CX Daily: New Pipeline Network Shakes Up China’s Natural Gas Dynamics

Natural gas /

In Depth: New pipeline network shakes up China’s natural gas dynamics

China’s recent love affair with natural gas is taking a new twist, following last year’s creation of a national pipeline network.

The shift has been shaking up the landscape in recent months among China’s three energy majors, China National Petroleum Corp. (CNPC), China Petrochemical Corp. (Sinopec) and China National Offshore Oil Corp. (CNOOC). Each is suddenly finding its position greatly altered following the creation of a modern national distribution network accessible to all.

That network came to life in October with the formal launch of China Oil & Gas Network Corp., also known as PipeChina. Years in the making, the new company took over the oil and gas pipeline assets, storage facilities and import terminals of the three state-run majors, with CNPC, which does business under the name PetroChina, contributing the most assets. The shift was meant to make the system more efficient and to open the door for competition among the three giants and potentially other future players by giving everyone access to the same national network.

PMI /

China’s manufacturing recovery takes a breather, Caixin PMI shows

China’s manufacturing sector expanded at the slowest pace in three months in June as growth in production and new orders softened, a Caixin-sponsored survey showed.

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, fell to 51.3 in June from 52 the previous month, according to a report released Thursday. A number above 50 signals an expansion, while a reading below that indicates a contraction.

Centenary /

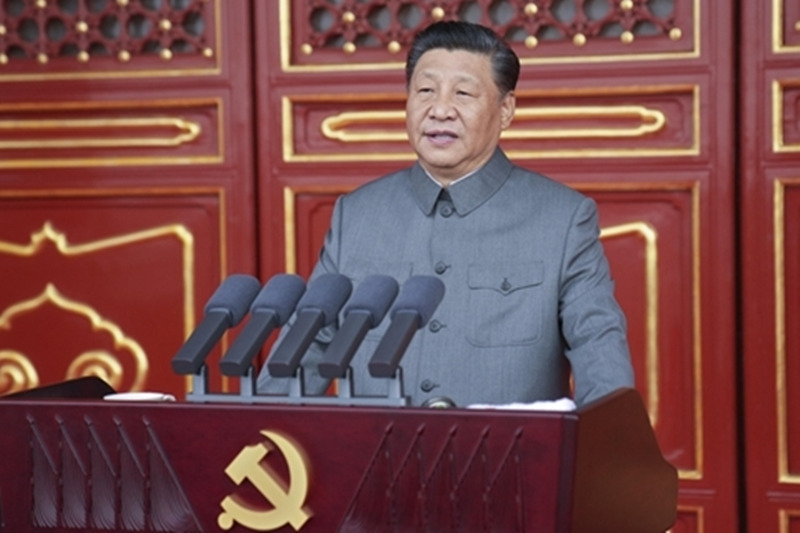

China has achieved goal of building moderately prosperous society, President Xi says

China has achieved the goal of building a moderately well-off society and is on its way to becoming a “great modern socialist country,” President Xi Jinping announced at an event celebrating the Communist Party’s 100-year anniversary.

“China has realized the first centenary goal of building a moderately prosperous society in all respects,” President Xi Jinping told a crowd of thousands gathered at Beijing’s Tiananmen Square Thursday morning.

He also said the country has realized “a historic resolution to the problem of absolute poverty.”

Banking /

Biggest China bank abandons $3 billion Zimbabwe coal plant

China’s biggest bank dumped a plan to finance a $3 billion coal-fired power plant in Zimbabwe, dealing a blow to coal developers in Africa that see China as the last potential funder of their projects.

Industrial and Commercial Bank of China Ltd. (ICBC) told Go Clean ICBC, an ad hoc body representing 32 environmental groups, that it won’t fund the 2,800-megawatt Sengwa coal project in northern Zimbabwe, according to a June 18 email seen by Bloomberg. The message was sent to 350.org, one of the Go Clean groups. ICBC didn’t immediately respond to a request for comment.

Rating /

Moody's downgrades Evergrande despite debt relief progress

Moody’s Investors Service downgraded China Evergrande Group’s credit rating by one notch to B2 as the debt-ridden property developer struggles to ease its debt crunch.

"The downgrade reflects Evergrande's weakened funding access and reduced liquidity buffer given its large debt maturities in the coming 12–18 months amid the tight credit environment in China and volatility in the capital markets," said Cedric Lai, a Moody's vice president and senior analyst, in a Wednesday statement.

Debt /

China tightens oversight of local government borrowing

China’s Ministry of Finance ordered that the allocation of quotas for local governments’ borrowing via special purpose bonds (SPBs) be linked to performance targets for the projects the bonds fund.

Authorities are moving to apply more rigorous oversight to trillions of yuan of local government debt taken on to finance public infrastructure and other projects that often don’t pay for themselves as intended, increasing risks associated with the borrowing.

Quick hits /

JPMorgan fund adds Chinese internet stocks hit by crackdown

Peoples of China and Singapore have greatly benefited from their ruling parties’ ties, Lee Hsien Loong says

BUSINESS & TECH

|

Reorganization /

Chinese offshore drilling rig giant gets $129 million SOE cash injection

China International Marine Containers (Group) Ltd. signed a $129 million strategic cooperation agreement with a state-owned enterprise to shore up its struggling marine engineering operations, the Shenzhen-based company said Wednesday.

State-owned investment company Yantai Guofeng Investment Holdings Co. Ltd. agreed to invest 835 million yuan ($129 million) in a joint venture with China International Marine Containers. The deal is intended to integrate the container enterprise’s money-losing marine engineering and fishery assets in the Yantai area and form a development platform for deep sea industries, the company said.

The global marine engineering industry is suffering from years of oversupply and sustained weakness in oil prices. Marine engineering companies are moving to transform or reorganize their businesses.

Property /

Property development glory days are over, Vanke says, as it hypes services

China Vanke Co. Ltd. said it will give more weight to real estate management and services as the country’s largest property developers tweak their business models to bolster profitability amid tighter government restrictions on borrowing.

The move heralds a shift away from the Hong Kong- and Shenzhen-listed firm’s focus on real estate development and toward a multi-pronged approach that balances other sides of its business, executives said at Vanke’s annual general meeting Tuesday.

IPO /

Didi gains 1% after second-biggest U.S. IPO by Chinese company

Chinese ride-hailing giant Didi Global Inc. closed its U.S. trading debut up 1% after raising $4.4 billion in an initial public offering (IPO).

The company’s American depositary shares opened Wednesday at $16.65, rising as much as 29% from the $14 offering price. The shares closed at $14.14, giving Didi a market value of about $68 billion. Accounting for stock options and restricted stock units, the company’s value exceeds $71 billion.

Consumer goods /

China’s cautious consumers give little lift to weak household goods market

China’s fast-moving consumer goods market experienced sluggish recovery as consumers remained cautious and tended to choose cost-effective foods, beverages and personal care products, according to a report from consultancy Bain & Co.

Sales of fast-moving consumer goods rose 1.6% in the first quarter this year compared with the same period in 2019, slower than the 3% growth achieved two years earlier, according to the report on the country’s shopper behavior published Tuesday. “Overall, growth is regaining traction but remains subdued,” the report said.

Quick hits /

Bubble-tea maker falls flat in Hong Kong trading debut

Christie's names media veteran to head China operation

China approves innovative new drugs for insurance price-setting talks

Energy Insider /

Energy Insider: Shanxi regulator warns of risks in power transactions; Datang clean energy unit names new chief

Thanks for reading. If you haven't already, click here to subscribe.

Today's CX Daily was compiled and edited by Kevin Guo (xinguo@caixin.com).

- MOST POPULAR