CX Daily: Huawei Is Still Willing to Buy From American Suppliers, Chairman Says

Huawei /

Despite U.S. chokehold, Huawei has enough chips, chairman says

Huawei Technologies Co. Ltd., the telecom giant at the center of U.S.-China tensions, has “sufficient” inventory for its communications equipment business while it seeks out supplies of smartphone chips that have been cut off by a Trump administration ban, the company said.

Guo Ping, Huawei’s rotating chairman, told reporters Wednesday on the sidelines of the Huawei Connect 2020 conference in Shanghai that the company has enough supplies to keep its enterprise and carrier units afloat, and it’s developing new consumer devices to offset the hit to its smartphone business. Huawei is still evaluating the impact of the U.S. blacklist, which has greatly limited business with American suppliers, Guo said, though Huawei is still willing to buy from those companies.

It’s the first time a Huawei executive has commented publicly on the latest round of U.S. sanctions on the company. The sanctions, announced Aug. 17 and enacted Sept. 15, target non-American companies by threatening to cut them off from their U.S. suppliers if they trade with Huawei.

FINANCE & ECONOMICS

|

The New York Stock Exchange on March 20. |

Brokerages /

Wall Street reaps commissions bonanza from flood of Chinese IPOs

U.S. brokerages earned record commissions from Chinese companies in the first eight months of 2020 as businesses and investors alike seek a slice of the booming American stock market.

Chinese companies paid more than $600 million in commissions to U.S. brokerages for stock issuances from January to August, up 80% from a year earlier, according to Refinitiv. The figure represents roughly half of the commissions paid by Chinese companies during the period.

KE Holdings’ underwriters, Morgan Stanley and Goldman Sachs, were the top two beneficiaries from Chinese commissions, earning $220 million and $120 million respectively in the January-August period. The boost has been fueled by a flurry of new listings in the U.S. market. A record 19 Chinese companies debuted on a U.S. bourse in January-August.

Bribery /

Exclusive: Former Citic Bank vice president sentenced to 12 years for bribery

A former vice president of state-owned China Citic Bank Corp. Ltd. was sentenced to 12 years in prison for accepting bribes after issuing loans, sources familiar with the matter told Caixin.

Chen Xuying, 47, surrendered to authorities in September 2018 along with her husband, Caixin previously reported. Chen expressed surprise at her conviction and said she would appeal the decision, people close to the matter told Caixin.

Chen was appointed Citic Bank’s vice president in 2017 and headed up the bank’s Shenzhen branch from 2012 to 2018, public records show. Chen’s conviction is linked to a criminal case involving the head of an asset management subsidiary of state-owned conglomerate Citic Group Corp. Ltd., which also owns Hong Kong- and Shanghai-listed Citic Bank, the sources said.

Former top Shenzhen official accused of abetting infamous businessman

Economy /

Wang Tao: China’s next five-year plan will play down GDP growth target

"The U.S.-China trade war and Covid-19 pandemic had a significant negative impact on China’s economy and made achieving the 13th Five-Year Plan objectives difficult," writes Wang Tao, head of Asia economics and chief China economist at UBS Investment Bank."Nevertheless, most of the objectives, including those on urbanization and environment, will likely be achieved at end of 2020, except GDP growth and household income growth."

"Compared with the '>6.5%' average annual growth target set in the 13th Five-Year Plan, we expect the government to either not set an explicit growth target or set a lower and more flexible (e.g., around 5%) growth target," Wang writes. "Despite an expected rebound to 7.6% in 2021, we expect China’s growth to average only 5% in the next five years, as aging population, lower savings rate, supply chain shifts and tougher tech restrictions are expected to weigh on potential growth."

Yuan /

Asian currencies decouple from yuan in two-speed recovery

Counting on China as an anchor of strength has been a good tactic for traders of Asia’s emerging currencies. That link is losing traction as recovery paths from the coronavirus pandemic diverge.

While China’s economy has bounced back from the Covid-19 crisis, countries including Indonesia and the Philippines are still grappling with rising outbreaks. The 30-day correlation between the offshore yuan and six regional counterparts has declined in the past week as the Chinese currency climbed to the strongest level in more than a year. Asia’s two-speed recovery is making it difficult to predict the fortunes of the region’s exchange rates amid mounting headwinds ranging from U.S.-China tensions to the American presidential election.

Quick hits /

Executive pick lays groundwork for Vanguard getting into China mutual funds

BUSINESS & TECH

|

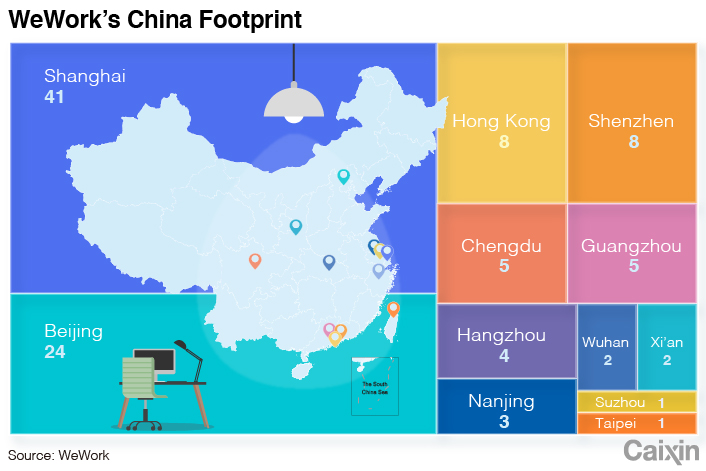

WeWork /

WeWork hands local partner keys to China venture

Shared workspace specialist WeWork is ceding control of its China operation to one of its local partners, the company said Thursday, as it continues working its way out of a debt crunch that sent its valuation plummeting last year.

Trustbridge Partners will pay $200 million for an undisclosed stake in WeWork China and will take over running the venture in the process. Trustbridge named its operating partner Michael Jiang as acting CEO of WeWork China effectively immediately.

The operation being taken over by TrustBridge includes about 100 locations in 10 cities on the Chinese mainland as well as several locations in Hong Kong and Taipei. That number is down from about 115 sites the company operated in China about a year ago, reflecting the pressure WeWork is facing due to stiff competition and large debt taken on through an aggressive expansion.

Macao /

Mainlanders allowed to visit Macao again in sign China is easing Covid-19 border controls

The central government is again allowing Chinese mainland residents to travel to Macao and has invited foreign workers stuck outside China to return in two major signs the country is starting to reopen its border.

Since Wednesday, mainland residents have been able to apply for travel permits to Macao with the exception of those who live in or have just traveled to areas associated with mid- to high-level Covid-19 infection risks within 14 days, according to a statement issued by the National Immigration Administration.

An influx of mainland tourists could help the Asian gambling hub reverse its fortunes as it has been battered by fallout from the coronavirus pandemic.

Gaming /

Alibaba restructures gaming unit to challenge Tencent, NetEase

Alibaba Group Holding separated its gaming unit from its sprawling entertainment division and created an independent group to compete with two bigger rivals, Tencent Holdings and NetEase.

The move was another major restructuring after Alibaba reorganized its culture and entertainment business in June 2019 into a new unit, which includes its video streaming platform Youku Tudou, streaming music platform Alibaba Music, movie division Alibaba Pictures, ticket-booking platform Damai and UCWeb browsers.

Alibaba said the restructuring aims to further upgrade and develop its gaming business. The new separate gaming unit will have an independent budget and more freedom in decision-making but will continue cooperating with other business units in the entertainment division.

Restructuring /

XCMG completes $3 billion mixed-ownership restructuring

Chinese construction equipment maker Xuzhou Construction Machinery Group, known as XCMG, brought in 16 new shareholders as part of a two-year restructuring to convert from a wholly state-owned enterprise to a mixed-ownership corporation.

XCMG said the mixed-ownership overhaul involved a 15.66 billion yuan ($2.3 billion) injection of new capital and a 5.4 billion yuan ($793 million) equity transfer, making it the largest mixed-ownership project this year. After the restructuring, the company’s state parent will hold a 34.1% stake, with 16 other shareholders — including state-controlled financial institutions, industrial funds, local state-owned enterprises in Jiangsu province, private investment institutions and an employee stock ownership platform — holding the remaining equity.

Quick hits /

Display giant BOE bids for two LCD plants as sector consolidation accelerates

ByteDance applies for Chinese tech export license as TikTok negotiations continue

Short video firm Kuaishou optimizes its e-commerce by connecting livestreamers with quality products

This story has been corrected to reflect that Chen Xuying was sentenced to 12 years in prison, not 15 years.

Thanks for reading. If you haven't already, click here to subscribe.

- MOST POPULAR