CX Daily: Taxing Rich SOEs

Private sector can own majority stake in some state enterprises

Private sector entities are allowed to hold a controlling interest in SOEs in certain highly competitive industries as a part of mixed-ownership reform, and they are also welcomed to invest in SOEs in certain “key” industries, an official of China’s top economic planner said, though it was not clear which industries the plan referred to.

The government will also intervene less in electricity generation and consumption for industrial and commercial use, push ahead construction of the power distribution network at the county level, and improve operation of the gas and oil network to make sure upstream energy enterprises have fair access, said Lian Weiliang, a deputy director of the National Development and Reform Commission, speaking at a press conference Wednesday.

Companies mainly involved in highly competitive industries have undergone the highest rate of mixed-ownership reform, at more than 73%, according to an official of the State-owned Assets Supervision and Administration Commission of the State Council, speaking in early 2018. However, questions remain about whether such companies achieved improvements to their governance structures and internal operations

FINANCE & ECONOMICS

|

Sinochem Chairman and CPPCC member Frank Ning. Photo: VCG |

Tax cuts /

State firm profits will pay for China’s tax cuts, Sinochem chief says

Chemicals giant Sinochem Group Co. Ltd. said the state sector will have to hand over more of its profits to the government to support broader tax cuts, in comments that signal the role SOEs will play in the country’s fiscal reshuffle.

Commenting on Premier Li Keqiang's annual government work report, which featured nearly 2 trillion yuan ($298 billion) in tax and fee cuts, Sinochem boss and CPPCC member Frank Ning said the government will have to offset lost revenue via other means, such as by increasing the share of SOE profits making their way into government coffers. The state sector will need to make sufficient profit for the tax cuts to take place all while pushing through industrial restructuring and upgrades, he said.

Missed payments /

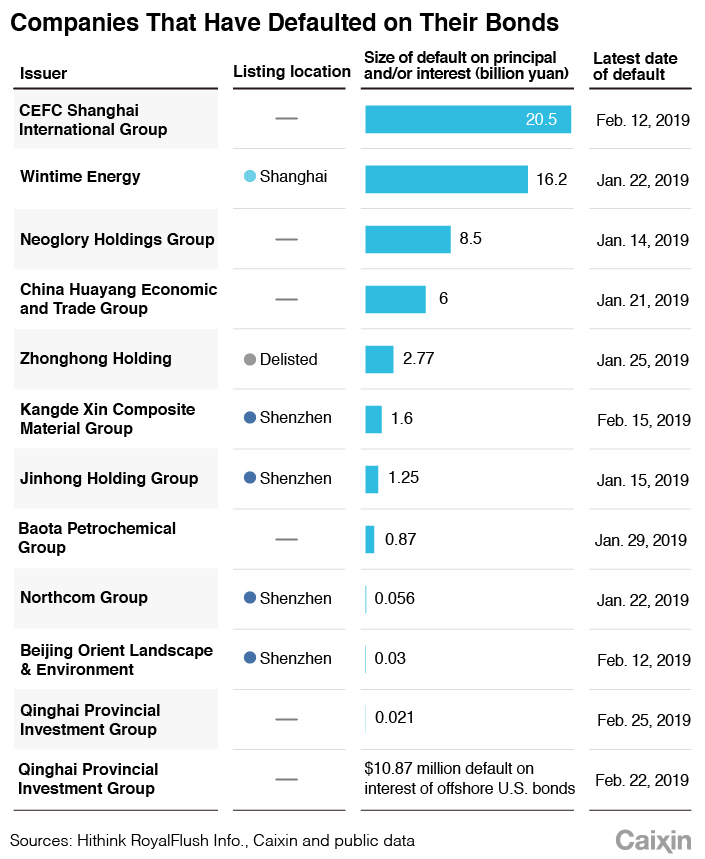

Wave of bond defaults continues in 2019

So far this year, at least 15 privately owned companies — five of which are listed and one that has delisted — have defaulted on 19 bond payments worth tens of billions of yuan, according to Caixin calculations based on data from financial data provider Hithink RoyalFlush Info.

|

Check out our breakdown of the biggest delinquencies.

Properties /

China probably won’t use real estate to boost economy

Real estate developers in China are unlikely to see the central government ease up nationally this year on its two-year campaign to rein in an overheated property market, analysts said, despite big fiscal efforts on the way to boost the cooling economy.

China’s government work report devoted fewer words than usual to the real estate market this year, despite its importance to the economy. “One key difference this time compared with previous easing cycles is that there has not been a broad relaxation of property controls,” as the government still appears to be concerned about rising home prices, said a research report by Capital Economics.

Local debt /

China’s most-indebted city in hot water over loan plan

Proposals to help resolve the financial problems of Zhenjiang, a city in Jiangsu province that’s one of the most indebted in China, have drawn ire from the Ministry of Finance as it risks running foul of regulatory efforts to clean up the mountain of on- and off-the-books borrowing by local governments.

A March 4 statement from the Jiangsu branch of the Central Commission for Discipline Inspection implied that the Ministry of Finance approved a debt disposal plan to defuse growing risks stemming from the Zhenjiang local government’s massive debts. However, a source close to the ministry disputed that the program referred to in the statement, now taken down, was the same as the ministry’s.

Opinion /

Beijing’s view of the trade war is very different from Washington’s

According to our senior finance reporter Lin Jinbing, Chinese Premier Li Keqiang couldn’t have expected signing off on Made in China 2025 to help trigger a U.S. investigation and later a trade war. To China's top leadership, it was simply a 2015 notice about a 10-year plan to move China up the high-tech value chain.

Overall, Lin writes, the U.S. seems to interpret "China’s acts, policies and practices related to technology transfer, intellectual property, and innovation" very differently from their Chinese counterparts, who say that some of the accusations are misleading and lack solid evidence. Check out his full analysis.

Quick hits /

• ‘Two Sessions’ grapple with private-sector finance

• Opinion: New high-tech board won’t transform China’s stock market

• Opinion: Changing China’s economy requires a difficult balancing act

• High-tech firms flee Beijing for better financing in Shanghai

• Policy bank head talks up risk containment

BUSINESS & TECH

|

Huawei /

Huawei gives source code access to select partners at new facility

Huawei has opened a cybersecurity facility in Brussels that will allow some partners access to the Chinese telecommunications company’s source code, the state-run Xinhua news agency said Wednesday.

The facility, named the Cybersecurity Transparency Centre, will showcase the company’s security and privacy protection features for products spanning 5G, IoT and the cloud, and will also allow some partners to access the code controlling all functions of Huawei products and programs, the company said.

Solar power /

China’s ‘artificial sun’ could rise this year

China plans to complete the construction of an "artificial sun" this year, a device intended to provide almost infinite clean energy by replicating the nuclear fusion process that occurs in stars, achieving temperatures above 100 million degrees Celsius.

This is according to an official at the China National Nuclear Corp. speaking to the state-affiliated Global Times. China also has plans to launch an "artificial moon" in the southwestern city of Chengdu to light up the city's night sky by 2020.

Bad deals /

Evergrande's crashed vehicle business of 2018

China’s second-largest property developer Evergrande expects its health unit to record a net loss of 1.4 billion yuan ($209 million) for last year, thanks to its investment in struggling electric car startup Faraday Future.

While the health business of Evergrande Health Industry Group “is expected to be stable,” with a net profit of around 300 million yuan, Evergrande Health’s new-energy vehicle business is expected to record a net loss of 1.7 billion yuan last year, according to a recent stock exchange filing, something the health unit attributes to its Faraday Future investment.

Electric cars /

Nio drops plan for Shanghai factory after Tesla beats it to the punch

Electric-car maker Nio Inc. is abandoning its 2017 plan to build a factory in Shanghai’s suburban Jiading district, the company said in a statement, announcing its decision two months after rival Tesla Inc. broke ground on a plant there.

The Nasdaq-listed company made the announcement as it released its 2018 financial results after Tuesday trading ended in New York. Net losses widened by 92% for the year to $1.4 billion, while losses in the last quarter more than doubled to $509.5 million. Nio’s stock price dropped more than 17% in after-hours trading.

Apple woes /

iPhone prices slashed on e-commerce sites for second time this year

Apple's latest iPhone models are being massively discounted in China for the second time this year with sources telling us price cuts are coming directly from the U.S. company.

E-commerce platform Tmall will lower the prices of almost all versions of the iPhone XR, iPhone XS and iPhone XS Max, by between 1,200 yuan ($179) and 2,000 yuan, according to a company statement. JD.com Inc. and Suning, other e-retailers, also revealed lower prices for Apple products.

Quick hits /

• China customs says it’s working with Tesla to resolve Model 3 holdup

• Facebook sues four Chinese companies for selling fake accounts

• KFC to promote communist hero at hundreds of outlets

• Uber goes solo on new HK service after local partner quits

• Laser company cut off from foreign stock buyers

Thanks for reading. If you haven't already, click here to subscribe.

- 1Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 2In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 5Over Half of China’s Provinces Cut Revenue Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas