China Business Digest: Nasdaq Kicking Out Luckin Coffee; Fidelity International Eyes Wholly Owned Mutual Fund Unit in China

|

|

President Donald Trump threatens to pull the U.S. out of the WHO while Chinese President Xi Jinping offers $2 billion in virus aid. Luckin Coffee is notified of delisting by Nasdaq following its massive financial reporting fraud. Meanwhile, asset manager Fidelity International is eyeing business in China.

— By Timmy Shen (hongmingshen@caixin.com) and Han Wei (weihan@caixin.com)

** ON THE CORONAVIRUS

Trump threatens permanent freeze on WHO funding

U.S. President Donald Trump toughened his posture toward the World Health Organization (WHO) by saying he plans to make a temporary freeze on funding for the United Nations health arm permanent unless “substantive improvements” are made. In a letter to WHO Director-General Tedros Adhanom Ghebreyesus Monday, Trump also said he’ll consider canceling U.S. membership in the organization.

Xi pledges $2 billion in aid to countries hit by Covid-19

China will allocate $2 billion over two years to help other countries, particularly developing nations, to fight and recover from the pandemic, President Xi Jinping said in an address to an online session of the World Health Assembly Monday.

Jilin continues to report local cases

On Monday, the Chinese mainland reported six new infections (link in Chinese), including three imported cases in the Inner Mongolia autonomous region and three locally transmitted cases in Jilin and Hubei provinces.

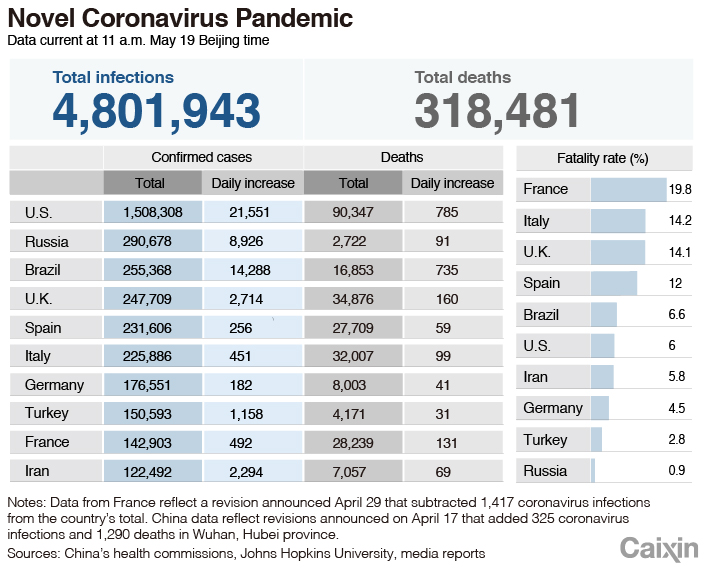

As of Tuesday morning Beijing time, global infections reached over 4.8 million, including over 318,000 deaths, according to data compiled by Johns Hopkins University.

Read more

Caixin’s coverage of the new coronavirus

** TOP STORIES OF THE DAY

Nasdaq moves to delist Luckin Coffee after fraud scandal

Luckin Coffee Inc. received notice from the Nasdaq Stock Exchange that it would be delisted. The notice came more than a month after the Chinese upstart disclosed a $310 million financial reporting fraud. Luckin said Tuesday that it plans to request a hearing before a Nasdaq panel. Sources told Caixin that Luckin has been preparing for a possible delisting that may halt its business expansion.

Fidelity International seeks to set up China mutual fund unit

U.S. asset management giant Fidelity International said it submitted an application to China’s securities regulators to set up a wholly owned mutual fund business in the country. Fidelity followed BlackRock and Neuberger Berman as the third international asset manager seeking such a license after China scrapped foreign ownership caps in the mutual fund sector April 1.

Ping An Good Doctor revamps management team

Health-care services provider Ping An Good Doctor replaced most of its senior executives in a recent management overhaul marked by the exit of almost all of its founding executives. The reshuffle won't affect the company’s operations but may lead to a major adjustment in its business structure, including a merger with another health-care unit of Ping An Insurance, sources said.

China vows more tariff cuts

China will further reduce tariffs and nontariff trade barriers, expanding imports of goods and services to improve the balance of trade, according to a sweeping reform document (link in Chinese) issued by the Central Committee of the ruling Communist Party and the State Council, the country’s cabinet, on Monday. The document said China would offer wider and easier access for foreign investors to more sectors.

Fiscal revenue shrinks at a slower clip

China’s fiscal revenue fell 15% year-on-year in April (link in Chinese), narrowing from a 26.1% decline in March, as economic activity showed signs of recovering from the coronavirus outbreak, according to data from the Ministry of Finance. The country’s fiscal expenditure rose 7.5% year-on-year in April, marking the first monthly increase this year.

|

Debate continues over deficit monetization

As the “Two Sessions” approach, scholars have once again begun to debate whether China should promote the monetization of its fiscal deficit. While some conditionally approve of this suggestion, more scholars have clearly expressed their opposition, arguing that the country mustn’t ease up on financial discipline even at a time when the pandemic remains serious.

There have been heated discussions (link in Chinese) recently over Monetary Policy 3 — which includes deficit monetization — and Modern Monetary Theory. Considered powerful boosting tools, they are mostly put to use with strict prerequisites such as war financing and economic crises, a research group at China’s central bank said.

AIIB’s Chinese president seeks reelection

Jin Liqun, president and chairman of the Beijing-based Asian Infrastructure Investment Bank, is seeking reelection as China has nominated him as a candidate for the organization’s next five-year presidential term, an official statement shows.

Investment grows in wealth management products

At the end of April, the outstanding value of banks’ and their subsidiaries’ wealth management products that don’t guarantee principal increased to 25.9 trillion yuan ($3.6 trillion), up 1.6 trillion yuan from the end of November, according to a Monday official statement (link in Chinese).

Baidu’s revenue declines

Chinese online search leader Baidu Inc. reported a 7% year-on-year revenue decline in the first quarter to 22.5 billion yuan, and posted net income of 41 million yuan, compared with a 327 million yuan loss in the same period last year, according to the company’s unaudited financial results.

The overall revenue decline was partially offset by growth in Baidu’s video streaming arm iQiyi Inc., whose membership revenue rose 35% year-on-year even though its online advertising revenue fell 27%.

|

** OTHER STORIES MAKING THE HEADLINES

Finance & Economy

• China’s Ministry of Commerce announced Monday that it is introducing an anti-dumping duty of 73.6% (link in Chinese) and an anti-subsidy duty of 6.9% on Australian barley, which takes effect Tuesday and remains in place for five years, according to a government statement.

• China’s banking watchdog has cleared out shadow banking businesses totaling 16 trillion yuan (link in Chinese) over the last three years, according to its Monday statement.

• As of the end of April, banks had extended repayment period (link in Chinese) for small and midsize enterprises’ loans totaling 1.2 trillion yuan, a Monday government statement shows.

• China’s property market, which was battered by the coronavirus epidemic in the first quarter, is showing signs of recovery, with government data pointing to a pickup in demand and rising prices in many parts of the country. (Read the full story.)

Business & Tech

• Stock of online education company GSX Techedu Inc. tumbled on Monday after short-selling firm Muddy Waters Research revealed that “at least 73.2% of the 54,065 users in the analyzed classes (of the company) are bots.”

• Chinese tech giant Huawei Technologies Co. Ltd. said that the latest U.S. sanctions on will inflict a “terrible price” on the global technology industry.

• Chinese video streaming service Bilibili Inc.’s total net revenues rose 69% year-on-year in the first quarter to 2.3 billion yuan. But its adjusted net loss more than tripled to 475 million yuan, from 145 million yuan a year earlier.

• A major Chinese builder of solar power plants, Jinko Power Technology Co. Ltd., rose by the daily limit in its Tuesday trading debut on the Shanghai Stock Exchange despite slumping profits last year.

• Foul play has been alleged after six people were killed at a building site owned by Country Garden Real Estate Group Co. Ltd. when a construction elevator collapsed Saturday evening.

** AND FINALLY

Ke Enya, a 7-year-old girl from Yichang, Hubei province, received a lot of attention after a photo of her studying under a table inside her parents’ food stall went viral. Ke had been taking her online classes in the confined space for about one month until her teacher visited the stall on April 29 and posted the photo on social media. Enya has since received a new desk and laptop from a local sponsor.

|

Ke Enya, 7, takes an online class from a makeshift desk under her parents’ food stall in Yichang, Central China’s Hubei province, on April 29. |

** LOOKING AHEAD

May 19: Weibo, Sina results

May 20: Xiaomi, Lenovo results

May 21: Annual meeting of the Chinese People’s Political Consultative Conference (CPPCC)

May 22: Annual meeting of the National People’s Congress (NPC), Alibaba results

Contact reporter Timmy Shen (hongmingshen@caixin.com) and editors Yang Ge (geyang@caixin.com) and Michael Bellart (michaelbellart@caixin.com)

Read more

China Business Digest: Wuhan Ramps Up Testing, Sluggish Property Market Stirs Back to Life

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas