CX Daily: Genebox Hypes a Fresh Breakthrough in Home DNA Testing. Will China Care?

DNA /

In Depth: Genebox hypes a fresh breakthrough in home DNA testing. Will China care?

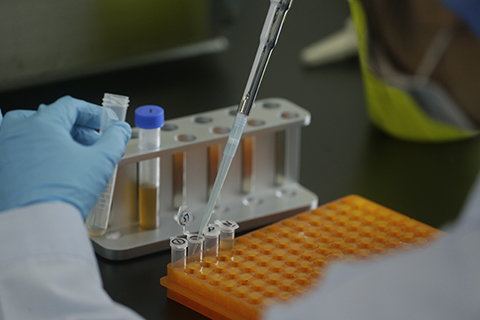

China’s bargain alternative to Google-backed genomics startup 23andMe — Genebox — says it has developed a type of testing apparatus key to consumer-grade DNA kits that could break a global duopoly.

High-density microarrays are key to so-called “direct-to-consumer” genetic testing kits used in the U.S. by DNA home-testing companies like 23andMe and Ancestry.com, which encourage people send them saliva samples and identify their potential to develop gene-linked diseases like Alzheimer’s, as well as things like their supposed ancestral background.

Also known as “gene chips,” the microarrays are made of a series of tightly-packed probes that bind to specific sequences in a DNA sample that can then be read using an optical device like a laser. They have been eclipsed in many areas by more advanced but more expensive genomic sequencing techniques such as those that were used to decode the genome of the virus that causes Covid-19.

Population /

Analysis: China’s three-child policy no quick fix for flagging birth rates, experts say

China’s new policy to encourage married couples to have as many as three children will provide a limited boost to the nation’s population growth and its low fertility rate, demographics experts say.

In interviews with Caixin, Chinese experts predicted that it was unlikely to boost population growth through policy alone and stressed the importance of the need for supportive measures for raising children.

FINANCE & ECONOMY

|

A 320,000 ton oil tanker docks at a crude oil terminal in Zhoushan, East China’s Zhejiang province, on April 10. Photo: VCG |

Options /

China to launch first options open to foreign investors

China is set to launch its first batch of yuan-denominated options open to trading by overseas investors as the country accelerates the domestic derivatives market’s opening-up to meet foreign investors’ demand for hedging tools.

The China Securities Regulatory Commission (CSRC) approved trading of crude oil options on the Shanghai International Energy Exchange (INE), and palm oil options on the Dalian Commodity Exchange (DCE), the securities regulator said (link in Chinese) Friday. Both products will be open to overseas investors, with palm oil options set to begin trading June 18 and crude oil options to follow June 21, according to the announcement.

PMI /

China’s manufacturing expands at fastest pace in five months, Caixin PMI shows

China’s manufacturing sector expanded at the fastest pace in five months in May despite surging raw material costs, a Caixin-sponsored survey showed.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose slightly to 52 in May from 51.9 the previous month, according to a report released Tuesday. A number above 50 signals an expansion in activity, while a reading below that indicates a contraction.

REITs /

China’s first publicly traded infrastructure REITs oversubscribed on debut

China’s first batch of publicly traded infrastructure-focused real estate investment trusts (REITs), which aim to raise around $4.8 billion for infrastructure projects, were all oversubscribed on their debut Monday.

The strong market sentiment toward the nine REITs will buoy the Chinese government’s drive to introduce private money into infrastructure projects and ease local governments’ heavy debt burden.

ETF /

HKEX scraps ETF fees to promote trading

The Hong Kong stock exchange waived trading fees for some exchange traded funds (ETFs) in an effort to boost trading and lure global investors.

Hong Kong’s ETF market is one of the largest in Asia, with HK$404 billion ($52 billion) in market capitalization, according to the bourse. The waiver will apply to Hong Kong-listed fixed income and money market ETFs starting Monday, according to a statement by Hong Kong Exchanges and Clearing Ltd. (HKEX).

Quick hits /

Postal Savings Bank of China chooses new head

Li Ka-shing sees big potential in German high-tech insurer Wefox

China calls for Europe to put aside ‘misgivings’ after Lithuania defects

BUSINESS & TECH

Aihuishou suffered net loss and negative net cash flows over the past few years, though the loss was narrowing, its prospectus showed. Photo: VCG

IPO /

Money-losing Chinese electronics reseller files for U.S. listing

Chinese electronics reselling platform Aihuishou International Co. Ltd. identified negative operating cash flows as well as its dependence on e-commerce giant JD.com Inc. as key risks in its filing for an IPO on the New York Stock Exchange Friday.

One of the largest second-hand goods platforms in China, Aihuishou — which has renamed its brand “ATRenew” — makes money by selling second-hand phones and other consumer electronics, and providing related services. Its largest single investor is e-commerce giant JD.com, whose subsidiary holds 34.7% of its total issued and outstanding shares before the IPO, according to the prospectus.

Steel /

North China’s steel hub may ease production cuts

Tangshan, China’s largest steel producing city in the northern province of Hebei, is considering easing steel output limits in the second half this year to increase supply in response to a recent surge in steel prices, Caixin learned.

The Tangshan city environmental authority met with local steel companies Monday to discuss relaxation of production limits that were imposed in March, sources with knowledge of the matter told Caixin. The city government ordered local steel mills to slash production by at least 30% between March 20 and Dec. 31 as part of efforts to reduce pollution.

Analysis: Beijing needs to better telegraph its plans for the steel market

5G /

Italy approves Vodafone 5G deal with Huawei — but there are strings attached

Huawei reportedly obtained conditional approval from Rome to participate in the construction of Vodafone’s 5G radio access network in Italy, winning a rare victory in Europe where the Chinese tech giant finds deals to buy its 5G equipment hard to come by.

The Italian government greenlighted a deal between Huawei and Vodafone on May 20 with strings attached, including banning Huawei from fixing technical glitches remotely and setting an extremely high security threshold, Reuters reported Tuesday, citing unnamed sources. The report did not provide details on the security threshold.

Quick hits /

Sinovac shot controls Covid in Brazil town after 75% covered

Money-losing e-retailer Mogu says livestreaming is driving sales

Chinese robot-maker Rokae raises fresh capital amid official push for intelligent manufacturing

Energy Insider /

Energy Insider: China starts tracking carbon emissions in real time; Inner Mongolia shutters 35 crypto miners

Thanks for reading. If you haven't already, click here to subscribe.

Today's CX Daily was compiled and edited by Kevin Guo (xinguo@caixin.com).

- MOST POPULAR