CX Daily: China Will Not Immediately Fight Back Against Tariff Threats, Analysts Say

Trade war /

Beijing says it is in contact with U.S. on trade, calling for de-escalation

Chinese and U.S. trade delegations have maintained “effective” communications to create proper conditions for further negotiations, said a spokesman of China’s Ministry of Commerce, calling for a “calm attitude” in resolving the dispute.

“China has made clear that we firmly reject any escalation of the trade war and are willing to solve the problem through negotiation and collaboration with a calm attitude,” Gao Feng said Thursday at a weekly ministry press briefing.

“China has plenty of countermeasures, but under the current circumstance, what should be discussed now is about removing the new U.S. tariffs on $550 billion Chinese goods to prevent further escalation of the trade war,” Gao said. Analysts said the remarks signal that China will not immediately fight back following Trump’s latest tariff threats.

FINANCE & ECONOMICS

|

Markets /

Mainland capital floods into Hong Kong stocks for weeks on end

The value of Hong Kong stocks bought by Chinese mainland investors has exceeded the value of the stocks they sold for 16 consecutive weeks, the longest streak for around a year and a half. Amid volatility on the Hong Kong stock market, there has been a net inflow of mainland capital to the bourse via the Stock Connect programs.

The total size of the net inflow, which is calculated by subtracting the value of stocks sold from the value of stocks bought, reached HK$129 billion ($16.4 billion) since the streak began in mid-May, as of Thursday, according to our calculations based on data from data provider CEIC and Hong Kong Exchanges and Clearing Ltd., which operates the Hong Kong bourse.

M&A /

Dajia Insurance sets up 4 units to take over Anbang’s assets

Dajia Insurance Group, created to take over parts of fallen Anbang Insurance Group Co. Ltd.’s assets, moved to erase the name Anbang from China’s financial industry as it established four subsidiaries and outlined their business scope in a statement Thursday.

The four Dajia subsidiaries cover life insurance, property and casualty insurance, annuity insurance and asset management, Dajia said. Dajia was set up in June to receive Anbang’s life insurance, annuity insurance and asset management operations and some of the assets of its property and casualty insurance unit.

BUSINESS & TECH

|

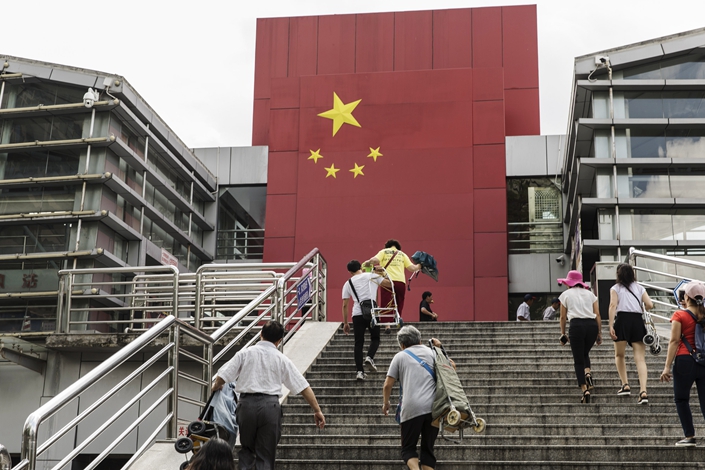

A border crossing facility at the Sha Tou Jiao Port of Shenzhen, China, on Friday, May 18, 2018. Photo: Bloomberg |

Trade war /

Most U.S. companies plan to stay in China despite trade war, survey suggests

When President Donald Trump ordered American companies last week to break off ties with China, he issued a directive that conflicts with the plans of a vast majority of large U.S. companies doing business there, according to a new survey of U.S.-China Business Council members.

Eighty-seven percent of respondents said they neither have moved nor plan to shift operations out of China, compared with 90% in a 2018 survey. Only 3% said their China operations were unprofitable, unchanged from a year ago.

Ride-hailing /

Didi Hitch convicted murderer executed

The man who was convicted of raping and murdering a Didi passenger last year — triggering national outrage over the safety of the company’s services — was executed Friday afternoon, according to a court in Zhejiang province.

The court found that Sichuan man Zhong Yuan, 27, raped and murdered a 19-year-old woman surnamed Zhao during a ride requested through Didi’s carpooling service Hitch on Aug. 24, 2018, in Zhejiang province. Zhong was also found to have forced Zhao to transfer 9,000 yuan ($1,260) to his account through WeChat.

E-commerce /

Group discounter Pinduoduo is now worth more than Baidu

E-commerce upstart Pinduoduo’s market cap reached $39.1 billion on Thursday, surpassing Baidu’s $36.5 billion, replacing it as China’s fifth-largest listed internet company.

While Alibaba and Tencent’s positions as China’s two most valuable listed internet companies remain stable, enterprises like Baidu, Meituan Dianping, JD.com, and Netease have moved up and down the rankings amid intense tech industry competition. Tencent-backed Pinduoduo debuted on the Nasdaq in July 2018 at the top of its IPO price range. Its share price has risen nearly 90% in a year.

U.S.-China /

Washington’s export controls hurt U.S. businesses in China: AmCham Shanghai

In an analysis of recent impacts of the Entity List and the Unverified List, the American Chamber of Commerce in Shanghai (AmCham Shanghai) concluded that U.S. export control regulations and other proposed policies on emerging technologies are “confusing and burdensome."

AmCham Shanghai added that such regulations often “place U.S. business entities at a competitive disadvantage while not substantially protecting U.S. national security and foreign policy interests.” The report outlined several complaints regarding recent U.S. policy developments on Chinese businesses, that have cost American firms in China revenue and reputation.

Quick hits /

When Elon Met Jack: Musings on AI, Mars and the end of civilization

In Obama-backed documentary, Chinese viewers see clash of ‘capitalism,’ not culture

Surprise blockbuster tops ‘Avengers’ in China cinema rebound

China’s Gaode Map teams up with automakers in ride-hailing services

Real estate giant Evergrande’s half-year profits sliced in half

Debt-ridden Leshi 1H net loss widens to $1.41 billion

Sunny skies overseas boost Chinese solar-panel makers

BYD in talks with Audi on battery supply: Bloomberg

Army of women earning $4 a day could be behind your next iPhone

Even more Chinese people are online now

State-backed media company Mango reports strong online video growth

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas