CX Daily: Ant Group’s $34.5 Billion IPO in Shanghai and Hong Kong Suspended

IPO /

Ant Group’s $34.5 billion IPO in Shanghai and Hong Kong suspended

Ant Group Co. Ltd.’s record $34.5 billion initial public offerings in Shanghai and Hong Kong were suspended reflecting increased scrutiny and toughened restrictions that may threaten the fintech giant’s microlending business.

The Shanghai stock exchange will suspend the listing amid changes in the regulatory environment, it said in a statement Tuesday without providing further details. The debut was expected for Thursday, the same day as the Hong Kong portion.

Shortly after the Shanghai bourse announcement, Ant Group said in a statement that the listing of the Hong Kong shares will also be suspended.

Would-Be Ant Investors Fear They’ll Be Left Holding the Bag

Regulatory challenges could dent Ant Group’s valuation, industry insiders expect

Hong Kong central bank seen selling debt to mop up cash after Ant’s IPO

FINANCE & ECONOMICS

|

The rules' publication comes at an inopportune time for Ant Group, whose planned dual listing in Shanghai and Hong Kong drew global attention. |

Lenders /

Ahead of Ant Group’s record IPO, China tightens online microlending rules

China’s financial regulators issued draft rules imposing more restrictions on online microlending activities, stepping up efforts to control risks in the sprawling sector just as fintech giant Ant Group Co. Ltd., one of the industry’s biggest players, was about to launch its world record $34.5 billion IPO.

The People’s Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) released draft rules (link in Chinese) Monday stipulating stricter standards for a range of operational and financial metrics including leverage levels, joint lending and cross-province business.

The rules aim to “regulate the online microfinance operations of microlenders, prevent risks from online micro loans, protect the legal rights and interests of microlenders and clients, and promote the healthy development of the online microfinance business,” according to the draft.

Oil /

China plans to import more oil as glut pressures prices

A sharp drop in oil prices may be about to get some relief from China.

Against a backdrop of sagging demand and signs of growing supply, the world’s biggest oil buyer raised the quota for use of overseas oil by nonstate entities next year by more than 20% versus 2020, according to an announcement Monday from the Ministry of Commerce.

The increase in the import quota is equivalent to about 823,000 barrels a day, which is slightly less than the amount that OPEC member Algeria pumps. The companies that will use the oil include private refiners, known as teapots, which have become increasingly important in the global oil market in recent years.

Bonds /

Prestigious university’s chipmaking progeny fails to buy back 1 billion yuan bond

State-owned chipmaker Tsinghua Unigroup Co. Ltd. said last week that it would not buy back a perpetual bond that was scheduled to be repurchased or have its coupon rate adjusted Friday.

The 1 billion yuan ($149 million) bond, which started to generate yields Oct. 30, 2015, comes with a coupon rate of 6.5% and is subject to a rate adjustment every five years if the issuer doesn’t buy back the bond.

Unigroup's yuan and dollar bond prices plummeted over the past few months, reflecting investor concerns over the company’s ability to meet its bond obligations.

Trade /

China blocks Australian timber imports in growing trade row

China suspended imports of timber from the Australian state of Queensland, China’s Foreign Ministry said Monday, expanding a trade clampdown amid souring relations between the two countries.

Ministry of Foreign Affairs spokesperson Wang Wenbin placed the blame on the Australian side in a news conference. “The Chinese customs has since January detected many cases of live pests in timber imported from Australia” that could “gravely endanger China’s forestry production and ecological security,” he said.

The measure is the latest in a series of bans and other trade barriers — including shipments of lobsters held up in customs in recent days — targeting Australian goods. The measures are seen as part of a pressure campaign against Canberra as tensions mount over issues including the coronavirus pandemic.

Quick hits /

Former Shanghai Pudong Development Bank executive falls under probe

Biden could ditch hawkish U.S. stance on China, top American scholar says

Opinion: China and the U.S. will still be at odds regardless of whether Trump or Biden wins

BUSINESS & TECH

|

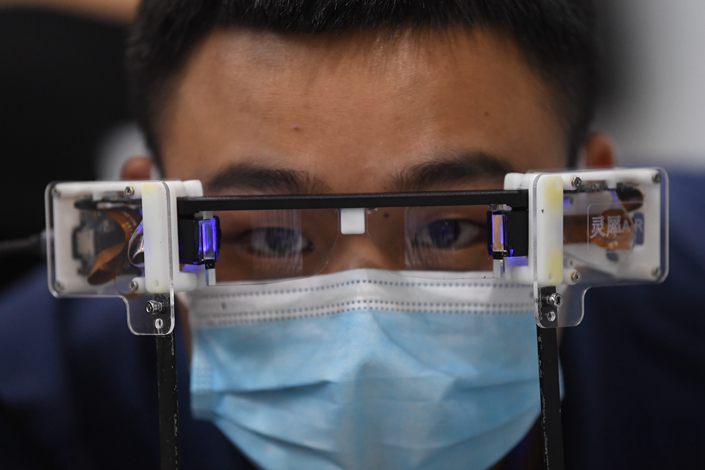

A visitor tries out a set of AR glasses on Sept. 17 at an industry event in Beijing. |

AR /

In Depth: Consumers give China’s AR startups a reality check

At the beginning of the year, the plan of a 62-year-old steel company in Central China’s Hunan province to upgrade its production line so it could forge a special type of steel almost ended before it even began.

Because of the Covid-19 pandemic, technicians from Germany and Austria were unable to come to China as planned to complete the installation and debugging of some of the crucial equipment needed for the line’s refit.

Unwilling to delay its plans, the company, Xiangtan Iron & Steel Co. Ltd. of Hunan Valin, got together with the local branch of China Mobile, Huawei Technologies Co. Ltd., and augmented reality (AR) startup HiAR to establish a 5G-driven AR network that would allow the foreign technicians to work on site without actually being on site.

Shell /

Shell acquires full control of Chinese gas station joint venture

Royal Dutch Shell Plc acquired full control of one of its gas station joint ventures in China as the oil major doubles down on the fuel retailing market in the world’s second-largest economy.

Shell agreed to buy the stake it didn’t already own in Chongqing Doyen Shell Petroleum & Chemical Co. and completed the deal Oct. 19, a company representative said following a Bloomberg inquiry.

The oil major paid about 1 billion yuan ($149 million) for 51% of the joint venture, according to a person familiar with the matter. That marked the full exit of Chongqing Doyen Shuorun Petrochemical Group Ltd. from the gas station chain, which was founded in 2006.

Drug stores /

Two pharmacy chains dismiss talk of merger as ‘rumor’

Two Chinese drug store giants went on the defensive after Reuters reported they were in “advanced talks” to merge via a share swap that would create the country’s largest pharmacy operator by revenue.

Shenzhen-listed Yixintang Pharmaceutical Group Co. Ltd., based in Yunnan province, told the bourse in a statement late Monday that the report it would merge with Laobaixing Pharmacy Chain JSC (LBX Pharmacy) was “untrue” and that it has no information to disclose. Also Monday, LBX Pharmacy head Wang Li told reporters that the story was “not at all true, purely a rumor,” the Beijing News reported.

Airlines /

Chinese airline losses narrow in third quarter

China’s aviation industry continued suffering from the fallout of the Covid-19 pandemic with net losses extending into the third quarter, although reviving domestic business helped some companies return to the black.

The six largest listed airline companies in China reported a combined net loss of 42.9 billion yuan ($6.4 billion) for the first nine months this year, extending the 39 billion yuan net loss of the first half, company financial reports showed.

The top three state-owned carriers — Air China Ltd., China Eastern Airlines Co. Ltd. and China Southern Airlines Co. Ltd. — posted combined losses of 26.7 billion yuan.

Quick hits /

Six die in south China gas terminal fire

China lowers NEV sales target for 2025

Didi’s budget service has a plan to subsidize rides for the long haul

Thanks for reading. If you haven't already, click here to subscribe.

- MOST POPULAR