CX Daily: Swine Fever-Driven Pork Prices Lead to Biggest Surge in Inflation in 6 Years

Economy /

China's CPI nears 6-year high as pork prices surge

China’s consumer inflation hit its highest level in nearly six years last month as pork prices continued to soar on disruptions to supply caused by the African swine fever crisis.

The CPI, which measures the prices of a basket of consumer goods and services, edged up 0.2 of a percentage point to a 3% YOY rise in September, according to data released Tuesday by the National Bureau of Statistics.

The average pork price rose 69.3% YOY in September, up from 46.7% the previous month and the fastest growth since August 2007.

FINANCE & ECONOMICS

|

Banks in September extended 40% more new yuan loans compared with August. Photo: VCG |

Credit growth /

China credit growth accelerates though real demand remains weak

China’s recent monetary policy easing has shown some effect, but not enough to significantly lift credit growth.

China’s total social financing (TSF), a broad measure of credit and liquidity in the economy, grew by a net 2.27 trillion yuan ($320 billion) in September, higher than the net increase of 1.98 trillion yuan the month before and the year-ago growth of 2.21 trillion yuan, data from the PBOC showed Tuesday. Last month, banks extended 1.69 trillion yuan in net new yuan loans, up 40% from August, recording the biggest September growth ever.

Economist projected more-aggressive easing soon, such as rate cuts, but the impact may still be limited.

Industries /

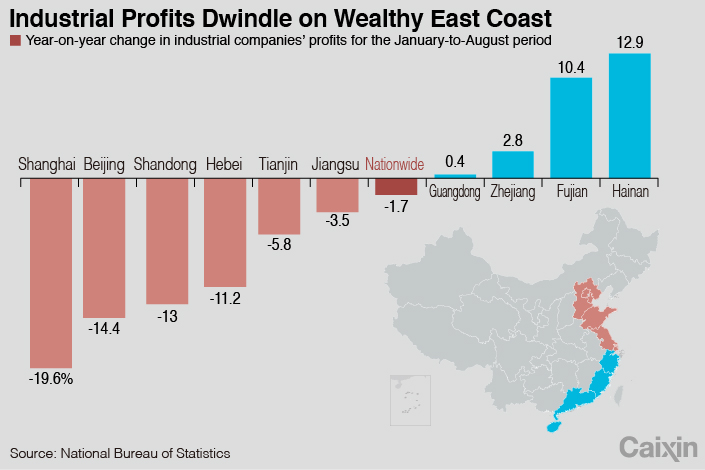

Chart: Industrial profits shrivel in China’s wealthy eastern regions

Multiple local governments in eastern China, one of the country’s most developed and wealthiest regions, reported plummeting industrial profits for the first eight months of the year, fueling concerns that the world’s second-largest economy is slowing further.

Of the 10 provincial-level regions, six recorded declines in industrial corporate profits year-on-year in the period from January to August, according to data from the National Bureau of Statistics (NBS).

Shanghai led the drop, posting a 19.6% plunge in profits. Beijing came second with a 14.4% decrease. Shandong, Hebei and Jiangsu provinces, as well as Tianjin municipality, also had declines.

|

Wealth mangement /

Banks get clarity over looming wealth management changes

As China’s financial institutions gear up to operate under a new regulatory system for the 100 trillion yuan ($14 trillion) asset management industry, the authorities clarified rules about the types of investments they will be able to offer customers.

The PBOC and the banking and securities watchdogs jointly released draft rules offering more specific definitions. Standard credit assets refer to asset-backed fixed-income securities, including government bonds, central bank bills, local government bonds, financial bonds, debt financing instruments of nonfinancial companies, corporate bonds and negotiable certificates of deposit, according to the draft rules published on the PBOC’s website Saturday.

Trade talks /

China has ‘no difference’ with Trump on state of trade talks

China's Foreign Ministry confirmed Tuesday that China has "no difference" with the United States on the state of trade talks, in reference to President Donald Trump’s declaration of a “substantial phase one deal” during last week’s trade talks in Washington. The two countries are expected to resume high-level negotiations next week.

The acknowledgment came four days after a Chinese trade delegation led by Vice Premier Liu He met with Trump Friday at the White House. The two sides had differed on the characterization of the outcome.

With Liu in attendance, Trump said, “we’ve come to a very substantial phase one deal.” Chinese vice premier took a more moderate stance, saying that “we are making a lot of progress toward a positive direction.”

Quick hits /

Citi to set up wholly owned securities business in China

Hong Kong’s Top Securities Regulator to leave in 2020

Paytm nears SoftBank, Ant Financial fundraising at a $16 billion valuation

Regulator Flags Risks of Concentration in Private Equity

China Caps Private Corporate Bonds to Stem Credit Risks

BUSINESS & TECH

|

The Trump administration has targeted Huawei and pressed allies to ban the Chinese company from taking part in local 5G projects. Photo: VCG |

Huawei ban /

Germany leaves 5G door open to Huawei, Reuters reports

Germany will not exclude China’s Huawei Technologies from its 5G mobile network construction despite pressure from the U.S. to cut off the Chinese telecom giant, according to Reuters.

Under newly finalized security rules, to create a level playing field Germany won’t bar a single vendor, Reuters reported, citing government officials. The so-called security catalogue will be published shortly.

German operators are all customers of Huawei and have warned that banning the Chinese vendor would add years of delays and billions of dollars in costs to launching 5G networks.

Cloud computing /

China’s fast-growing cloud computing sector still lags: report

Despite rapid growth, China’s cloud-computing market has a long way to go to catch up with the United States.

That’s the conclusion of a report published Saturday by the International Institute of Technology and Economy (IITE), a nonprofit research organ affiliated to China’s cabinet.

Although the value of China’s cloud computing market grew 39.2% YOY in 2018 to 96.3 billion yuan ($13.6 billion), its total size represented only around 8% of the U.S. market during the same year, the report says.

IPO /

Weather forecaster Moji’s IPO plan rejected

The operator of one of China’s largest weather forecasting apps, Beijing Moji Fengyun Technology Co. Ltd., had its share market listing plan rejected after the securities regulator raised a series of issues, including potential data privacy violations.

In a statement late last week, the CSRC said the company, known for its popular Moji Weather app, would need to resolve the issues, which also include questions about its business model, before it could be approved for a listing.

Citing a government probe into how the country’s mobile apps collect user data — which singled out Moji for poor practices — the CSRC said the company needed to prove that its collection policy complied with current rules and regulations.

Quick hits /

Bike-sharing app Ofo says it 'hasn’t given up'

Huawei offers ‘no backdoor’ deal to India amid security concerns: report

Apple under fire for handing over some web browsing data to Tencent

Alibaba defends 'Double 11’ practice

Bird Rides Scooter Maker Sees Profit Surge on Overseas Orders

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas