Cover Story: The Herculean Task of Bailing Out Huarong

As China Huarong Asset Management Co. Ltd. belatedly confirmed the vast amount of red ink it spilled last year, the Herculean scope of the government-led rescue is becoming clear — with billions of dollars in offshore bonds and domestic debt at stake.

The scandal-plagued state-owned bad asset manager reported a record loss Sunday of 102.9 billion yuan ($15.9 billion) for 2020, in line with the preliminary figure it issued Aug. 18. The Beijing-based company missed the March deadline for reporting last year’s results, triggering the suspension of its shares in Hong Kong and roiling markets across Asia as doubts over its financial health festered.

News Aug. 18 of a long-expected rescue plan involving new state-backed investors eased some of the concerns about the company’s future and buoyed its battered dollar bonds. And yet, the prospective bailout may require capital injections totaling nearly 100 billion yuan from strategic investors and asset sales, Caixin learned.

The restructuring is likely to lead to an ownership change. As of June 2020, Huarong was controlled by the Ministry of Finance with 61.41%, followed by the National Council for Social Security Fund with 6.34%. Citic Group Corp., the state-owned giant leading the rescue, said it plans to invest 20 billion yuan to 50 billion yuan in Huarong, becoming the largest shareholder, ahead of the Finance Ministry.

The four other strategic investors lined up for Huarong are China Insurance Investment Co. Ltd., China Life Asset Management Co. Ltd., China Cinda Asset Management Co. Ltd. and Sino-Ocean Capital Holding Ltd.

The new investors are expected to bring billions of dollars of fresh capital to Huarong, which is trapped under a mountain of debt after decades of reckless expansion. Huarong has not publicly given details of its total debts. But the group and its subsidiaries have nearly $20 billion of outstanding offshore bonds, market data showed.

The company said it will make share placements with the new investors. It did not disclose the amount of the strategic investment but said the funds will help replenish capital and consolidate the company’s foundation for sustainable operations. The deal is subject to regulatory approval.

Although Huarong’s shares will remain suspended as the reshuffle unfolds, the progress has offered some relief to investors. The shares had plunged 67% since debuting in Hong Kong in 2015.

“Now, the biggest uncertainty of Huarong’s fate has been settled,” one market source said.

Established in 1999, Huarong is one of four national asset management companies created to dispose of a massive volume of nonperforming assets held by China’s big state banks. Their job is buying up distressed debt and trying to recoup as much money as possible by selling or restructuring the assets or applying other methods of recovering the debt.

Huarong has been in turmoil since the downfall of former Chairman Lai Xiaomin in April 2018. Under Lai’s decade-long tenure, Huarong expanded beyond its original mandate and grew into a financial conglomerate engaged in a wide range of financial services, including securities, trusts, banking and financial leasing. But the aggressive expansion through opaque deals with affiliated companies left Huarong with hundreds of billions of yuan of unresolved bad debt.

Lai was sentenced to death and executed in January in the country’s biggest financial-sector corruption case. He was convicted of taking a record 1.79 billion yuan of bribes from 2008 to 2018 as well as bigamy and embezzlement.

|

| Lai Xiaomin was convicted of taking a record 1.79 billion yuan of bribes from 2008 to 2018 as well as bigamy and embezzlement. |

In its Aug. 18 statement, the company said the 2020 loss reflected the clearing and disposal of risky assets taken on under Lai’s “aggressive operation and disorderly expansion.”

Since the downfall of Lai, the actual size of Huarong’s risky assets has become a burning question. Caixin learned that Citic Group sent a due diligence study team to Huarong in June to review the company’s books, interview staff and make spot checks. The inspection is set to be completed in October, ahead of the strategic investment that is scheduled by Dec. 31, sources said.

Huarong’s auditor Ernst & Young has classified about 380 billion yuan of the company’s assets as risky — meaning part of their value may be unrecoverable.

Most of Huarong’s risky business endeavors on Lai’s watch were related to overseas expansions, affecting nearly 400 billion yuan of the company’s offshore assets. The company raised more than $20 billion through offshore bond sales to fund the deals, according to authorities’ investigation.

According to the Sunday earnings release, Huarong reported a 102.9 billion yuan loss for 2020 but returned to a profit of 158 million yuan in the first half this year. Its capital adequacy ratio was 6.32% as of June 30, falling from 13.2% at the end of June last year and was far below regulatory requirements.

The company’s borrowings amounted to 782 billion yuan as of June 30, of which those coming due within one year amounted to 578 billion yuan.

Risk exposure

Huarong has spun off some of the souring assets to its subsidiary Huarong Huaqiao Asset Management Co. Ltd. in preparation for a restructuring. By the end of 2020, more than 200 billion yuan of questionable assets were transferred to Huarong Huaqiao, Caixin learned.

In April 2020, Huarong’s wholly owned arm Huarong Zhiyuan Investment Management Co. Ltd. said it planned to sell its 91% stake in Huarong Huaqiao, a move seen as an effort to separate Huarong from the risky assets. But no progress on that deal has been published.

Since early 2019, Huarong has started to pare back its operations outside the distressed asset disposal business at the request of regulators. The company has consolidated its overseas businesses into two platforms — Huarong International Holdings for normal operations and Huarong Huaqiao for disposal of bad assets.

|

Huarong’s risk exposure in the home market is a concern.

“During the years when the bad asset businesses underwent reckless expansion, asset managers led by Huarong have aggressively purchased some assets that will be difficult to dispose of,” said one industry source.

In its half-year financial report for 2019, Huarong said it would write off a total of 42.3 billion yuan for 2018 and 2019 for impairment. In its report for 2020, the bad loan manager said it booked 107.8 billion yuan of impairments and suffered a 12.5 billion yuan loss on financial assets.

|

Strategic investors

A restructuring plan for Huarong has long been under discussion, Caixin learned. In June, Citic proposed to lead the Huarong restructuring and won regulatory support. As China’s largest state-owned financial conglomerate, Citic had total assets of 8 trillion yuan as of the end of 2020 with annual profit of 47.2 billion yuan. The company has a wide range of financial businesses but lacks a national license for distressed asset management.

“With such a huge size, Huarong’s restructuring can only be led by industry leaders such as Citic,” one industry source said. “The strategic investment will help (Huarong) defuse risks accumulated from aggressive expansion.”

While introducing new investors, Huarong’s restructuring will also include asset disposals to downsize its noncore businesses. Huarong’s assets expanded from 309.3 billion yuan in late 2012 to more than 1.87 trillion yuan by the end of 2017 during Lai’s tenure. But many of the investment turned out to be risky bets, leaving the company with huge piles of bad assets.

As Huarong steps up asset disposals, total assets shrank to 1.7 trillion yuan by 2020. Its employment headcount fell from 13,000 to 10,000.

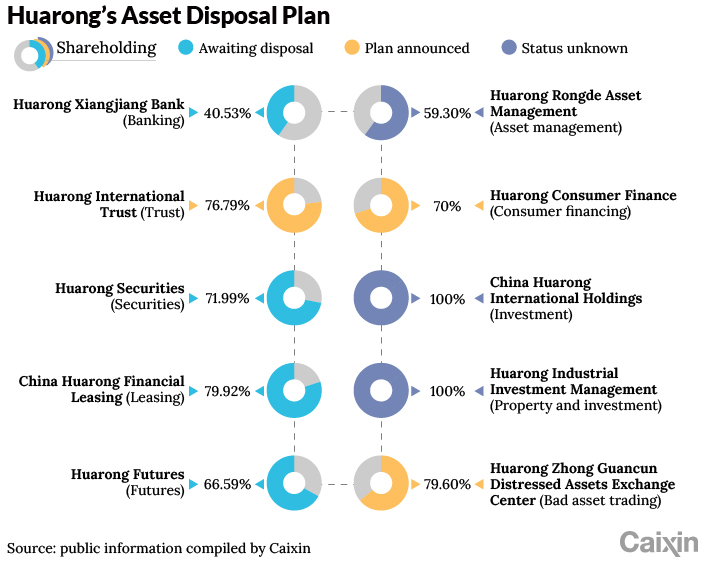

Huarong is seeking to raise cash by selling its stakes in at least seven units, involving 700 billion yuan of assets, to repay debt and downsize the business. The company reassured investors in August that its liquidity was sufficient and indicted that there is no plan for debt restructuring.

The units up for sale include Huarong’s holdings in Huarong Xiangjiang Bank Corp. Ltd., Huarong Securities Co. Ltd., Huarong International Trust Co. Ltd., Huarong Consumer Finance Co. Ltd. and China Huarong Financial Leasing Co. Ltd., as well as its stakes in two local asset management companies, Caixin learned.

Huarong holds a 76.79% stake in Huarong International Trust, which managed 142.5 billion yuan of assets as of the end of 2019. Around 70 billion yuan of assets managed by the trust have become nonperforming, sources said.

Huarong Securities, 72% owned by Huarong, is also hobbled by risky assets totaling about 30 billion yuan. In January, the Beijing branch of the top securities regulator ordered the brokerage to work out a plan for the disposal of its risky assets as soon as possible.

Uncertain outlook

Investors are closely monitoring how Huarong’s restructuring will affect its bond repayments. Since the share trading suspension, Huarong’s bonds have suffered waves of selloffs amid growing concerns over its financial health.

In early April, China’s financial regulator tried to calm investors in its first official comments on Huarong after a wild plunge of the company’s bonds.

“Operations at Huarong remain normal, and the company has ample liquidity,” an official at the China Banking and Insurance Regulatory Commission said. “The company is actively cooperating with its auditor and will complete its annual report as soon as possible.” Huarong’s offshore bonds rebounded following the comments but remained highly volatile in following months.

Despite its problematic overseas assets and investments, Huarong aims to guarantee the liquidity of offshore debts from the perspective of the whole company — it generally makes liquidity arrangements three months ahead of the maturity of overseas debt. Overall, Huarong is nowhere near defaulting on its offshore bonds, and neither the major shareholder nor the regulators will allow that to happen, analysts said.

As of Aug. 24, Huarong’s outstanding offshore bonds totaled early $20 billion, down from $22 billion in April. The company said it repaid 94 offshore bonds totaling 63.3 billion yuan on time between April 1 and Aug. 18.

Although Huarong’s offshore bonds rebounded on news of the bailout plan, global credit rating companies remain cautious on the company’s outlook.

On Aug. 23, Moody’s Investors Service cut Huarong’s credit rating to Baa2 from Baa1 and left the company on watch for a potential further downgrade. The ratings company cited the deterioration of the asset manager’s capital. While the prospective capital injection by state-owned enterprises indicates Huarong’s systemic importance, the plan’s exact impact remains unclear, Moody’s analysts wrote.

Moody’s said Huarong’s outlook will depend on the impact of the bailout and the government support it obtains. It is also important to assess whether Huarong can improve its asset quality and profitability after the capital injection and asset sales, as well as its ability to maintain abundant liquidity, Moody’s said.

Contact reporter Han Wei (weihan@caixin.com) and editor Bob Simison (bobsimison@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.