Movers and Shakers: $140 Trillion Market Gets New Boss

| World of Finance

China’s multitrillion-dollar interbank market now has a new head. On Wednesday, Liu Wei (刘薇) officially assumed her new position as the Communist Party chief of the central-bank-backed National Association of Financial Market Institutional Investors (NAFMII). The NAFMII oversees the over-the-counter financial market, which saw more than $140 trillion in assets traded in 2017.

Previously, Liu worked for the State Administration of Foreign Exchange (SAFE), which handles the country’s $3 trillion of currency reserves. Before joining SAFE in 2010, she had served the central bank for years.

Liu’s predecessor, Xie Duo (谢多), earlier this month was appointed chairman of the state-backed Silk Road Fund, which provides financing support for cooperation associated with China’s ambitious Belt and Road Initiative.

| Companies Roundup

|

Richard Liu (left), Hu Weiwei (center), and Shu Yuhui |

No charges for JD.com founder: Prosecutors in the U.S. state of Minnesota have decided not to file sexual assault charges against e-commerce mogul Richard Liu (刘强东). The prosecutors determined that there were “profound evidentiary problems” that would have made it highly unlikely that any criminal charge could be proved. In late August, the JD.com Inc. chairman and CEO was accused of rape in Minnesota by a college student.

The student’s attorney condemned the prosecutors’ decision, saying the case is another demonstration of Minnesota’s “numerous systemic problems” in conducting sexual assault investigations.

On your bike: Hu Weiwei (胡玮炜), co-founder and CEO of shared bike operator Beijing Mobike Technology Co. Ltd., left the company, eight months after it was wholly acquired by online-to-offline services provider Meituan Dianping for $2.7 billion.

This is the latest sign of trouble in a cash-bleeding nascent industry that was once a darling of investors. Over recent years, rampant price wars and a large number of damaged bicycles, along with clashes with officials frustrated at a new form of urban clutter, have taken a toll on the industry.

Scandals and Death:

Shu Yuhui (束昱辉), the founder of Chinese herbal-medicine maker Quanjian Group Co. Ltd., faced a public outcry after a viral article accused the company of making exaggerated claims about its products, which were linked to the cancer death of a 4-year-old girl. The company described itself as China’s biggest direct seller of herbal-based medicine and health-care products. However, Caixin found that only 13 of more than 100 products sold by the company have proper registration records.

Chen Bo (陈波) and Zhan Qi (詹麒), two top officials at Unipec, China’s biggest oil-trading company, have been suspended, according to the firm’s controller, state-owned oil major Sinopec Corp. Sources told Caixin that an investigation is underway into the risk management flaws in Unipec’s hedging operations amid recent wild swings in global crude oil prices, which have led to losses in its oil import business.

Jia Libin (贾利宾), a senior executive of a unit of China’s state-owned shipping giant China COSCO Shipping Corp. Ltd., fell to his death from the 15th floor of a hotel in Taipei. Local police found a nine-page letter in his room saying he had been suffering from depression.

| Corruption Casebook

|

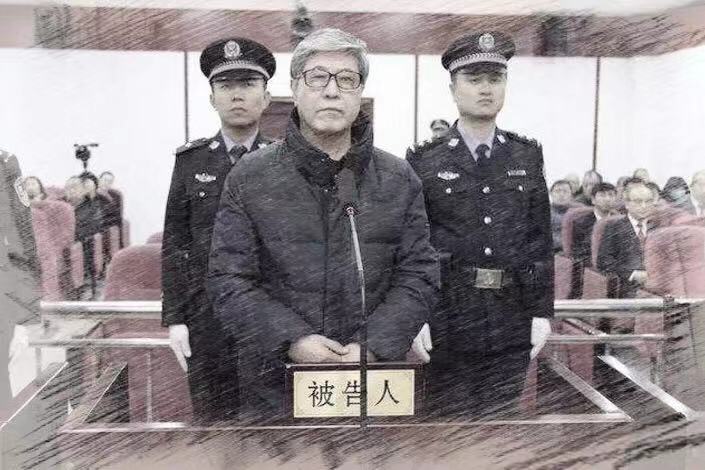

Yang Chenglin |

Yang Chenglin (杨成林), the former chairman of a major joint-stock bank based in the Inner Mongolia autonomous region, was handed a suspended death sentence after being convicted of corruption involving over $87 million.

In addition, Zhang Ting (张婷), Yang’s mistress, was sentenced to five years behind bars for taking bribes. Yang Hai (杨海), Yang’s son, was sentenced to 19 years in prison for taking bribes and embezzlement.

Ma Jian (马建), the controversial former vice minister for state security who oversees counterintelligence operations, was sentenced to life in prison after he was convicted on charges that included bribery and insider trading.

The investigation of Ma was linked to one of China’s most-wanted fugitives, Guo Wengui (郭文贵), a property tycoon who fled China in 2014 and is now living in the U.S. According to a court statement, Ma used his power to help Guo gain business favors, and received bribes totaling more than $15 million.

Contact reporter Lin Jinbing (jinbinglin@caixin.com)

Read more about Caixin’s Movers and Shakers.

If you think we’re missing important moves, or if you have any other comments on this newsletter, please let us know.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas