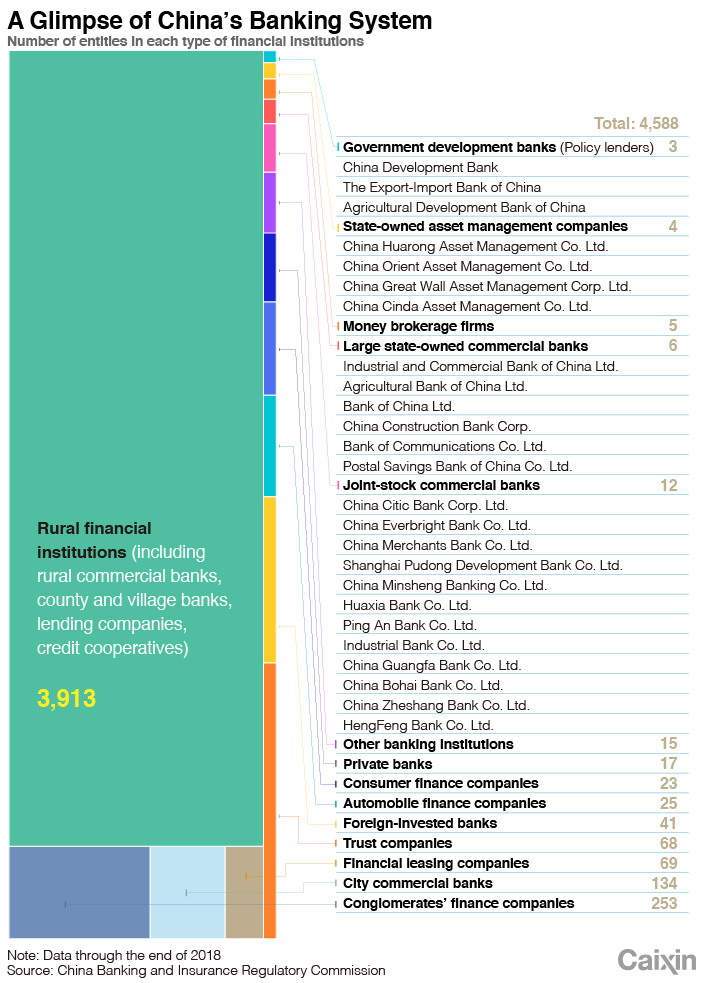

China has more than 4,500 financial institutions overseen by the banking regulator, most of which are small and midsize. Some are struggling with mounting bad loans resulting from poor internal risk management and China’s stalling economic growth.

Authorities have been acting to bail out banks that face the most profound crises, seizing control of the troubled Baoshang Bank Co. Ltd. in May and restructuring HengFeng Bank Co. Ltd. and Bank of Jinzhou Co. Ltd. All three banks have been dogged by embezzlement scandals and all do large amounts of interbank business, meaning their risks could have a systematic impact despite their modest size.

Zhou said the regulator will deal with risks at banks separately, taking different approaches to each, and would prioritize those with potential systemic impacts. They will encourage shareholders to replenish capital, he said. It implies that financial regulators will probably allow small and midsize banks to replenish capital by issuing preferred shares, perpetual bonds or using other means.

He also attempted to comfort investors by saying it was not necessary to be overly pessimistic or fearful of China’s banking risks. China has over 4,000 financial institutions overseen by the banking regulator. The problematic ones only account for a tiny part of them, he said, adding that the growing domestic economy is backing up small and midsize banks.

|

This story has been updated.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com)

- PODCAST

- MOST POPULAR