CX Daily: Managing China’s $1.6 Trillion Private Investment Market

Private investment /

Cover Story: Managing China’s $1.6 trillion private investment market

Chinese venture capitalists and private equity investment funds are at a crossroads as the 10 trillion yuan ($1.6 trillion) market faces a slowdown worsened by the Covid-19 pandemic. The once-freewheeling industry needs more effective regulatory oversight and self-discipline to stop a three-year decline, analysts said.

In the first half of 2020, 1,069 venture capital (VC) and private equity (PE) investment funds raised 431.8 billion yuan in China, down 29.5% from a year ago and extending a slide since 2017. The number of investment deals totaled 2,865, a drop of 32.8%, according to data from Zero2IPO Research.

VC and PE funds are major private investment services that raise vast pools of capital from qualified investors, known as limited partners, to invest in privately owned companies for long-term returns. VC operations funds target startups, and PE funds focus more on mature companies.

FINANCE & ECONOMICS

|

A man rides a bicycle past the People’s Bank of China headquarters in Beijing in June 2019. |

Yuan /

China acts to slow yuan’s rapid ascent without causing panic

China’s central bank is taking steps to restrain the yuan’s rally while stopping short of encouraging declines, a sign that officials are willing to tolerate some currency strength.

After scrapping a two-year-old rule Saturday that made it expensive to bet against the yuan, the People’s Bank of China set its daily reference rate Monday only slightly weaker than analysts expected. While the moves triggered a 0.6% slide in the yuan in early trading, the currency is still up 4.2% in the past three months.

Analysts said the moves will reduce one-way bets on the yuan, slowing a rapid ascent that had pushed it to its strongest since April 2019 versus the dollar. The yuan surged about 1.6% Friday when the currency traded for the first time this month following the National Day holidays, extending its best quarterly advance in 12 years.

Chinese yuan soars as policy makers usher on ‘blue wave’ rally

Shenzhen /

Xi to visit China’s pioneer city of reform and opening-up Wednesday

President Xi Jinping will attend a grand gathering and deliver a speech in Shenzhen Wednesday celebrating the southern Chinese city’s 40-year history of being the country’s pioneer of reform and opening-up, the Xinhua News Agency reported Monday, in an apparent reassurance that Beijing will not close its door on foreign investors despite decoupling pressure from the United States.

Xi’s visit comes as the world’s second-largest economy is recovering from the Covid-19 pandemic and grappling with the United States in a geopolitical and economic competition in which Washington is attempting to cut off Beijing from the developed countries’ markets and supply chains for advanced technologies such as 5G and high-end microchips.

Covid-19 /

China’s beer capital to test entire population for Covid-19 after local flare-up

Authorities in the Chinese city of Qingdao plan to test millions of people for the coronavirus following a dozen new cases, a rare flare-up in a country that has brought infection rates down to almost zero.

As of 11 p.m. Sunday, the eastern port city had confirmed six cases while a further six tested positive for the coronavirus but were asymptomatic, according to a notice (link in Chinese) published Monday on the municipal health commission’s website. China does not count cases as confirmed until the patient shows Covid-19 symptoms.

The cluster is “highly associated” with the Qingdao Chest Hospital in the center of the city, the notice said, adding that more than 110,000 medical workers, hospital patients and other people tested negative for the virus. Officials plan to test the entire city of 9 million within five days.

Securities /

Standard Chartered applies to set up securities firm in China

Standard Chartered Plc applied to establish a securities company in China, the China Securities Regulatory Commission (CSRC) said. The CSRC received the application Saturday, it said on its website, without providing details.

China’s 7.26 trillion yuan ($1.1 trillion) securities industry is opening up further to foreign investment banks such as Goldman Sachs Group Inc. and JPMorgan Chase & Co., which are allowed to take full control of ventures in the country this year. That’s likely to provide a jolt to the sector, forcing consolidations and winnowing out those that can’t compete.

Quick hits /

Hong Kong office vacancies hit 15-year high

Exclusive: Chinese insurance giant Taiping appoints new chairman

Editorial: Data protection law should put citizens ahead of business

BUSINESS & TECH

|

Takeout /

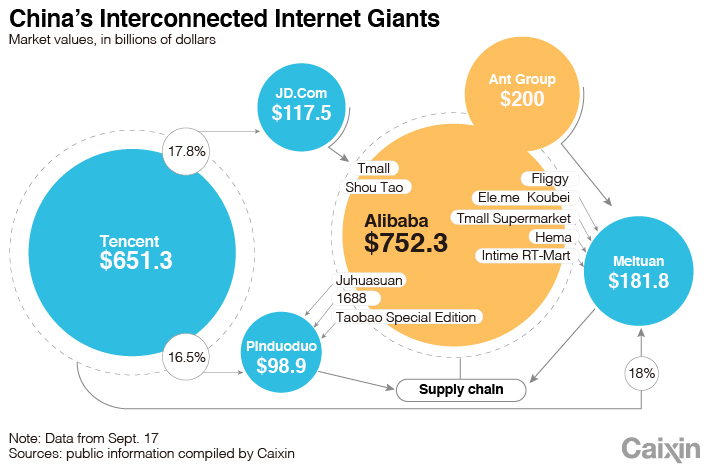

In Depth: China’s takeout wars — is Meituan set to eat Alibaba’s lunch?

A year after Alibaba began a new chapter with the departure of founder Jack Ma, the e-commerce giant has found little time for rest as two of its biggest businesses face fresh assaults from younger rivals with ambitious leaders who look much like Ma in his early days

Among those, Meituan Dianping has emerged as the largest threat to Alibaba’s ambitions in local lifestyle services, with the two companies’ core takeout dining businesses at the center of the battle. Alibaba has fallen dangerously behind in the war over the last two years, mostly due to its newness in the space.

Meituan Dianping began life as a Chinese imitator of U.S. group buying sensation Groupon and later cobbled together a series of online-to-offline (O2O) offerings with a common theme of letting local businesses use its digital services to sell things like meals and movie tickets to consumers. By comparison, Alibaba formed its local lifestyle products group only last year, centered on its Ele.me takeout dining unit.

Steel /

Beijing melds steel behemoth Baowu to troubled mining giant

Leading Chinese steelmaker China Baowu Steel Group Corp. Ltd. will take over a struggling peer that is one of the country’s top producers of mining equipment and related services in a further move to consolidate the industry.

Sinosteel Corp. will be entrusted to Baowu, according to announcements Sunday from two of Sinosteel’s publicly traded units, Sinosteel Engineering & Technology Co. Ltd. and Sinosteel Anhui Tianyuan Technology Co. Ltd. They said Sinosteel, a centrally administered state-owned asset, has yet to learn the exact nature of its entrustment to Baowu.

Baowu and Sinosteel are among the nation’s largest state-owned enterprises (SOEs) administered from Beijing by the State-owned Assets Supervision and Administration Commission (SASAC).

Hydrogen energy /

Sinopec looks beyond oil for growth with hydrogen investment

The state-owned oil giant known as Sinopec Group is set to invest in hydrogen energy through a fund it set up in August as it seeks to broaden its expansion into energy sources that aren’t fossil fuels.

The expansion into new energy offers the staid China Petrochemical Corp. a new path forward as the country’s leadership is expected to make environmental protection and the green economy a greater priority in the five-year plan for 2021-25.

Sinopec Capital Co. Ltd. and the Enze Fund (link in Chinese) it set up in August reached an agreement Saturday with Cummins (China) Investment Co. Ltd. to develop technology to produce hydrogen fuel through electrolysis, Sinopec Group said in a social media post (link in Chinese).

NBA /

NBA broadcasts returning to Chinese TV after more than a year

Basketball returned to Chinese TV. China Central Television revived its coverage of the National Basketball Association Saturday, just in time for Game 5 of the NBA Finals between the Los Angeles Lakers and the Miami Heat.

The network, which holds exclusive rights for the NBA in China, stopped showing the league’s games after Houston Rockets general manager Daryl Morey tweeted support for protesters in Hong Kong in October 2019. “During the recent Chinese National Day and Mid-Autumn Festival celebrations, the NBA sent their well wishes to fans in China,” state-run CCTV said in a statement published by ESPN, adding that the league had shown kindness by making efforts to support Chinese people during the Covid-19 outbreak.

Quick hits /

Car services provider Dida beats larger rival Didi to market

In search of sales, Cathay’s budget airline offers ‘flights to nowhere’

State Grid pledges to juice up clean energy investment in next five years

Thanks for reading. If you haven't already, click here to subscribe.

- MOST POPULAR