Regulator Warns China’s Trust Firms That Crackdown Isn’t Over

China’s banking and insurance regulator has pledged to continue its crackdown on the trust industry this year, with a particular focus on curbing trust financing and channel lending, amid concerns about mounting risks in the sector.

At a meeting on Sunday, the China Banking and Insurance Regulatory Commission (CBIRC) outlined a target of cutting the total outstanding value of trust-financing products by another 1 trillion yuan ($155 billion) this year and effectively shutting the business down completely over the next five years, several trust firm executives who attended the annual regulatory work conference told Caixin.

For years, the trust industry has played an important role in shadow banking by providing loans to higher-risk companies and those with difficulty obtaining credit from banks. But the authorities have become increasingly concerned about the potential risks in the once-freewheeling and lightly regulated sector following a series of scandals and defaults involving billions of yuan. Among the most high profile are Sichuan Trust Co. Ltd., which failed to repay investors more than 20 billion yuan, and Shanghai-listed Anxin Trust Co. Ltd., which was found to have a 50 billion yuan black hole in its books.

Read more

China Tightens Rules for Scandal-Hit Trust Sector Amid Campaign to Contain Risks

Trust financing, which involves providing loans to businesses that are packaged into trust products and sold to investors, became a booming business for trust firms last year as companies scrambled for cash to help them weather the impact of the Covid-19 outbreak or to repay maturing loans. After surging 34% in 2019 to 5.83 trillion yuan, outstanding trust financing continued to increase in 2020, rising by 10.5% in the first half of the year to 6.45 trillion yuan (link in Chinese), according to data from the China Trustee Association (CTA), the industry’s state-backed self-regulatory body.

The growth came despite demands from the regulator that firms should shrink their outstanding trust financing business by at least 20% from 2019 levels, equating to a total of around 1 trillion yuan (link in Chinese).

By the end of September, after further window guidance from the CBIRC, the total outstanding value of financing-related trust products declined to 5.95 trillion yuan. The figure accounted for 28.5% of all trust products, down from a peak of 30.3% at the end of June, according to the latest CTA report (link in Chinese).

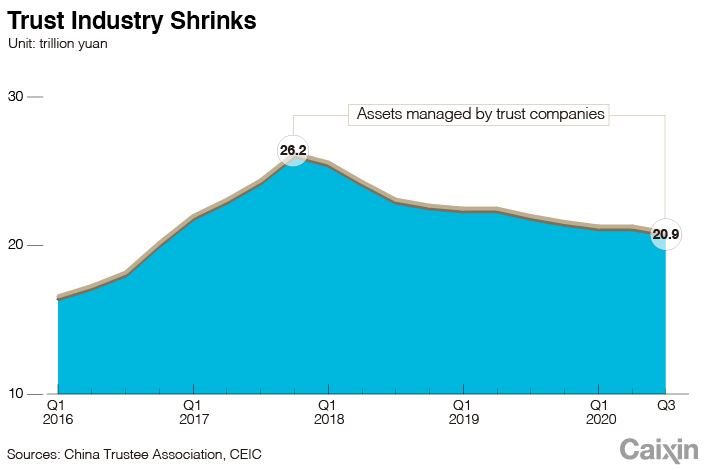

Trust financing has grown even as the overall value of assets managed by the trust industry has been shrinking since reaching a peak of 26.25 trillion yuan in 2017 as the government has implemented a campaign across the financial sector to rein in risky lending and investment and control leverage. Assets managed by the country’s 68 licensed trust companies fell to 20.9 trillion yuan at the end of September, down 3.4% from the end of 2019, and set for the third straight annual decline, data from the CTA show.

|

The meeting was held to discuss supervision of the trust industry in 2021 and was attended by local branches of the CBIRC, senior managers of trust companies, and staff from industry organizations including China Trust Protection Fund Co. Ltd., which operates the state-backed bailout fund for trust companies.

A number of trust companies were called to account by the regulator for their poor performance last year, multiple sources close to the matter told Caixin. Among them were four companies that had expanded their trust financing business: Jiangsu International Trust Corp. Ltd., China Jingu International Trust Co. Ltd., Guolian Trust Co. Ltd. and National Trust Ltd., the sources said. Six failed to meet the annual goal, including Citic Trust Co. Ltd., one of China’s largest trust firms, and troubled Jilin Province Trust Co. Ltd. These firms are being required by the regulator to make up the shortfall for 2020 and complete their target for 2021, the sources said.

CBIRC officials also told the meeting that the regulator will tighten its grip on the channeling business, where trust companies earn commissions by facilitating lending by third parties, typically banks, without bearing sufficient risk control responsibility. A source who attended the meeting said that as a result, it will be “almost impossible” for such partnerships between banks and trust firms to continue.

In 2019, nearly one-third of the 68 licensed trust companies were punished by regulators for a wide range of violations, including conducting illicit off-balance-sheet lending, with fines amounting to 22.5 million yuan. At least four firms were punished for their involvement in illegal activity in the channeling business, including Citic Trust.

The CBIRC officials at Sunday’s meeting criticized some trust firms for skirting regulations by packaging trust financing products into investment products and hiding trust financing behind complex product structures. They also made it clear the regulator wants the trust industry to return to its roots of managing money and encouraged firms to increase their involvement in managing assets for charitable trusts and family trusts, the sources said.

Timmy Shen contributed to this report.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.