CX Daily: It's Off to U.S. Prison for Patrick Ho

Hong Kong ex-official sent to prison in U.S. for bribery linked to embattled CEFC

A former Hong Kong official has been sentenced to three years in prison and fined $400,000 for bribing African officials on behalf of a major Chinese energy conglomerate, the U.S. Department of Justice announced Monday.

Patrick Ho, the former head of the Hong Kong Home Affairs Bureau, on Monday was sentenced in U.S. District Court for the Southern District of New York for paying millions of dollars in bribes to top officials in Chad and Uganda, the statement said.

Ho made the bribes in exchange for business favors for CEFC China Energy Co. Ltd. while using a U.S.-based nongovernmental organization to hide his criminal intentions.

Ho’s crimes are another blow to the embattled CEFC, which has had a turbulent time since its founder and former chairman Ye Jianming was placed under investigation and then stepped down last year. Since then, CEFC has missed payments on nearly 2.1 billion yuan ($329 million) of bonds, and has seen its deal to take a $9.1 billion stake in Russian oil major Rosneft fall apart, forcing the Chinese company to pay $257 million in compensation to the would-be sellers.

FINANCE & ECONOMICS

|

China's securities regulator has banned most institutional investors from using multiple accounts to make offline bids for newly issued convertible bonds. Photo: VCG |

Securities /

Regulator closes loophole in hot corner of bond market

Most institutional investors will no longer be allowed to use multiple securities accounts to bid on newly issued convertible bonds in offline auctions, China’s securities regulator announced.

The change closes a loophole in securities rules that had given certain types of investors an advantage over competitors in investing in convertible bonds, a type of security that the holder can convert into shares of the issuing company. It has become one of the hottest corners of the securities market this year.

Leadership /

Exclusive: China’s social security fund chief Lou Jiwei retires

Lou Jiwei, an outspoken former finance minister who has headed China’s 2 trillion yuan ($297 billion) social security fund since 2016, has retired from the post, we've learned.

Lou, 68, will be replaced by 58-year-old Liu Wei, a vice minister of finance, according to an internal announcement Monday at the National Council for Social Security Fund, which manages China’s national pension fund, which amounted 2.2 trillion yuan by the end of 2017.

Investments /

China’s sovereign wealth fund to invest in French companies

China Investment Corp., the country’s sovereign wealth fund, will set up an industrial cooperation fund worth between 1 billion euros and 1.5 billion euros ($1.7 billion) along with French bank BNP Paribas and private equity firm Eurazeo, people familiar with the matter told us.

The fund will invest in French companies demonstrating potential in Chinese markets, sources said. Sources close to China Investment Corp. said the fund aims to establish a cross-border ecosystem involving governments, industry players, financial institutions and third-party service providers.

Quick hits /

Opinion: China and the summer solstice of the German-American axis

Editorial: Governance of SOEs must adapt to the new international situation

Trump has scant power to bring manufacturing jobs back to the U.S., Chinese minister says

Merchants Bank exposed to $414 million investment loss in U.K.

BUSINESS & TECH An Apple store in the western city of Chongqing on Sept. 29. Photo: VCG

Supply chain /

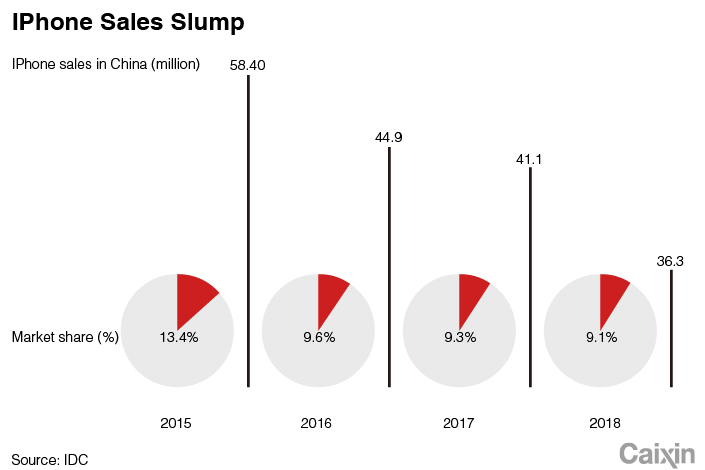

In depth: iPhone slowdown hits Apple’s Chinese manufacturers

Apple's iPhone price cuts have so far failed to soften the blow to manufacturers, who first felt the impact of the brand's slowing sales in November. That's when Apple told many of its suppliers that it was slashing orders, we've learned, some saying by as much as 30%.

|

In our deep dive, we look at the effects of Apple's slowing China sales on local manufacturers and how they are working to diversify revenue sources.

Reshuffles /

Exclusive: HNA casts off youngest board member as tech division downsizes

HNA Group has let go of director Tong Fu, the youngest member of its board who also headed its technology unit, marking the former high-flyer’s latest adjustment amid a government crackdown on debt-heavy conglomerates.

Several company sources told us of the latest departure, the fifth change to the company’s 11-member board since the death of co-founder Wang Jian in France last year. The company has continued a steady string of asset sales since Wang’s death, reversing a major buying spree that made it one of China’s most aggressive global acquirers over the last decade.

Boeing /

China deals blow to Boeing with large Airbus purchase

China has ordered 300 aircraft from Airbus SE in a $35 billion contract, dealing a blow to the European jetmaker’s archrival Boeing Co., whose bestselling jet model was grounded around the world after a deadly crash in Ethiopia.

The purchase, which consists of 290 A320-series narrow-body planes and 10 A350 wide-bodies, was signed during Chinese President Xi Jinping’s state visit to Paris Monday. State-owned China Aviation Supplies Holding Co. acted on China’s behalf.

Q&A /

Chinese iron ore demand will rebound this year: Australian exporter

Last year, net profits of Fortescue Metals Group Ltd. (FMG), the world’s fourth-largest iron ore producer, plunged 58% YOY to $878 million on the back of shrinking demand in China — its major market. The country’s iron ore imports dropped for a second month in November, plunging 8.8% YOY, dragging down imports in the first 11 months of 2018 by 1.3% to 977.89 million tons, according to customs figures.

FMG CEO Elizabeth Gaines told us that despite softer Chinese demand for the raw material for making steel, the industry is set to rebound with an estimated growth of 3% to 4% in 2019. Check out our Q&A.

More commodities /

Coal king predicts weak year amid industry overcapacity

China’s largest coal company, state-owned China Shenhua Energy Co., is lowering its operating targets for this year, aiming to produce 290 million tons of coal for commercial sales, down 6.6 million tons from 2018.

Shenhua expects 2019 operating revenue to fall 16.2% YOY, a decline of 221.2 billion yuan ($32.98 billion). Its coal sales will also most likely drop by around 34 million tons to 427 million tons — a 7% fall from last year — which the company attributed to caution in the industry after mine accidents led to stricter safety inspections and national environmental protection goals.

Quick hits /

Bitmain gives up listing plan amid market downturn

Beike online housing agent raises $800 million

Premium liquor Kweichow Moutai is cutting out the middlemen

State power giant weighs floating financial assets

Thanks for reading. If you haven't already, click here to get this briefing.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas