CX Daily: Education Companies Knew Sweeping Rules Were In The Pipeline

Tutoring /

Education companies knew sweeping rules were in the pipeline

Chinese officials held multiple rounds of talks with top private education firms to discuss the industry’s future before announcing sweeping new regulations last week that are set to transform the sector, Caixin learned.

The meetings indicate that companies were bracing for the impact weeks before Friday’s announcement, which roiled a sector that employs millions of people and torched the share prices of major players including New York-listed TAL Education Group, New Oriental Education & Technology Group Corp. and Gaotu Techedu Inc.

More than $100 billion has fallen off the three above companies’ combined market value compared with highs recorded earlier this year. TAL fared worst of all with a 70% plunge in its equity price, while Gaotu fell by 63% and New Oriental sank by 54%. The dual-listed New Oriental's Hong Kong shares slumped by around 40% Monday.

China spells out sweeping reforms to turn after-school tutors into non-profits

Chinese education stocks on NYSE collapse amid new crackdown

Rainfall /

Cover Story: How historic rainfall overwhelmed Zhengzhou

The evening of July 20 left a devastating memory for many people in Zhengzhou, Henan province, as record rainfall inundated the central China metropolis.

Torrential rain turned streets into rivers, flooding subways and road tunnels just as commuters were making their way home. More than 500 people were stranded in subway carriages when floodwaters burst into the metro system. They struggled for hours amid thinning air and rising water before they were rescued, but some didn’t make it out alive.

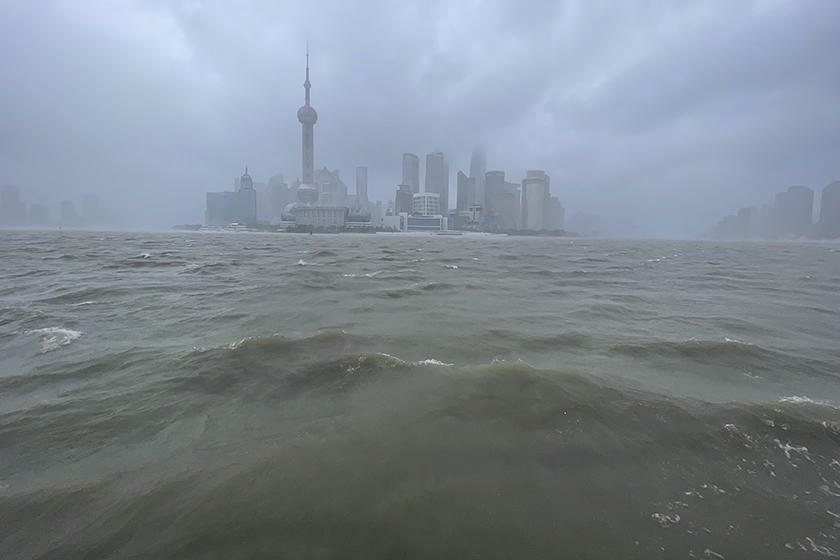

Typhoon In-fa brings transportation to a standstill around Shanghai

FINANCE & ECONOMY

|

A passenger walks past a company sign of Temasek Holdings in Singapore on Feb. 6, 2009. Photo: IC Photo. |

Carbon /

Temasek makes carbon emissions essential to its investment decisions

A Singaporean sovereign wealth fund is making carbon emissions an essential factor in its investment decisions, executives told Caixin, as it looks to fulfill its commitment to be carbon neutral by 2050.

Temasek Holdings Pte. Ltd. set an internal price of $42 per ton of carbon dioxide equivalent to gauge the environmental costs of a project’s greenhouse gas emissions, according to the company’s financial report released July 13. That was included in a valuation model Temasek uses to make investment decisions.

“In the long run, we believe that carbon pricing will become an important economic basis for getting a return on investments,” Wu Yibing, head of Temasek’s China operations, said in an interview on July 15.

Trade /

Hainan promises to put foreign service providers on equal footing, mostly

China’s Ministry of Commerce published a negative list (link in Chinese) Monday for the cross-border services trade in the island province of Hainan that promises to put foreign businesses and individuals on an equal footing with domestic peers, provided their businesses don’t violate 70 restrictions in 11 industries.

The negative list (link in Chinese) for the Hainan Free Trade Port includes industries such as transportation, information technology, and finance. In areas outside the scope of the list, however, all service providers, be they Chinese or foreign, will be entitled to “equal treatment and market access,” Wang Shouwen, a vice commerce minister, said at a Monday briefing (link in Chinese).

China-U.S. /

China urges U.S. to lift sanctions, visa restrictions on Chinese citizens

China urged the U.S. to revoke sanctions and visa restrictions on Chinese nationals, a Chinese vice foreign minister said during a media briefing about his meeting with a senior U.S. diplomat in the northern city of Tianjin on Monday.

Xie Feng, the Chinese official, said after his talks with U.S. Deputy Secretary of State Wendy Sherman that China urged the U.S. to “correct mistakes on its China policies” including visa restrictions on Chinese students, Communist Party members and their families, and sanctions on Chinese officials and government agencies.

Pension /

Citic Securities plans to take stake in new private pension venture

Citic Securities Co. Ltd., one of China’s biggest brokerages, is planning to take part in a new pension joint venture, embracing the nation’s call to tackle a looming pension crisis fueled by questions surrounding the sustainability of the current pension system as the population rapidly ages.

In a bid to overhaul the strained, state-dominated pension system, China is looking to spur development of a private, so-called third-pillar (第三支柱), with a view to encourage people to save more through commercial pension products and play a bigger role in supporting themselves after retirement.

Quick hits /

China’s ongoing recovery showed signs of weakness in July

Editorial: Clearing the obstacles to the three-child policy’s success

Delivery, ride-hailing and other flexible workers to get new labor protections, guidelines say

BUSINESS & TECH

Steel /

How a London power duo outfoxed China’s biggest private steel giant

Nestled in London’s exclusive Mayfair district among high-end brands and eye-watering rents sits 51-52 New Bond Street, home to the London flagship store of Italian luxury fashion house Armani.

The seven-floor building was recently bought by the Reuben brothers, expanding a vast property portfolio for notoriously media-shy siblings David and Simon. The wealth of the Mumbai-born pair was estimated this year by the Sunday Times at 21.5 billion pounds ($29.6 billion), making them Britain’s second-wealthiest on the list.

That nest egg is likely to have been helped amply by the at least 6.2 billion pounds they gained in a shrewd deal with a Chinese-invested consortium headed by Jiangsu Shagang Group Co. Ltd., China’s largest private steel company.

Internet /

Ministry launches six-month campaign to clean up internet platforms

China’s government launched a six-month special rectification campaign for the internet industry, officials said Monday, as authorities continue to crack down on online platforms.

The Ministry of Industry and Information Technology said in an online statement (link in Chinese) that the campaign would target eight areas including disturbing market order, violating users’ rights and interests, and endangering data security.

Energy /

China mulls unified five-year plan for renewables

Chinese planners will abandon their previous practice of issuing separate five-year plans for different forms of new energy in favor of a joint renewables package with a stronger emphasis on solar power, an energy official said Thursday.

The draft plan, which has not been released and is yet to be submitted for review, focuses on building a new electricity system with new-energy power at its foundation, said Kong Tao of the National Energy Administration (NEA) in a speech to a photovoltaic industry conference.

Tencent /

Beijing orders Tencent to give up exclusive music copyrights

Beijing ordered Tencent Holdings Ltd. to relinquish all its exclusive global music licensing deals within 30 days and fined the company 500,000 yuan ($77,175) for anti-competitive practices, according to an executive punishment (link in Chinese) published Saturday by the State Administration for Market Regulation.

An official probe of Tencent’s 2016 purchase of a major stake of China Music Corp. concluded this week that the deal breached China’s Anti-Monopoly Law as it helped the tech giant net rights to 80% of exclusive music licensed in China.

Quick hits /

China probes property development industry in continued housing crackdown

Chinese truck-maker says unpaid stake sale of German auto brand sinks earnings

Out-of-favor Jack Ma tops Forbes China Philanthropy List with $494 million in donations

Energy Insider /

China’s auto sales back to pre-pandemic level

GALLERY

|

Typhoon torments East China

Thanks for reading. If you haven't already, click here to subscribe.

- MOST POPULAR