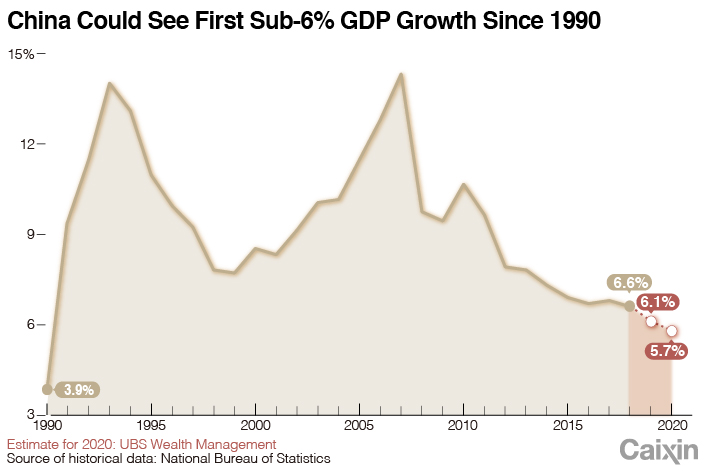

China’s Economy Set for More Pain in 2020 as Growth Forecast to Sink Further

China’s economic growth could drop below 6% next year for the first time since 1990 as the world’s second-largest economy continues to be affected by the trade war with the U.S. and cooling infrastructure investment, UBS Wealth Management forecasts.

Real gross domestic product (GDP) is set to increase by just 5.7% in 2020, according to Hu Yifan, regional chief investment officer and chief China economist at UBS Wealth Management, a unit of Switzerland-based banking group UBS AG. That compares with an estimated 6.1% in 2019 and would mark the third straight annual slowdown.

China’s GDP growth slipped to 6.6% in 2018 from 6.8% the previous year, and was 6.2% year-on-year in the first nine months of 2019, the National Bureau of Statistics said in October.

Hu isn’t the only analyst forecasting sub-6% GDP growth in 2020. Nomura Holdings Inc., Goldman Sachs Group Inc. and Moody’s Investors’ Service estimate expansion of 5.8%. Morgan Stanley is a little more optimistic, with a base case scenario of 6%, although its economists say growth could slip to 5.9% if the trade war worsens and the property market slumps, and could fall as low as 5.3% in a worst-case scenario where trade talks with the U.S. break down and more tariffs are imposed by Washington on Chinese goods.

|

Economic growth is being dragged down partly by slowing domestic demand fueled by a slump in investment, and partly by the trade dispute with the U.S., which has led to a significant decline in exports to what was previously China’s biggest overseas market. Beijing and Washington announced in October that they were working toward “phase one” of an agreement to end their row, although it has yet to be concluded.

Sluggish housing market

Hu said the two sides are moving closer to a “phase one” deal, but they are not likely to strike more ambitious “phase two” or “phase three” deals next year given their disagreements at recent talks. That has dimmed the outlook for trade next year and Hu said she is forecasting zero growth in imports and exports next year, or even an outright decline. However, if “phase two” and “phase three” of a trade deal are struck in 2020, growth for the year could be as high as 6%, she said.

U.S. President Donald Trump said on Tuesday that the two sides were in the “final throes” of negotiations to complete the first phase, which would see China increase purchases of American agricultural goods and commit to protecting U.S. intellectual property. However, Hu said that market concerns are growing over whether the partial deal can be reached before Dec. 15, when the U.S. is set to implement previously announced tariffs of 15% on $160 billion worth of imports from China.

In addition to international factors, on the domestic front cooling investment in the sluggish housing market is putting downward pressure on economic growth, Hu said. She forecast a continued slow decline in real-estate investment in 2020 as the government maintains controls over the property market to prevent speculation and restricts property developers’ ability to raise capital.

Infrastructure investment has been a key plank in the government’s counter-cyclical adjustment policies to support economic growth. The State Council, China’s cabinet, has urged local governments to speed up the issuance of special-purpose bonds, which are used to raise money specifically for public works, including infrastructure projects. The Ministry of Finance also announced this week the early allocation of 1 trillion yuan ($142 billion) of such bonds from next year’s quota.

But the measure has not had a significant impact on infrastructure investment, which rose just 4.2% in the first 10 months of 2019. Hu told Caixin that growth in infrastructure investment in 2020 may still be slightly lower than her estimated 2019 growth rate of 5%, and if can match that pace that would already be very good.

China’s central bank is also likely to further loosen monetary policy and lower banks’ reserve requirement ratios between 100 basis points to 200 basis points by the end of next year to support growth, she said. But even this may not be as effective as it has been in previous economic cycles as businesses, especially small and medium-sized enterprises, have less need to borrow and raise capital due to concerns over sinking profits from weakening demand, He said.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Caixin Global has officially launched Caixin CEIC Mobile, a mobile-only version of a world-class platform for macroeconomic and microeconomic data.

From now on, all users can enjoy a one-month free trial on the Caixin App through December 2019. If you’re using our App, click here. If you haven’t downloaded the App, click here.

- PODCAST

- MOST POPULAR