CX Daily: Tencent To Create $10 Billion Livestreaming Juggernaut

Livestreaming /

Tencent pushes for creation of $10 billion livestreaming juggernaut

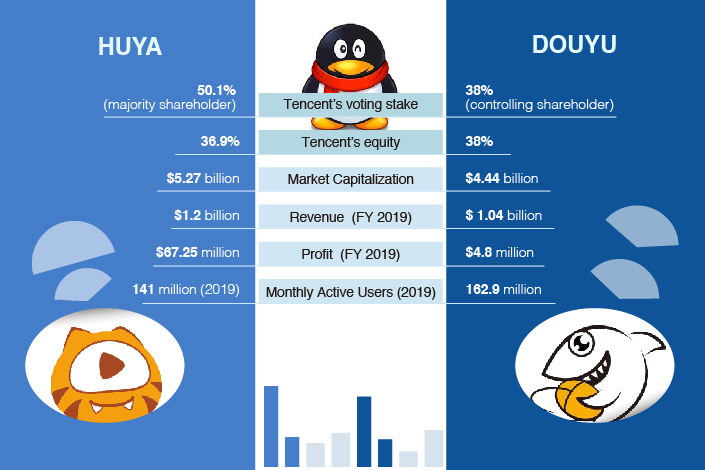

Tencent has gone public with its plan to merge China’s top two livestreaming platforms into an industry dominating $10 billion juggernaut with 300 million users.

In a Monday letter to Huya Inc. and DouYu International Holdings Ltd., the internet giant proposed a stock-for-stock merger. Under the plan, Huya would acquire all outstanding DouYu shares via DouYu shareholders, ex-changing their stock for an as-yet undetermined number of newly issued Huya shares.

Both companies released statements Monday saying they were considering the nonbinding proposal but no decisions had been reached. If the companies approve the plan, it may still face hurdles from China’s anti-monopoly watchdog. Tencent is the largest shareholder of both companies.

FINANCE & ECONOMICS

|

Among the 7,831 returned individuals, 2,075 were party members and government employees, and 348 were listed on Interpol’s “red notice.” |

Fugitives /

China seized 7,831 fugitives abroad and recouped $2.8 billion since 2014

China seized 7,831 fugitives over the past 6½ years and recouped losses of 19.7 billion yuan ($2.8 billion) under a government campaign to pursue corrupt officials and dodgy business people who fled abroad, according to a report by the National Supervisory Commission (NSC), the top government anti-graft agency.

The fugitives, who allegedly committed economic or corruption crimes, were either repatriated under cross-border law enforcement partnerships or voluntarily returned from more than 120 of the world’s nearly 200 countries and regions, the commission said in its first work report submitted Monday to the national legislature.

The NSC report for the first time the detailed results of China’s international operations to hunt down wanted fugitives between 2014 and June 2020.

Regulator /

China urges frank dialogue on cross-border audit reviews

China’s securities watchdog said the right way to improve cross-border cooperation on audit inspections is to have frank dialogue (link in Chinese). China has proposed joint accounting inspection plans repeatedly since 2019 and has shown “full sincerity for cooperation,” the China Securities Regulatory Commission (CSRC) said Sunday.

The Trump administration issued a report Thursday recommending that regulators delist U.S.-traded Chinese stocks that fail to meet auditing requirements by January 2022. The two countries have had a longstanding dispute between regulators over access to audits of U.S.-listed Chinese companies. Yi Huiman, China’s top securities regulatory official, told Caixin in an interview in June that China has never banned or stopped Chinese companies from providing audit working papers to overseas regulators.

Bribes /

Disgraced financial bigshot accused of taking more bribes than anyone else in China

A former chairman of one of China’s “Big Four” state-owned bad-asset managers, Lai Xiaomin, was accused of taking a record 1.79 billion yuan ($258 million) of bribes over 10 years as he stood trial in North China’s Tianjin municipality Tuesday.

Lai’s case shocked the Chinese public with astonishing details, such as the tons of cash stashed at his home, the 300 million yuan bank account under his mother’s name, and his more than 100 mistresses.

The bribery involved in Lai’s case took place between 2008 and 2018, according to a court statement (link in Chinese). Lai was also accused of colluding with others to illegally embezzle 25.1 million yuan in public funds from 2009 to 2018. In addition, he was accused of bigamy.

Banking /

Commercial banks post 9.4% profit drop in first half as pandemic bites

China’s commercial banks reported a 9.4% decline in first half net profits to 1 trillion yuan ($143 billion), reflecting the impact of the Covid-19 pandemic, data from the China Banking and Insurance Regulatory Commission (CBIRC) showed Monday.

The CBIRC didn’t provide a breakdown of the quarterly profit figure, but a Caixin calculation based on previously released figures showed that the second-quarter profit of commercial banks dropped 28.4% from a year ago. The bad-loan ratio increased by 0.03 of a percentage point from the first quarter to 1.94% at the end of the second quarter while provision coverage for risky assets declined 0.8 of a percentage point to 182.4%.

Quick hits /

Fanya Metal Exchange scandal nets small fry who raised funds from investors

Investors take longshot to subscribe for registration-based ChiNext IPOs

Haidian district investment platform plans stop-gap short-term borrowing

BUSINESS & TECH

|

Autos /

China car recovery gathers pace with July sales accelerating

A recovery in China’s car sales accelerated last month, signaling the world’s biggest auto market is emerging from a two-year slump as the economy improves and pandemic restrictions ease.

Retail sales of sedans, SUVs, minivans and multipurpose vehicles increased 7.9% in July from a year earlier to 1.63 million units, the China Passenger Car Association said Tuesday. The sales trend had been improving on a monthly basis since March before a 6.5% drop in June. Tesla Inc. and BYD Co. led the way in electric-car sales last month. The car industry is betting that the reopening of showrooms and malls as the coronavirus pandemic eases in China will lead to a sustained increase in demand.

After a year in reverse, new-energy vehicles sales return to growth

App /

WeChat users in the U.S. fear losing family links with ban

U.S. President Donald Trump’s order to ban Chinese social media app WeChat may not have resonated with many Americans who are used to Facebook, Instagram and Twitter to keep in touch with family. But for millions of people with family or business in China, the move has personal consequences.

WeChat has about 19 million daily active users in the U.S., according to analytics firm Apptopia. For some, the app is a way to stay connected to the elderly in the U.S. and abroad. A feature of the app allows users to translate messages in real time, according to its description on Apple Inc.’s App Store. Some users said Trump’s actions against WeChat and other Chinese apps are unjustified.

Medicine /

Japan, U.K. to launch $20 billion global vaccine alliance, countering U.S., China

Japan, the U.K. and more than 70 other countries plan to form an alliance this fall to jointly procure 2 billion doses of coronavirus vaccines by 2021, looking to gain financial leverage in talks with pharmaceutical companies.

The partnership, initially pitched around June by Japan, the U.K., Germany, France and the EU, aims to pool up to $20 billion. The alliance, named Covax, will pay vaccine makers in advance and procure doses for member countries. Supplies for individual nations will be capped at 20% of the population. The U.S. and China each have deep enough pockets to negotiate vaccine deals independently, putting others at a disadvantage. Japan intends to use the partnership to level the playing field in talks with vaccine developers, especially when dealing with a Chinese or American manufacturer.

Education /

GSX Techedu continues under short-selling pressure in New York

Short seller Citron Research continued to attack China’s New York Stock Exchange-listed GSX Techedu, calling the online after-school tutoring service provider “a fraud” and pushing the stock down nearly 10% Monday.

Citron Research, which accused GSX this spring of overstating its revenue by as much as 70% and shorted the shares, tweeted Friday that GSX is the only large cap stock in 20 years that reported expanding revenue more than 350% in a year and posted profits during the growth. The short seller also said it has confidence in auditors and regulators to expose it as fraud. GSX has consistently denied the allegations of financial reporting fraud.

New Oriental picks 3 banks for $1 billion Hong Kong listing

Quick hits /

Tencent-backed China Literature posts massive loss, citing ‘structural issues’

China mainland leads U.S. in Fortune Global 500 companies but trails in profitability

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas