China Business Digest: AIIB Reappoints President Jin Liqun for Another 5 Years; Luxury’s Luster Dims Amid Pandemic Fallout

|

|

|

|

Sichuan Trust is the latest to get into trouble as China steps up scrutiny of the industry. President of the Beijing-based Asian Infrastructure Investment Bank will stay for another five years. Hong Kong is expanding foreign access to Chinese mainland stocks with four new funds tracking the CSI 300 Index. Meanwhile, a price war fueled a surge in China’s June oil imports from Saudi Arabia. And China’s latest Covid-19 outbreak in the coastal city of Dalian has spread to at least four provincial-level regions outside Liaoning province.

— By Tang Ziyi (ziyitang@caixin.com) and Han Wei (weihan@caixin.com)

** TOP STORIES OF THE DAY

Sichuan Trust fails to secure new funding from shareholders

A major shareholder of embattled Sichuan Trust Co. Ltd. said it will not take part in the trust company’s new share placement, which aims to raise funds to repay investors. The mid-sized trust company was hit by a repayment crisis that’s dragged on since May. The local industry regulator said it stepped in to the company’s operations.

AIIB President Jin Liqun reappointed for second term

The Asian Infrastructure Investment Bank (AIIB) Tuesday reappointed its President Jin Liqun for a second five-year term starting Jan. 16, 2021. Jin is the first president of the Beijing-based multilateral funding institution, which has grown from 57 founding members to more than 102 members from around the world since its establishment in 2016.

LVMH first-half profit nosedives amid pandemic closures

The world’s largest luxury conglomerate LVMH reported an 84% decline in first-half profit to 522 million euros ($612 million) amid the Covid-19 pandemic. Revenue dropped 27% to 18.4 billion euros. Nevertheless, the company said there are signs of recovery since June as the outbreak wanes and economies reopen. China has shown a particularly strong rebound, it said.

Hong Kong launches four ETFs tracking mainland stocks

The Hong Kong Stock Exchange on Monday launched four exchange-traded funds (ETFs) tracking the CSI 300 Index, which covers major listed companies in Shanghai and Shenzhen. The products add to a growing list giving global investors access to China’s A-share market, an analyst said. (Read a related story here.)

China boosts crude oil imports from Saudi Arabia

The volume of China’s crude oil imports from Saudi Arabia in June surged 15% from a year ago, following a price war between the Middle Eastern country and Russia, the top oil suppliers to China, customs data showed (link in Chinese). China’s total crude oil imports in June rose month-on-month for the second consecutive month to a record high of 53.2 million tons, customs data showed (link in Chinese) earlier this month.

China’s box office booked $15.6 million in first week of reopening

China’s cinema box office brought in 109 million yuan ($15.6 million) between July 20 and Sunday (link in Chinese), the first week since the country’s movie theaters in areas with low coronavirus risk were officially allowed to reopen as the nation’s epidemic eased, industry data showed. The figure was down 92.2% from the same period a year earlier.

Only two cities on the mainland are currently designated as medium- or high-risk areas: Urumqi in the northwestern region of Xinjiang and Dalian in the northeastern province of Liaoning. Movie theaters in low-risk areas must take precautionary measures, such as capping audiences at 30% of capacity and prohibiting eating and drinking.

Automaker Dongfeng announces secondary IPO in Shenzhen

The board of Hong Kong-listed Dongfeng Motor Group Co. Ltd. has approved a decision to list on Shenzhen’s ChiNext board, becoming the latest overseas-listed Chinese company to announce a mainland listing plan.

** OTHER STORIES MAKING THE HEADLINES

• Joseph Yam Chi-kwong, a former chief executive of the Hong Kong Monetary Authority, warned that a third global financial crisis might be on the horizon as the Covid-19 pandemic halts many economic activities. He said the third crisis may not be easy to handle if it occurs, as the problems leading to the two previous financial crises in 1997-1998 and 2008-2009 have not yet been solved.

• ByteDance Ltd., owner of popular short video app TikTok, said the head of its artificial intelligence lab, Ma Weiying, will leave the company to take a position at the Institute for AI Industry Research of Tsinghua University, multiple media outlets reported. TikTok is facing increasing regulatory challenges from India and the U.S. amid rising geopolitical tensions.

• China said (link in Chinese) it would lower broadband fees for companies by an average of 15% as the government steps up efforts to support businesses affected by the Covid-19 pandemic.

• Hong Kong-based newspaper South China Morning Post will reintroduce a subscription program starting August. Its editor-in-chief said Monday in a letter to readers that its current advertising business model was no longer enough to support their reporting.

** ON THE CORONAVIRUS

• On Monday, the Chinese mainland reported 68 new Covid-19 cases with symptoms (link in Chinese), according to China’s top health body. The Xinjiang Uygur autonomous region reported 57 new cases, including a cluster related to a local gathering (link in Chinese). Liaoning added six cases.

The new Liaoning outbreak in the city of Dalian began in a seafood distribution center, much like the recent outbreak in Beijing. That outbreak had spread to (link in Chinese) at least four provincial-level regions outside of Liaoning as of Tuesday morning, with connected cases reported in Beijing as well as Heilongjiang, Jilin and Fujian provinces.

• Hong Kong reported 145 new Covid-19 cases on Sunday, of which 142 were locally transmitted, as the city reported more than 100 daily new cases for the sixth consecutive day.

Read more

Caixin’s coverage of the new coronavirus

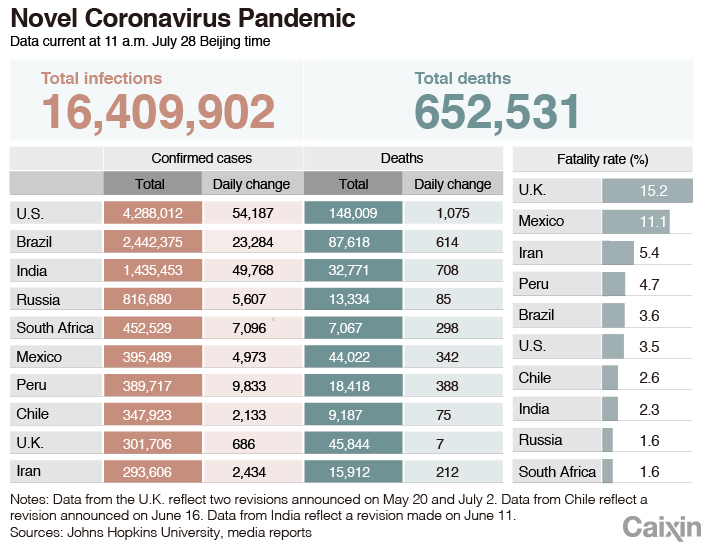

• As of Tuesday afternoon, Beijing time, the number of coronavirus infections globally exceeded 16.4 million, with the death toll passing 654,000, according to data compiled by Johns Hopkins University.

** LOOKING AHEAD

Aug. 3: Release of Caixin China manufacturing PMI

Aug. 5: Release of Caixin China services PMI

Aug. 6: SMIC reports second-quarter financial results

Aug. 7: Release of China’s import and export data for July

** AND FINALLY

In August 2019, a woman in Henan province surnamed Liu jumped from a second-story window to allegedly escape domestic violence. She became paralyzed as a result but remained stuck in her relationship after a local court denied her divorce petition. Now she is trying for a second time to leave her husband. The case has drawn the attention of media and millions of people seeking to pressure the court to this time grant the divorce.

|

In May, China’s national legislature passed the nation’s first civil code, effective next year. Its mandatory month-long “cooling-off period” for divorce filings, aimed at discouraging impulsive decisions, has been criticized for prolonging the suffering of those in failed marriages, especially victims of domestic violence whose safety is at risk.

Contact reporter Tang Ziyi (ziyitang@caixin.com) and editor Yang Ge (geyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas