Cover Story: HNA Group’s Final Crisis

The final crisis for China’s formerly high-flying HNA Group Co. Ltd. began unfolding two weeks before the Lunar New Year holidays.

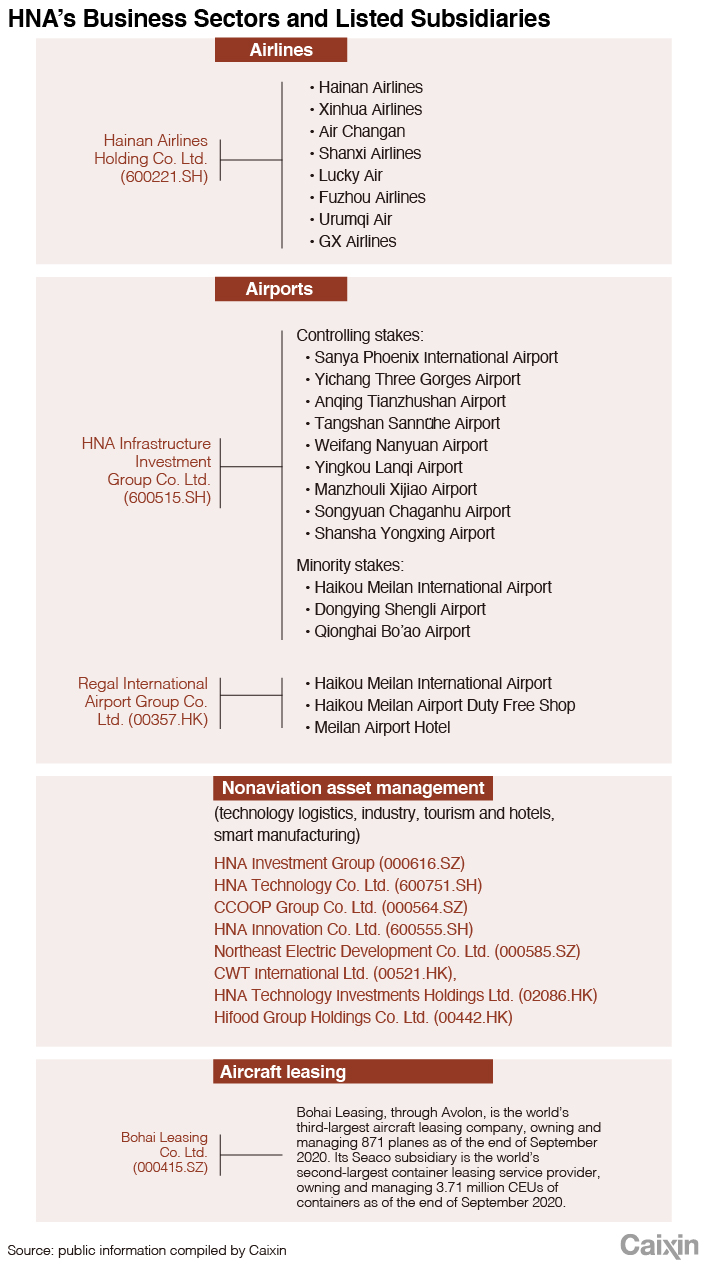

Creditors of HNA and its three core listed companies petitioned a court to order a bankruptcy restructuring after the giant conglomerate failed to repay trillions of yuan in debts. The reorganization may involve as many as 500 companies in a sprawling enterprise that at its peak tallied 1.2 trillion yuan ($171 billion) of assets.

As one of China’s biggest bankruptcy cases, the restructuring will bring to a close the HNA chapter in a freewheeling era when Chinese conglomerates including Anbang Insurance, Fosun Group and Dalian Wanda went on a global spree of buying up trophy assets using heavy borrowings. HNA was one of the most aggressive of China’s deal-making companies. Plowing more than $50 billion into assets ranging from golf courses to duty free shops and landmark hotels across six continents, HNA became the top shareholder of Deutsche Bank AG and Hilton Worldwide Holdings Inc.

It all began to sink back to earth in 2017 as alarmed Chinese authorities began letting the air out of the conglomerates’ ballooning debt. HNA has been scrambling to unload assets for years in an unsuccessful effort to get out of its resulting liquidity crisis. The pandemic’s crippling effects on the company’s core airline and travel businesses proved too much to overcome, forcing a massive bankruptcy reorganization that will wipe out shareholders under a plan intended to repay creditors over the next five to eight years.

Under a plan worked out by a government-appointed task force, HNA’s three listed companies — Hainan Airlines Holding Co. Ltd., HNA Infrastructure Investment Group Co. Ltd. and CCOOP Group Co. — will go through a judicial restructuring, Caixin learned from people close to the working team. That will include attracting strategic investors, swapping debt for equity and resolving a maze of related-party debt issues. Other listed HNA units won’t go through judicial restructuring but will also need to attract strategic investors. The unlisted companies will be consolidated and restructured, and their debt might be packaged into trust beneficial shares, according to these people.

After the restructuring, founder Chen Feng and other long-term shareholders will be out, and HNA Group will be owned by creditors and strategic investors. But whether the giant aircraft will ever straighten up and fly right or will be dismantled into smaller planes remains to be seen.

In self inspections, the three core listed companies discovered at least 112 billion yuan of misused funds, undisclosed debt guarantees and questionable investments by major shareholders and their affiliates. Hainan Airlines said it expects to report a 2020 loss of as much as 65 billion yuan, a record for mainland-listed companies. HNA Infrastructure estimated 2020 losses of as much as 8 billion yuan, and CCOOP, as much as 4.9 billion yuan.

The government-appointed working team and auditors are sifting through a mountain of papers to unravel a tangle of debt and assets at HNA Group and its hundreds of subsidiaries and affiliates. After countless meetings with creditors, the central bank, the securities regulator, the aviation regulator and other government departments, all key parties agreed to a restructuring path, the core of which is a marketized and implementable plan following the rule of law, the people with knowledge of the matter said.

|

A game of ‘10 pots and seven lids’

This is not the first crisis for the 32-year-old company. Founded in 1989 as a state-owned airline in southern China’s island province Hainan by Chen and co-founder Wang Jian, HNA set records as the country’s first joint-venture airline and as a leader in the first wave of Chinese private companies to make large global acquisitions. Its growth strategy was simple and effective: Acquire assets through leverage, then use them as collateral to obtain more financing and buy more assets. HNA bet that as long as asset prices kept rising and its financing chain didn’t tighten, the cycle could continue forever.

HNA survived two crises during the SARS epidemic in 2003 and the global financial crisis in 2008.

“Basically every three to five years, people would say HNA’s capital flow is broken and the company is going to have big trouble,” Wang once acknowledged in an internal meeting.

Especially in the 2003 SARS episode, HNA’s business was in a slump, with a loss of 1.5 billion yuan, five times the average of its peers, and a debt-to-capital ratio as high as 90%.

“We call it a game of ‘10 pots and seven lids,’ a Hainan provincial official said. “As long as there are no problems in operation, the pots will keep boiling. But if you get down to five lids only, there will be a problem.”

Until 2017, HNA had enough lids for its multiple pots. It was able to fund its global acquisition spree through government support and funds raised in the capital markets by listed subsidiaries.

The 2015 stock market frenzy in particular provided low-cost funds. According to Caixin data, HNA Group raised 130 billion yuan on stock markets from the end of 2014 to 2016. A Shanghai-listed unit of HNA Logistics Group Co. Ltd., with only 32 million yuan of assets and an annual loss of 130 million yuan, was able to raise 12 billion yuan through a stock placement in 2013. The company used the proceeds and loans to acquire New York-listed information technology provider Ingram Micro Inc. for $6 billion.

By the end of 2017, HNA’s assets ballooned to 1.23 trillion yuan with total debt of 740 billion yuan. The group’s revenue more than tripled to 587 billion yuan in 2017, ranking 78th among Fortune 500 companies.

Confusingly, HNA’s highly leveraged acquisitions reduced rather than increased its debt-to-assets ratio to 60% at the end of 2017, which the company often cited to argue that its shopping binge made its finances healthier. An investment banker attributed HNA’s lower debt-to-capital ratio to the high quality of the assets HNA acquired.

“But with the high leverage, it will be hard to even pay the interest costs in three to five years,” the banker said.

Beijing launched a crackdown in mid-2017 on “excessive” overseas investment by some Chinese conglomerates and warned banks not to lend to them, forcing companies such as Anbang, Fosun, HNA and Wanda to unload offshore assets.

In December 2017, a new rule issued by the country’s top economic planning body tightened oversight of Chinese companies’ foreign investments, which “effectively cut off HNA’s funding source for overseas investment,” Wang told Caixin at the time. The co-founder died in 2018 in an accident in France.

S&P Global Ratings in November 2017 lowered HNA’s credit rating from B+ to B and later further downgraded the company to CCC+ to reflect its deteriorating liquidity position. The group is facing “significant debt maturities” and liquidity pressure due to “uncertain access to capital markets,” S&P said. Such rating cuts dramatically reduce a borrower’s access to credit while jacking up the cost.

Meanwhile, China Citic Bank, a major HNA creditor, said Hainan Airlines Holding had difficulty repaying commercial notes. The company insisted that it was in a “very healthy financial position,” even as it started to dispose of domestic and overseas assets. In 2018, HNA sold about 300 billion yuan of assets, including its stakes in Hilton and Deutsche Bank, land parcels in Hong Kong and property projects in Australia and the U.S.

At that time, governments at all levels and regulators were still relatively lenient toward HNA, believing that the company was just facing a liquidity crisis and could return to healthy development as long as it could raise cash by quickly selling assets and focus on its core airline business.

Read more

In Depth: HNA Charts New Course Back to Airline Basics

In 2018, under the coordination of regulators, HNA’s creditor committee led by China’s largest policy bank China Development Bank provided about 10 billion yuan of loans to help the company repay bonds.

Not selling assets quickly enough

In retrospect, HNA missed its best opportunity in 2017 and 2018 to dispose of assets in time to save itself, according to a person who participated in HNA’s asset disposal.

“Especially after the second half of 2018, when the crisis was already very severe, Chen didn’t want to aggressively sell assets,” the person told Caixin.

When HNA sold its stake in Hilton in 2018, it still netted 10 billion yuan of profit. But after 2019, HNA had to sell many assets at a loss and even failed to dispose of some. If HNA had managed earlier to divest Swissport International AG, an airport ground services business it acquired for 2.73 billion Swiss francs ($2.8 billion) in 2015, it wouldn’t have incurred much of a loss, the person said.

HNA had held talks to sell Swissport to potential bidders including Brookfield Asset Management Inc. and Cerberus Capital Management, but didn’t make a deal. The Swiss company has been in a liquidity crisis and laid off more than half of its workforce last year.

The biggest problem was that HNA misled creditors and regulators into thinking that it was just a short-term liquidity risk and could plug the debt hole by selling assets. In fact, the company was already insolvent and facing a serious debt crisis, said the person who participated in HNA’s asset disposals.

The Covid-19 pandemic became the last straw. According to financial reports, net cash flow generated by HNA Airlines operations was a negative 12 billion yuan in the 2020 third quarter.

HNA did not report 2019 and 2020 financial results, making it difficult to get a clear picture of its overall financial situation. According to HNA Group’s 2019 half-year report, as of June 2019 the company had total assets of 980.6 billion yuan and total liabilities of 706.7 billion yuan, with a 72% assets-to-liabilities ratio. However, several sources told Caixin that HNA’s actual assets-to-liabilities situation was far worse than the books showed as there was a large amount of off-balance-sheet loans and hidden financing. Presidents of several big banks said they were not clear about HNA’s leverage ratio.

When the government-appointed working team looked at the books, it quickly found that almost all of HNA’s good-quality assets were already pledged or frozen, and some of them were even pledged more than once, making them impossible to sell. Gu Gang, who heads the government working team, said HNA Group doesn’t even have a proper consolidated balance sheet.

After months of inspection, the working team and auditors confirmed HNA’s insolvency. They combed through 2,300 HNA subsidiaries and affiliates and found that 90% of them were shell companies and fewer than 200 were actually operating entities. They also found that capital flows between affiliated companies amounted to trillions of yuan.

Back on feet in 5–8 years

The working team plans to complete the bankruptcy restructuring in six months, including debt payoffs, debt extensions, debt-for-equity swaps, debt-for trust shares and introduction of strategic investors, according to the people close to the working team. Ideally, HNA could achieve steady development over the next two years and repay creditors in five to eight years, the people said.

Subsidiaries that can maintain normal operations and have clear financial ties with the parent company, such as six units in the leasing sector, will not have to go through bankruptcy restructuring but may introduce strategic investors, according to a person close to the working team. After the reorganization, HNA Group will become a holding company with no operating entities that can be managed by the debt committee or an asset management company, the person said.

As for HNA’s core airline business, the working team has given up on a plan proposed by Chen to sell HNA’s regional airline units to local governments. Instead, the airline business will seek to attract strategic investors as a whole. New investors and creditors will become the main shareholders of the airline unit and maintain HNA’s status as China’s fourth-largest airline.

The restructuring also means that HNA’s major shareholders will lose their stakes. According to information released by HNA in July 2017, the company’s two largest shareholders were charitable funds. One, the U.S.-registered Hainan Cihang Charity Foundation, held 29.5% of the company while a similarly named foundation based in Hainan held 22.75%. Co-founders Wang and Chen, each with a 14.98% stake, were the biggest individual shareholders. After Wang’s death, HNA said his stake would be donated to the domestic Cihang foundation. The two charitable funds would then together hold 67.23%.

Based on the basic legal principle that the interests of creditors take precedence over those of shareholders, the equity of existing shareholders should be adjusted and cleared in bankruptcy proceedings and then allocated to creditors to offset the debt, or the equity of the existing shareholders will be sold to strategic investors to generate funds to repay creditors.

Because of their large losses, the three core listed companies face the risk of delisting. Only after the problems of misused funds and debt guarantees between HNA subsidiaries and affiliates is resolved can the restructuring actually start, several creditors said.

Under the restructuring plan, Hainan Airlines will transfer interest-bearing debt of at least 72.5 billion yuan to the parent HNA Group and to HNA Aviation Group Co. At the same time, HNA Infrastructure and CCOOP will convert part of their capital reserves into new shares and then ask the controlling shareholders and their related businesses to surrender shares.

Creditors said the plan is aimed at meeting the requirements of securities regulators to resolve misused funds by related parties and protect the interests of minority shareholders.

As for how much of HNA’s hundreds of billions of yuan of debt on the balance sheet will be restructured and how much will be repaid, it will depend on how much in assets and liabilities HNA needs to maintain normal operations in the future, as well as how much cash new strategic investors can bring, people close to the working team said.

At a routine meeting with HNA employees Jan. 25, working team leader Gu told colleagues that “we should have the confidence to defuse risks, but not be blindly optimistic.”

Contact reporter Denise Jia (huijuanjia@caixin.com) and editor Bob Simison (bobsimison@caixin.com).

Download our app to receive breaking news alerts and read the news on the go.

- MOST POPULAR