CX Daily: Chinese President Xi Says Imports Will Grow Over the Next Decade

Fintech /

Ant Group to Refund IPO Investors Plus Fees and Interest

Chinese mainland retail investors who applied for Ant Group Co. Ltd.’s A-shares will get refunds after the fintech giant’s record initial public offering (IPO) in Shanghai and Hong Kong was suspended.

Underwriters will return the funds and brokerage commission fees plus interest to investors starting Saturday, Ant Group said Thursday in a statement. The money should be back in investors’ accounts by Monday, and the shares they subscribed for will be canceled Friday. The company promised Wednesday to refund investors who subscribed to the Hong Kong offering.

China’s securities regulator and the Shanghai Stock Exchange said they will work with relevant entities to ensure smooth and orderly refund payments to investors.

Top securities regulator backs suspension of Ant IPO

Would-be Ant investors in $9 billion strategic funds demand money back

Bankers reel as Ant IPO collapse risks $400 million payday

FINANCE & ECONOMICS

|

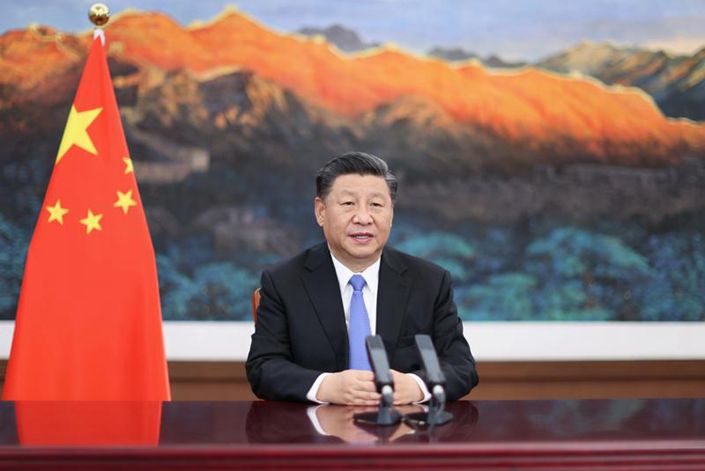

President Xi Jinping delivers the keynote speech Wednesday at the opening ceremony of the third China International Import Expo in Shanghai. Photo: Xinhua |

Trade /

Xi Jinping says imports will grow over the next decade

President Xi Jinping said he expects imports to grow over the next decade and pledged to further open the country’s markets, even as the goal of nurturing domestic supply chains plays an increasingly large role in policymaking.

Goods imports will likely exceed $22 trillion over the next 10 years, Xi said Wednesday in a video keynote speech played at the opening ceremony of the third China International Import Expo (CIIE) in Shanghai. “With a population of 1.4 billion and a middle-income group of more than 400 million, China is the world’s most promising large market,” he said.

In China, a typical middle-income household would be a three-member family with an annual income between 100,000 yuan ($15,080) and 500,000 yuan, according to (link in Chinese) the National Bureau of Statistics.

Yuan /

China’s currency swings most since 2015 devaluation on Biden’s prospects

China’s yuan is emerging as one of the most sensitive assets to the outcome of the U.S. presidential elections.

The offshore yuan climbed as much as 0.9% in late trading Wednesday to 6.6202 per dollar, its strongest level since July 2018, after earlier falling as much as 1.4%. That was the biggest intraday swing since the day after Beijing devalued the currency in August 2015. The currency’s one-week implied volatility — a proxy for market risk —fell from a record high, while traders reduced their hedges against yuan weakness.

The yuan, also known as the renminbi, is particularly sensitive to the election outcome given that analysts view a Biden administration as potentially more moderate — or at least more predictable — toward China in the trade war. The Democrat won Michigan and Wisconsin Wednesday, putting him on the brink of taking the White House from President Donald Trump.

Bonds /

Chart of the Day: Overseas investors can’t resist China’s interbank bonds

Foreign holdings of China’s interbank bonds hit a record high as investors couldn’t resist the relatively strong yields of the securities.

Outstanding overseas holdings of interbank bonds rose to 2.99 trillion yuan ($447.9 billion) by the end of October, up 1.9% from the end of September, according to data from Bond Connect Co. Ltd., a Hong Kong-based company that helps overseas investors trade in the Chinese mainland bond market.

That value of overseas-held interbank bonds accounted for 3% of all outstanding interbank bonds, according to a statement (link in Chinese) released by the Shanghai branch of the People’s Bank of China (PBOC).

New economy /

Caixin New Economy Index rebounds on rising capital inputs

The contribution of high value-added industries, such as new information technology, to China’s total economic inputs grew in October following three straight months of decline, largely boosted by an increase in capital inputs from the previous month, a Caixin index showed.

The Mastercard Caixin BBD New Economy Index (NEI) came in at 29.5 last month, indicating that new economy industries accounted for 29.5% of China’s overall economic input activities. The reading was up from 28.9 in the previous month. The NEI, which was released Monday, aims to track the size of, and changes in, China’s nascent industries by using big data. It measures labor, capital and technology inputs in 10 emerging industries relative to those used by all industries.

Quick hits /

China suspends entry from U.K. and Philippines as Covid-19 surges

China’s banking regulator cracks down on fintech-fueled joint lending

New indexes debut tracking shipping prices from China to U.S., Europe

BUSINESS & TECH

|

Fosun International Ltd. headquarters building in Shanghai |

IPO /

China’s Fosun kicks off biggest pharma IPO in India

Gland Pharma Ltd. and its shareholders are looking to raise as much as 64.5 billion rupees ($871 million) in what would be India’s biggest initial public offering (IPO) by a pharmaceutical company.

The company and existing holders including majority owner China’s Fosun Pharma Industrial Pte. are selling as many as 43.2 million shares in the offering, according to terms of the deal obtained by Bloomberg News. The shares are marketed at 1,490 rupees to 1,500 rupees each.

At $871 million, Gland Pharma’s IPO would be the largest ever by a pharmaceutical enterprise in India, way above the $260 million share sale by Eris Lifesciences Ltd. in 2017, according to data compiled by Bloomberg. It would also be the country’s second-biggest this year after SBI Cards & Payment Services Ltd.’s $1.44 billion offering.

Hiring /

Xiaomi ramps up R&D hiring to push tech-driven expansion

The world’s No. 3 smartphone-maker Xiaomi Corp. plans to increase its research staff by roughly half next year as it hopes that improved tech will help grow its market share.

Xiaomi aims to recruit 5,000 professionals to help it scale up research and development (R&D) efforts across the board, including smartphone cameras and internet-enabled home appliances, company founder and CEO Lei Jun said at its annual developer conference Thursday. “Xiaomi can only continue to make technological breakthroughs with more and more top-notch developers strategically grouped together,” he said.

Pipeline /

PipeChina’s five-year target risks shorting energy sector needs

China’s newly-formed national oil and gas infrastructure titan PipeChina unveiled its pipeline construction target for the next five years — and it’s less than expected.

The firm plans to build at least another 25,000 kilometers of oil and gas pipeline in the next five years through 2025, taking its overall pipeline assets across the country to 120,000 kilometers, said Liu Zhongyun at a conference Saturday. Liu is a deputy general manager at PipeChina.

But a long-term construction scheme released by the country’s top economic planner in 2017 indicated that China’s total pipeline network would aim for a size of 240,000 kilometers by 2025.

Steel /

Recovering demand leaves China’s steelmakers rolling in profits

China’s steelmakers posted strong third-quarter profit growth, thanks to accelerating spending from big buyers like infrastructure builders and carmakers as China’s economy rebounded from its Covid-19 outbreak early in the year.

Following the exceptionally strong quarter, the China Iron and Steel Industry Association said it expects the sector’s annual profit for 2020 to be flat to down slightly compared with 2019 — a major improvement over the first half of the year when profits fell sharply.

The industry’s publicly listed companies posted third-quarter profits that were up anywhere from 40% to 200% year-on-year, according to Caixin’s calculations using company data. Put differently, profits from the three-month period accounted for anywhere from 40% to 60% of companies’ total profits in the first nine months of the year.

Quick hits /

Former top CNPC executive comes under graft probe

China Alzheimer drug seeks global legitimacy with U.S. trial

Market wonders over Alibaba selling down stake in medical checkup specialist

Thanks for reading. If you haven't already, click here to subscribe.

- MOST POPULAR