CX Daily: China Removes Limits on Credit Card Interest Rates

Credit card /

China removes limits on credit card interest rates

China’s central bank removed the upper and lower limits on credit card interest rates starting Jan. 1 as part of a strategic move to let markets set rates. The measure could foster greater competition between conventional banks and fintech rivals, lowering costs for borrowers, industry experts said.

Under the new policy, credit card issuers can set their own interest rates for unpaid monthly balances, also known as overdrafts. Previously, the upper limit was a daily interest rate of 0.05%, equivalent to an annualized rate of 18.25%, and the lower limit was 0.7 times the upper limit, or an annualized 12.775%. According to a notice issued in late 2020, credit card operators must fully disclose annualized interest rates and ensure that card holders know and accept the rates.

The move is a signal that regulators are trying to help credit cards regain mainstream status in the consumer credit market, analysts said. Removal of the interest rate caps will have little impact on bigger credit card providers but is expected to benefit smaller issuers, a credit card executive at a big bank told Caixin.

FINANCE & ECONOMY

|

Futures exchange /

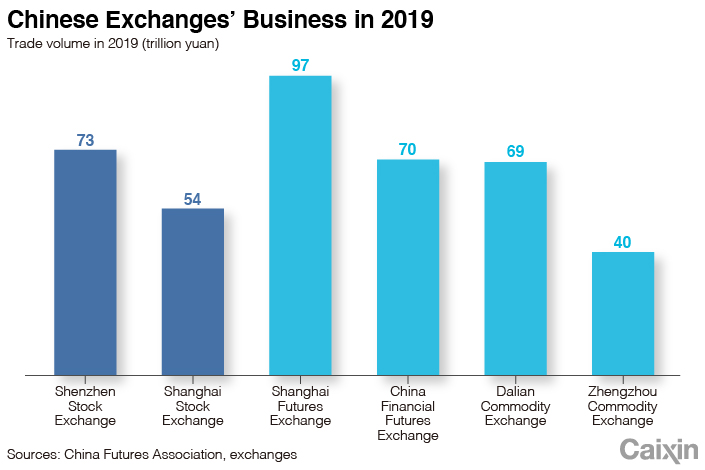

In Depth: China wants its next futures exchange to run a lot more like a company

China wants its next futures exchange to be a lot more corporate.

The planned Guangzhou Futures Exchange, which will be the country’s first new futures exchange to open in 14 years, will also be the first to be run as a company with some private shareholders, sources knowledgeable of the matter said, making it more like multiple major exchanges around the world.

The establishment of the Guangzhou Futures Exchange could be telling about the government’s commitment to market reform, particularly when it comes to financial exchanges, as it seeks to make its exchanges more innovative and more competitive with global giants. The practices of the new exchange —corporatization and introducing private shareholders — will likely be pitted against the interests of regulators that tend to prize stability above all else.

Blacklist /

Hong Kong’s largest ETF suspends investment in Chinese firms on U.S. blacklist

The manager of the largest exchange-traded fund (ETF) in Hong Kong said it will not invest any more of the ETF’s money in companies that the U.S. has blacklisted for their alleged ties to the Chinese military.

The plight faced by Hong Kong’s most actively traded ETF — and its HK$103 billion ($13.3 billion) in assets under management — became the latest example of how the Asian financial hub found itself caught between Beijing and Washington as tensions mount between the world’s two largest economies.

U.S. investment company State Street Global Advisors Asia Ltd., which runs the Tracker Fund of Hong Kong (TraHK), said Monday that the ETF was “no longer appropriate” for American investors due to the U.S. executive order barring them from trading the securities of certain Chinese firms.

BlackRock selling stakes in sanctioned Chinese mobile firms

Fintech /

Finance loses its luster as JD.com merges lending arm with other units

Chinese e-commerce giant JD.com Inc. will merge its fintech arm with its artificial intelligence (AI) and cloud computing business and set up a new subsidiary called JD Technology Group, the company said Monday, highlighting tech services and downplaying the importance of its finance business, which has come under stepped-up regulations.

On Dec. 30, JD.com said it was considering spinning off its cloud and AI business into Jingdong Digits Technology Holding Co. Ltd., or JD Digits.

Last year, JD Digits filed an application to list on Shanghai’s Nasdaq-style STAR Market, but the IPO plan faces uncertainty as financial regulators tighten oversight of fintech companies.

Covid-19 /

Beijing on alert after identifying first Covid-19 patient linked to outbreak in neighboring region

Beijing identified a confirmed Covid-19 patient with links to the latest local outbreak in neighboring Hebei province, raising fears of further spread of the pathogen in the Chinese capital.

The patient, surnamed Zhou, commuted while potentially infectious between her home in the city of Langfang (廊坊) in Hebei and her workplace in Beijing’s Xicheng district, local health authorities said. Her 95 close contacts in recent weeks are being kept under observation.

During the New Year holiday, Zhou traveled twice to the city of Shijiazhuang, a hot spot in the Hebei outbreak. She returned from Langfang to Beijing after the holiday and initially tested negative for Covid-19 Saturday.

China extends ban on U.K. flights

Zhang Wenhong: Hebei outbreak will be under control in a month

Quick hits /

China stocks slump most in three weeks on valuation concerns

China approves 2 GMO corn strains for import as demand soars

BUSINESS & TECH

|

Drugs /

No new foreign additions from front-line group of cancer drugs to government medical insurance list

No imported forms of a key type of cancer drug will be available on China’s public health insurance this year because the government and multinational pharmaceutical companies were unable to strike a deal to set lower prices, a high-level official involved in the negotiations said.

Last month, the National Healthcare Security Administration (NHSA) included three Chinese developers of front-line cancer drugs in the public insurance system, allowing patients to access the treatments at a fraction of their full price. However, two imported medicines developed by Bristol-Myers Squibb Co. and Merck & Co. Inc. were not included.

In an interview with Caixin, Xiong Xianjun, the head of the NHSA’s medical service administration office, said the government and foreign drugmakers were unable to reach an agreement during talks that sought to keep cancer treatments below the current price of sintilimab, a lymphoma drug co-developed by China’s Innovent Biologics Inc. and U.S. drug giant Eli Lilly & Co. that became available under the public insurance system last year.

E-commerce /

Fired Pinduoduo worker adds fuel to long work hours debate

Discount e-commerce specialist Pinduoduo Inc. landed at the center of a fresh controversy for the second time in just days, after an employee linked his recent firing to a photo he posted online alluding to a corporate culture of long work hours.

The spate of negative news has taken some of the shine off one of China’s biggest e-commerce up-and-comers, wiping 8% off its stock over the past week, including a nearly 5% fall in the latest trading session. Much of the news revolves around a “996” culture that is common at many Chinese high-tech companies, referring to working 9 a.m. to 9 p.m. six days a week.

Some believe that culture may have contributed to two recent deaths, including one by a male employee who jumped from his family’s 27th floor apartment in the Central China city of Changsha over the weekend. Two weeks earlier a 22-year-old employee collapsed and died shortly after getting off work in the early hours of Dec. 29.

Lithium /

Lithium prices in overdrive as China's electric-vehicle sales grow

Lithium prices in China are picking up after sliding to a near historic low in mid-2020, following steady growth in new-energy vehicle (NEV) sales in the world’s biggest market.

Prices for battery-grade lithium carbonate — a key metal used in batteries for a string of NEV modules including Tesla’s Shanghai-made Model 3 — soared to 59,000 yuan ($9,102) per ton Monday, up by nearly 50% on the August 2020 price, according to data from the Shanghai Metals Market (SMM).

Flying cars /

Eastern General Aviation embraces pilotless flying cars to cut costs

Shenzhen Eastern General Aviation Co. is willing to use pilotless flying cars if manufacturers launch mature products, the Greater Bay Area rescue and business aviation provider said.

Eastern General Aviation, serving China’s Guangdong-Hong Kong-Macau area, is among several commercial aviation providers embracing the prospect of the nascent technology.

An Airbus 135 helicopter costs about 60 million yuan ($9.3 million), and a pilot costs about 1 million yuan a year plus several hundred thousand yuan per person in annual ground crew costs, Zhao Qi, chairman of the company, told Caixin. If pilotless flying cars can replace helicopters, the cost of urban air transport could be drastically reduced, he said.

Quick hits /

China’s smartphone shipments fall nearly 13% in December amid virus flare-up

Luxury retailer Secoo looks to join exodus of Chinese companies from U.S. stock exchanges

Thanks for reading. If you haven't already, click here to subscribe.

- MOST POPULAR