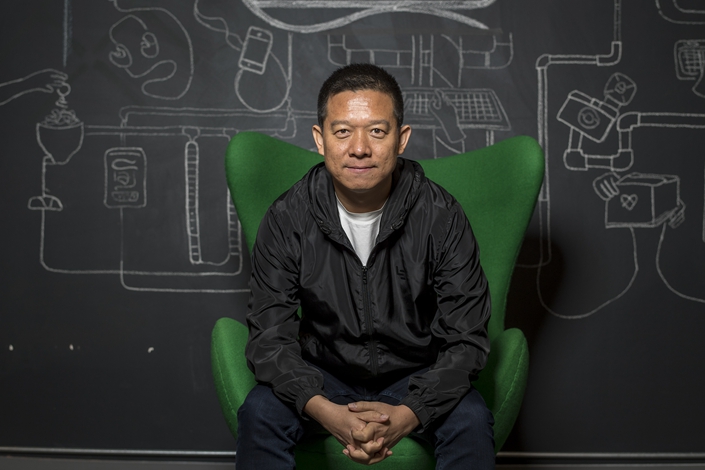

Embattled Entrepreneur Jia Yueting Postpones Bankruptcy Proceedings

Entrepreneur and blacklisted debtor Jia Yueting has delayed his bankruptcy proceedings, amid insufficient creditor support for his reorganization plan.

Jia, former CEO of U.S.-based electric-car startup Faraday Future, filed for Chapter 11 bankruptcy last month in the U.S.

According to a statement posted by Faraday at the time, Jia planned to set up a “creditor trust” that would receive all of Jia’s equity interest in Smart King Ltd., the holding company that controls Faraday Future. The trust would be jointly managed by a committee of creditors and the trustee, the statement said.

Jia had previously set Nov. 8 as the deadline for creditors to vote on whether or not to accept this plan. However, according to a filing to a Delaware court on Nov. 6, Jia has terminated this deadline and will present a revised plan to the court in two weeks. Jia will seek approval at a hearing in December, and if it is approved it will then be up to the court to decide a voting deadline, according to the filing.

A statement issued by Jia on Monday said that he plans to meet with creditors on Nov. 25 to discuss the matter.

A separate statement from Jia’s legal team sent to Caixin on Monday said that they need more time for due diligence. But Caixin has been told that a lack of support for his plan was likely behind the decision.

Jia faces claims of about $2 billion from a total of 154 creditors, according to previous court filings. However, the legal team’s statement said only eight creditors had cast their votes as of Nov. 6.

Of those eight, the six who voted in favor of the plan have claims on about $460 million, according to Jia’s filing to the Delaware court last week. That amount represents 23% of Jia’s total debt, well below the 67% level for official creditor approval required under U.S. bankruptcy law.

A creditor who declined to be named told Caixin that Jia’s plan to pay his debts with his Faraday Future stake is unappealing. “Faraday Future’s prospects are far from clear,” he said. Another creditor told Caixin that he hasn’t decided whether to attend the Nov. 25 meeting.

Jia currently holds 33% of Faraday. Before that, he was known for founding the former star online video firm LeEco, which has been troubled since 2016 after taking on too much debt during a frenzied business expansion. Jia was later blacklisted as a debt defaulter by Chinese regulators and barred indefinitely from traveling by rail or air in the country for failing to repay about 480 million yuan ($69.7 million) in debt owed by LeEco.

Faraday has run into financial issues, with sources saying its headcount had dropped to 350 by the middle of this year. The company had claimed a headcount of 2,000 at the end of 2018.

Jia stepped down as Faraday’s CEO in September, but remains the company’s chief product and user officer.

Jia was embroiled in a months-long dispute over control of Faraday Future with real estate giant Evergrande Group, as their partnership went sour and seized media attention for much of last year.

Contact reporter Mo Yelin (yelinmo@caixin.com)

- MOST POPULAR