CX Daily: China Is Eliminating 'Hukou' Restrictions for Some Cities

China is eliminating residency restrictions for some smaller cities

China’s state planner is requiring local governments to lift household registration restrictions for people who live and work in some second- and third-tier cities to advance reform of the residency system for migrants.

China will eliminate all restrictions for household registration, or “hukou,” for all cities with an urban population of 1 million to 3 million, the National Development and Reform Commission (NDRC) said in a notice Monday.

Based on their urban populations in 2016, cities such as Wuxi and Ningbo in eastern China would qualify for the relaxed residency rules. The NDRC said governments of cities with an urban population of 3 million to 5 million should also ease restrictions for migrant workers who have lived there for more than five years.

FINANCE & ECONOMICS

Foreign investment / Australia

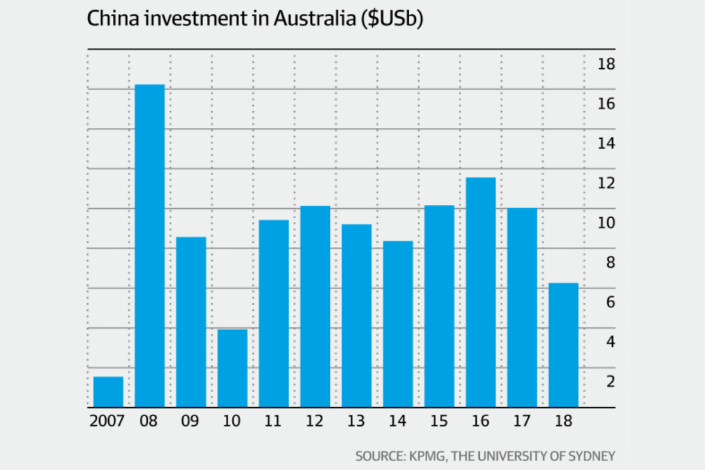

Chinese investment in Australia lowest in decade

Australia experienced its sharpest drop in Chinese investment in more than a decade last year due to Beijing’s clampdown on capital outflows and the demise of big mining and commercial property deals, a report released on Monday shows.

|

In-depth /

The ‘reverse mortgage’ trap for retirees

What sounded like a lucrative investment plan offered by Zhongan Minsheng Elderly Service Co. Ltd. – take out a big loan with just a house as collateral and invest the borrowed money with the promise of decent four-figure (in dollar terms) monthly earnings to help ease a tight pension – has turned out to be anything but.

Less than three months after one person pledged his home and signed the investment contract with Zhongan, the lenders accused him of failing to pay interest and threatened to sue him for breach of contract. At the same time, he stopped receiving investment returns from Zhongan.

Check out our in-depth look at a brewing scheme that's snared as many as 190 elderly Chinese who now face debt collection.

Forex /

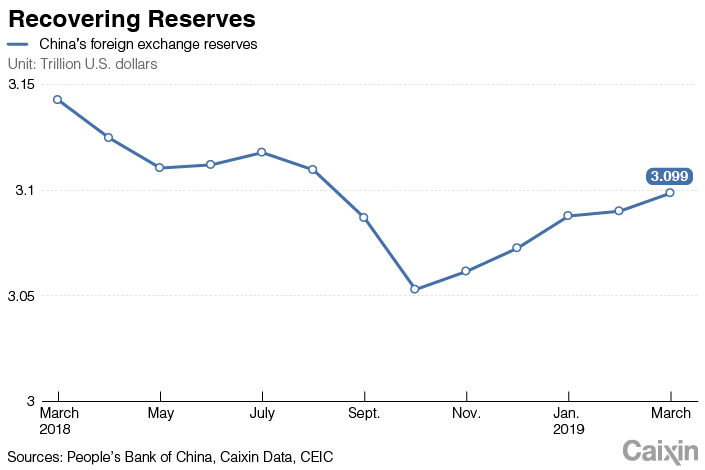

China’s foreign exchange reserves grow to seven-month high

|

Regional integration /

Here's who might benefit from China’s Greater Bay Area plan

Investment banks UBS Global Wealth Management and Singapore-based DBS Bank have listed specific companies that they see benefiting from investment opportunities created by forthcoming Greater Bay Area (GBA) development policies.

Among them are companies with a high proportion of revenue generated in the area, including insurers AIA Group Ltd. and Ping An Insurance and Bank of China (Hong Kong). Tencent Holdings Ltd. could benefit from favorable policy for talent in the region, DBS said. Other industries covered included property, auto, cement, rail, as well as those with established relationships with local governments.

Check out the full list.

Quick hits /

China has good reasons to join Pacific trade pact, but plenty stand in its way

BUSINESS & TECH

Mixed-ownership /

Northeast China looks to private sector to bolster state assets

A state-owned asset management watchdog in northeast China’s Liaoning province, part of the country’s rust belt, has offered 52 provincial SOEs the opportunity for “mixed-ownership reform,” which would allow the companies to accept both investment and management from the private sector, according to state-run Xinhua News Agency.

The 52 SOEs are in the equipment manufacturing, environmental services, and metallurgy industries, among others. Notable on the list is Benxi Steel Group Corporation, which was founded in 1905 and is widely considered one of the “cradles of China’s steel industry.” The total assets of these SOEs are worth an estimated 200 billion yuan ($29.78 billion), and they currently employ approximately 80,000 people, an official said to Xinhua.

Energy /

Earthquakes are the latest setback to China’s fracking ambitions

After viral backlash against shale gas mining following a series of earthquakes in Rong County, Sichuan province, in February, the local government finally suspended fracking operations. Sources at the two state-owned giants drilling in the region, Sinopec and CNPC, say they don’t know when operations will resume, if at all.

Many have long dreamed that China might follow the U.S. and its shale gas transformation by harnessing its own reserves. After all, the country sits atop an estimated 1.115 trillion cubic meters (39 trillion cubic feet) of shale gas, the largest reserves in the world. But the suspension marks the latest major setback for such ambitions.

Check out our in-depth look at China's shale boom-turned potential bust.

Higher ed /

Under pressure from Beijing, Tsinghua cuts stake in another firm

Tsinghua Holdings Co. Ltd. plans to sell a portion of its stake in Tsinghua Tongfang Co. Ltd., an information and energy-conservation technology company, to an investment unit of China National Nuclear Corp., in a deal valued at 7 billion yuan ($1.04 billion), the Shanghai-listed Tongfang said in a statement.

The deal is just the latest move by the very profitable Tsinghua University-affiliated holding company to unload some of its assets since the central government began last year pushing Chinese universities to focus more on education and less on business.

Logistics /

JD.com confirms trials to eliminate delivery drivers’ base pay

JD Logistics, a decade-old unit of e-commerce giant JD.com, has tested cutting the base pay of delivery workers in some regions, leaving them with only performance-based pay, in a further move to cut costs.

In the cities where base pay was eliminated, many delivery workers were making an average of 8,000 yuan ($1,190) a month, the company said. Local news site Sanyan Caijing estimated this would amount to a pay cut of 15-20%.

Logistics /

Consolidation delivers knockout to midsize courier Rufengda

Midsize courier Bejing Rufengda Express Delivery Co. Ltd. has collapsed, becoming one of the largest victims in a consolidating sector that boomed with the rapid rise of e-commerce in China.

Like many emerging Chinese business sectors, parcel delivery is heading into the cleanup phase of a boom-bust cycle that spawned dozens of companies at its height. Seven publicly listed players, including the likes of S.F. Holding Co. Ltd. and ZTO Express (Cayman) Inc., now control more than 70% of the market, according to official statistics.

Quick hits /

Beijing halves electricity bill surcharge to zap flagging economy

African swine fever spreads to Tibet

Thanks for reading. If you haven't already, click here to subscribe.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas