CX Daily: The Monumental Challenges Facing Biden

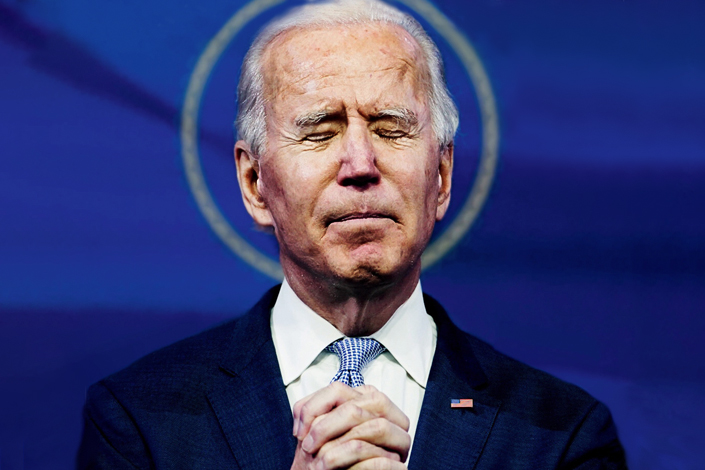

Biden /

Cover Story: The monumental challenges facing Biden

After a bruising election that former President Donald Trump and his allies attempted to overturn, Joe Biden was sworn in last week as the 46th president of the United States, wrapping up one of the most dramatic political transitions in American history.

Now, the real work begins for the 78-year-old Democrat, who faces the world’s worst Covid-19 pandemic, deepening domestic political fissures, fractured international relations and the need to make up for four years of lost time in responding to the global climate crisis.

“There is no time to waste when it comes to tackling the crises we face,” Biden wrote in one of the first tweets from his official presidential account.

Chips /

In Depth: Pandemic demand, smartphone shuffle put squeeze on global chipmakers

High-tech veteran Guo Ming first noticed that change might be brewing in the highly cyclical sector for microchips in last year’s third quarter. His company, a midsize Chinese manufacturer of display driver integrated circuits, was a typical industry player, designing its own chips and using third-party partners to manufacture them.

Realizing supplies were tightening, he quickly negotiated with his company’s Taiwan partner to secure the manufacturing capacity he would need through 2021. But the partner also saw what was happening and used the situation to its advantage.

“Fortunately, by virtue of our long-term cooperation and considerable order volume, we were able to get their support,” Guo said. But that support came at a price, as his company was forced to make full payments for all orders it anticipated in the first half of 2021. That kind of pressure is typical in the highly cyclical chip sector, indicating a new boom cycle may be starting.

FINANCE & ECONOMY

The Shanghai STAR Market's more than 200 listed companies may soon be available to investors on the Hong Kong stock exchange.

Stocks /

China to open new path for foreign investors to trade hot high-tech board shares

The Hong Kong and Shanghai stock exchanges announced that they will open a path for foreign institutional investors to trade certain shares listed on the Chinese mainland’s red-hot high-tech board via a program connecting the two bourses.

China is pressing ahead with measures to open mainland financial markets to foreign capital. The move will give investors that trade in Hong Kong, including foreign investors, greater access to shares listed on the STAR Market, the Shanghai Stock Exchange (SSE) said in a Friday statement (link in Chinese).

Starting Feb. 1, shares listed on Shanghai’s STAR Market that are also part of the SSE 180 and SSE 380 indexes, or those whose issuers concurrently have shares listed in Hong Kong, will be eligible to be traded in the Asian financial hub through the Shanghai-Hong Kong Stock Connect program, according to the statement.

World Economic Forum /

Davos 2021: China’s Xi Jinping Warns of ‘Shaky,’ ‘Uncertain’ Recovery

Chinese President Xi Jinping called on the world to step up macroeconomic policy coordination and balance pandemic response and economic development in the face of a "shaky,” “uncertain" global recovery.

Speaking at a virtual World Economic Forum Monday, Xi warned against "ideological prejudice" and called for a path of "peaceful coexistence" of civilizations that would prevent the world from falling into "division and even confrontation."

The Chinese president made the remarks five days after U.S. President Joe Biden took over the White House, inheriting China-U.S. relations at the lowest point in decades. That has impeded bilateral cooperation on pandemic response and macro-economic coordination after four years of confrontation under former President Donald Trump.

Davos 2021: Global Covid vaccine rollout will require fighting misinformation

Antitrust /

China’s antitrust campaign isn't singling out private firms, regulator says

China’s recent antitrust measures covering internet platforms are not targeting private enterprises and will not impact their business development, Liang Tao, a vice chairman of the China Banking and Insurance Regulatory Commission, said Friday at a news conference (link in Chinese).

The remarks came after some banks scaled back loans to private companies as regulators stepped up scrutiny of e-commerce giant Alibaba Group Holding Ltd. and its fintech affiliate Ant Group Co. Ltd. to rein in “disorderly capital expansion” and monopolistic practices. Many interpreted this as a signal that the government is tightening its grip on private enterprises.

Liang said recent antitrust measures are consistent with the goal of supporting the stable long-term development of private enterprise, adding that banking and insurance institutions are encouraged to cooperate with internet platforms in accordance with laws and regulations.

Covid-19 /

Leading Chinese drug researcher calls for greater transparency on China vaccines

China’s Covid-19 vaccines may have won approval in a dozen countries for emergency use, but the failure to publish detailed trial data could undermine public trust, a leading researcher said in an interview.

Ding Sheng, dean of Tsinghua University’s School of Pharmaceutical Sciences and director of the Global Health Drug Discovery Institute (GHDDI), called for the original clinical trial data from Chinese experimental vaccines to be made public so that experts can better assess their efficacy and eliminate lingering safety concerns that have emerged in China and abroad.

“The clinical data (of our vaccines) need to be further disclosed,” Ding told Caixin last week.

NetEase shutters Beijing headquarters after staff member tests positive for Covid

Hong Kong imposes city’s first Covid lockdown in Kowloon area

Quick hits /

Editorial: Innovation is China’s only path to high-quality growth

China gives nod to first bourse designed to run like private company

BUSINESS & TECH

Jiang Jinquan

Blockade /

Party calls on private sector to break U.S. tech blockade

China must mobilize all its national resources, including private-sector research and development, to overcome key bottlenecks and become more self-reliant in the face of the U.S.-imposed technology blockade, a top Communist Party theoretician said.

Jiang Jinquan (江金权), head of Communist Party’s top ideology think tank, the Central Policy Research Office (CPRO), made a five-point proposal for achieving technological independence from the United States in a commentary published Monday by the Study Times (学习时报), the official newspaper of the elite Central Party School.

The top party researcher appealed to the private sector in China, saying that the party supported private capital and businesses in their efforts to research and develop emerging technologies.

E-cigarette /

Shares in e-cigarette maker RLX Surge on New York debut

Shares of e-cigarette maker RLX Technology Inc. surged 146% on their first trading day in New York as investors bought into its growth story despite heightened scrutiny of listings by Chinese companies in the U.S. and regulatory crackdowns in its home market.

RLX’s stock closed at $29.51 a share Friday, more than double its IPO price of $12. The company raised nearly $1.4 billion from its share sale, which gave it a market value of $45.8 billion. That makes it one of the most valuable non-tech Chinese companies listed in New York.

Incorporated in 2018, RLX Technology manages China’s most popular vaporizer brand, Relx, which had a 62.6% market share in the first three quarters last year, according to its filing with the U.S. Securities and Exchange Commission.

Academic fraud /

Whistleblower kicks off another academic storm after state probe clears scientists of fraud

Just as an official investigation into academic plagiarism was about to end with a slap on the wrist, China’s highest-profile scientific whistleblower started another storm.

Rao Yi, president of Beijing’s Capital Medical University, sent an open letter leveling accusations of academic misconduct at one scientist whose name was cleared by the probe. The letter suggested a new investigation should be conducted and that it should be led by the accused’s American post-doctoral adviser, a Nobel laureate.

This unusual confrontation brings to the surface long-standing and increasing worries over academic integrity in China.

Energy /

State-owned power major takes lead in $1.54 billion new energy fund

A group of companies led by one of China’s top electricity producers announced the formation of a 10 billion yuan ($1.54 billion) fund to invest in new energy technologies and related initiatives.

Investors include China Energy Investment Corp. Ltd., a company set up in 2018 through the merger of major power generator China Guodian Corp. and leading coal producer Shenhua Group, as well as China Reform Holdings Corp. Ltd. and China Orient Asset Management Co. Ltd. The new fund will invest in projects involving solar and wind power as well as hydrogen-based technologies.

Quick hits /

New airline rises from the ashes of Cathay Dragon’s demise

Shanghai CPPCC member proposes regulating the ‘996’ work culture

Thanks for reading. If you haven't already, click here to subscribe.

- PODCAST

- MOST POPULAR