China’s Property Stocks Are Hot Again

Prospects for China’s biggest mainland-listed property developers could be looking up this year after a dismal 2020, when they fell out of favor with investors spooked by an increasingly hostile regulatory environment.

Real estate companies got left behind in the stocks rally that gathered steam in the second half of last year when optimism grew that China’s economy would recover strongly from the impact of the Covid-19 pandemic. The market worried about the intensified crackdown on homebuyers aimed at preventing a bubble in housing prices and about tougher controls on developers’ debts and their ability to raise fresh funding.

But sentiment has turned since the beginning of the year and some analysts are expecting a better performance in 2021.

“Taking into account current industry valuation levels, which are at a historical low, along with the boom in real estate sales and investment throughout 2020, we believe the continued resilience of the property market will serve as a catalyst for a gradual turnaround in the pessimism surrounding the medium- and long-term prospects for the sector,” Wang Song, chief analyst at Capital Securities Co. Ltd., wrote in a recent report (link in Chinese). “Against this backdrop, the real estate industry has bottomed out and will rebound.”

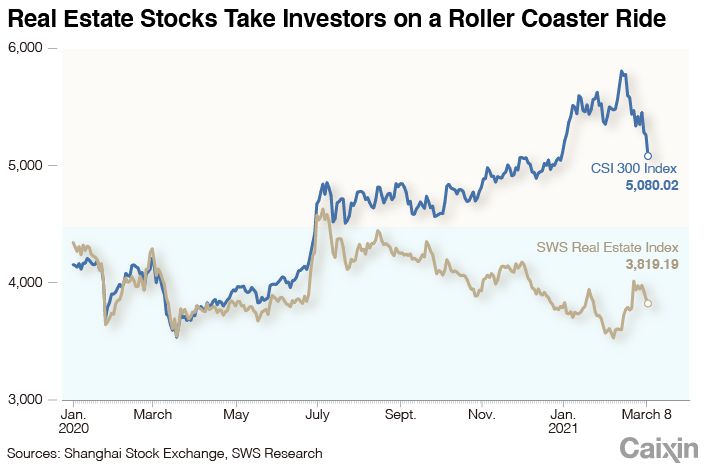

In the first half of 2020, an index of Chinese property developers listed on the Chinese mainland’s A-share markets in Shanghai and Shenzhen compiled by SWS Research Co. Ltd., the research arm of Shenwan Hongyuan Securities Co. Ltd., pretty much tracked the performance of the benchmark CSI 300 Index, which comprises the exchanges’ largest and most liquid stocks. But the SWS gauge, which tracks more than 120 listed property stocks, underperformed significantly in the second half of the year as prospects for the real estate industry looked gloomy compared with other sectors of the economy.

|

The property market was being squeezed from all sides. The government made it clear that the package of policies to support an economic rebound from the Covid-19 epidemic would not include a relaxation of its long-standing campaign to rein in property speculation and price bubbles. Many big cities imposed tighter restrictions on purchasing while smaller cities that tried to relax controls to encourage buying were forced into a U-turn by the central government. Financial regulators introduced what became known as the “three red lines” policy in August in an effort to control surging debt among property companies, and a trial was rolled out for the biggest developers. The policy involved linking their ability to borrow with adherence to three debt metrics. In September, the government signaled that it would work to ensure that stimulus funds didn’t end up in the real estate market, and in December, regulators issued a new bank loan management mechanism to cap banks’ lending to the sector including consumer mortgages and borrowing by developers.

Guo Shuqing, the head of China’s banking regulator capped a dismal few months when he warned in December that real estate was the biggest “gray rhino” threat to China’s financial system.

From the beginning of 2020 to March 1, 2021, the shares of 90 of about 130 A-share listed property firms fell, and the shares of 15 out of 45 property firms with a market capitalization of more than 10 billion yuan ($1.5 billion) dropped by more than 20%, Caixin calculations show. Over the same period, the Shanghai Composite Index, a gauge of all stocks traded on the Shanghai Stock Exchange, rose by 16.4%.

Mutual funds pared their holdings of property stocks in the second half of last year as they shifted their focus to sectors seen as more likely to benefit from China’s economic recovery and out of concern that tighter regulations on home purchases and on developers’ ability to finance their operations would hurt profitability. Property stocks accounted for 1.77% of the total equity holdings of mutual funds in the fourth quarter, down from 2.39% in the previous quarter, a January report (link in Chinese) from Northeast Securities Co. Ltd. (000686.SZ) showed.

But the tide seems to be turning. As of March 8, the SWS Real Estate Index has jumped about 8.4% since its Feb. 4 low, while the CSI 300 Index has fallen 7.2%. The sector’s outperformance suggests a shift in sentiment is underway as investors see value in a sector that’s been oversold and is due for a rebound.

Read more

Developers Face New Debt Limits as Property Crackdown

Early earnings reports and forecasts from many of China’s bigger property companies show that profits and sales in 2020 were buoyant and total spending on land was cut, helping to rein in debt. Optimism is rising that the debt risks of larger real estate companies are being controlled as the government’s three red lines make it harder for them to accumulate fresh borrowings. At a briefing on March 2 ahead of the annual “Two Sessions” political meetings, Guo reiterated the regulator’s determination to strictly supervise key property developers to ensure they follow the policy.

The regulator’s warnings about debt are “a clear signal” that may lead some real estate firms to slow down the pace of land acquisition, one source at a major property developer told Caixin last year. Land costs form a significant part of real estate firms’ expenditure, and reducing the purchases is one of the most effective measures to curb debt, the source said.

Analysts say the government’s debt controls could actually benefit the bigger listed developers because they have stronger balance sheets than smaller, local rivals who tend to be even more heavily leveraged and may be struggling to raise fresh capital to buy land.

Signs that local governments and lenders are prepared to step in to help large, heavily indebted property companies rather than let them go under is also improving sentiment. In December, Guangzhou R&F Properties Co. Ltd., which had already stepped over the government’s three red lines, pledged equity in 10 subsidiaries in return for a massive bailout led by the Guangzhou city government as nearly $2 billion of debt came due in January. Also in December, two subsidiaries of Chinese property developer Tahoe Group Co. Ltd. (000732.SZ) were granted a more than 3-1/2 year extension to pay back 12 billion yuan of debt, as the parent company struggled with a mounting debt crisis. The creditor was a Shenzhen unit of state-owned China Great Wall Asset Management Co. Ltd.

Another factor in the renewed enthusiasm for listed property developers is a new government-mandated system for local-authority land sales that is being rolled out in multiple cities this year. Analysts say they expect the program to lower acquisition costs for companies, help them plan their land purchase budgets, and improve cash flow management. Beijing, Qingdao and Tianjin (link in Chinese) are among the cities that will have a fixed number of large land auctions per year, rather than holding random smaller sales throughout the year. The supply of land made available at each auction will be increased.

Tang Ziyi contributed to this report.

Contact reporter Timmy Shen (hongmingshen@caixin.com) and editor Nerys Avery (nerysavery@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.

- PODCAST

- MOST POPULAR