CX Daily: Manufacturing Finally Improves, But Don't Celebrate Quite Yet

China’s manufacturing activity posted its first growth in four months since November, with employment expanding for the first time in more than five years, our survey showed Monday.

The Caixin China General Manufacturing PMI rose to 50.8 in March signalling expansion, after three straight months of contraction. The reading hasn’t been this high since July.

“Overall, with a more relaxed financing environment, government efforts to bail out the private sector and positive progress in Sino-U.S. trade talks, the situation across the manufacturing sector recovered in March,” an analyst said. But just because the signs are encouraging doesn't mean China's economy has turned the corner. Check out this week's Caixin View to see why we urge cautious optimism.

FINANCE & ECONOMICS A Vanke building under construction in Yichang, Hubei province, on April 1. Photo: VCG

Real estate /

Land purchases plummet in Q1 for largest Chinese developer

Country Garden Holdings Co. Ltd., China’s largest real estate developer by sales, spent 7.4 billion yuan acquiring new land in the first three months of 2019, equating to a whopping 29 billion yuan ($4.3 billion) decline compared with the same period in 2018, according to a Friday market report. The drop was attributed to sluggish demand in the smaller cities where it has long focused.

China’s housing market has recently shown signs of slowing after years of breakneck growth. In 2018, major developers’ sales grew by 33%, down from 54% in 2017. China Evergrande Group, the sector’s No. 3 player by sales, spent 14.2 billion yuan, roughly the same as in the first quarter last year.

Markets /

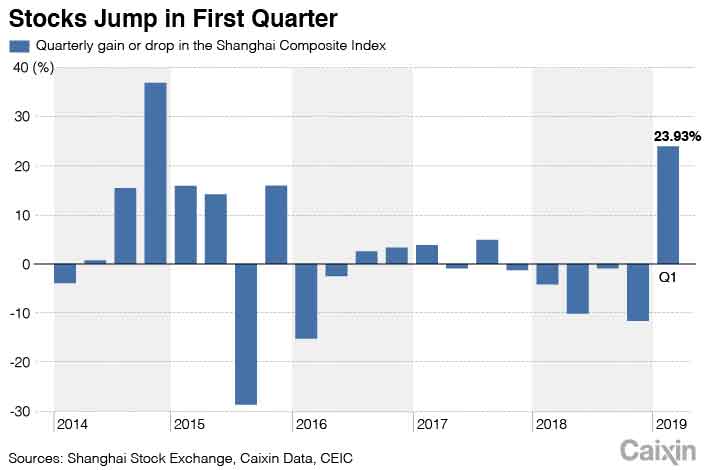

Stocks climb nearly a quarter for the quarter

The benchmark Shanghai Composite Index rose nearly one-quarter in Q1 2019, the market’s best performance since late 2014. On Friday, the last trading day in March, the Shanghai Composite closed at 3090.76, up 23.93% from Dec. 28, the last trading day of 2018’s fourth quarter.

Loans /

Agricultural Bank sees higher-than-average bad loan ratio for private firms

The nonperforming loan (NPL) ratio for loans to private companies at the Agricultural Bank of China Ltd., one of the country’s “Big Five” state-owned commercial lenders, reached 6.37% at the end of last year, 4 percentage points higher than the ratio for the entire corporate sector, executives said. The ratio was also much higher than the lender’s overall NPL ratio of 1.59%.

The higher NPL ratio for the bank’s loans to private companies illustrates the complications that banks face meeting the central government’s demand to lend more to the private sector, which has sparked concerns that the quality of banks’ assets could deteriorate.

Local credit /

China’s burgeoning social credit system stirs controversy

Depending on where you land on China's complex social credit system, you can either find yourself with eased access to bank loans and public services such as libraries and transportation, or, as one businessman in Zhejiang with outstanding one-child policy-related fines learned, ineligible to borrow.

Personal credit ratings are becoming ubiquitous, but criticism of the local rating systems is mounting. Applying nonfinancial data to credit decisions isn’t fair, and neither is using social credit scores to determine access to social services, say critics, which now include former PBOC credit rating department officials.

Check out our deep dive into China's rather unique effort in fixing social issues.

Quick hits /

Sign of something bigger? China holds off on reimposing U.S. auto tariffs

Calling China-U.S. trade frictions a war is an exaggeration: Premier Li

JPMorgan, Nomura cleared to control China brokerages

China stocks rally on upbeat economic outlook

BUSINESS & TECH

Illustration: Sixth Tone

Privacy /

Spying on kids in the classroom: Part one

Jason would never have questioned the presence of the tiny white surveillance camera installed above his classroom’s blackboard. That's until the 16-year-old Beijing Niulanshan First Secondary School student came across an image online of its facial recognition technology in action.

After all, Niulanshan never informed him — or any of its 3,300 other students — that cameras were analyzing their every move in class. In fact, it’s unlikely that the combined 28,000 students in the six other schools testing the same system know they are part of China’s grand AI experiment.

In this feature, we look at the system as well as the 2017 national initiative that brought it to life.

Commodities /

Chinese steel could flood market this year, denting profits

Steel demand will remain steady thanks to stable levels of investment in infrastructure and real estate, but production capacity remains much higher than demand and may lead to weaker profits in 2019, Zhang Zhixiang, the chairman of the China Chamber of Commerce for Metallurgical Enterprises, warned this week.

Despite government promises to cut excess capacity, China still produces more than half the world’s steel, with national production up 8.1% YOY to a record 928 million tons, according to government statistics. Industry profits reached 470.4 billion yuan ($70.07 billion) in 2018, up 39.3% YOY.

AI race /

You can now major in 'artificial intelligence' in China

China's Ministry of Education has given a green light for undergraduate majors in AI at 35 higher education institutions, including the prestigious Beijing University of Aeronautics and Astronautics, as well as Shanghai Jiao Tong University and Chengdu-based University of Electronic Science and Technology of China.

The new major will be a four-year undergraduate program supervised by the schools’ engineering — rather than computer science — departments, fueling speculation that new AI courses might emphasize infrastructure projects.

Restructuring /

State-owned ship company swaps assets among units

One of China’s two state-owned shipbuilding conglomerates disclosed plans to restructure and swap certain assets of its two listed subsidiaries as part of the nation’s efforts to push forward market-based restructuring at SOEs.

The asset swap consolidates the shipbuilding assets of China State Shipbuilding Corp. (CSSC) into one listed arm while putting its marine propulsion businesses into another. The restructuring came amid renewed speculation that China may merge CSSC with its rival China Shipbuilding Industry Corp. (CSIC) amid a broad shakeup of state-owned enterprises.

Quick hits /

Huawei's cloud unit reaches 1 million customers

China-assisted cobalt bust hits local players

Beingmate says it’s being good and wants stock exchange to stop stigmatizing it

iPhone prices in China are slashed – again

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas