CX Daily: Manufacturing Activity Expands at Fastest Pace in Almost Three Years

PMI /

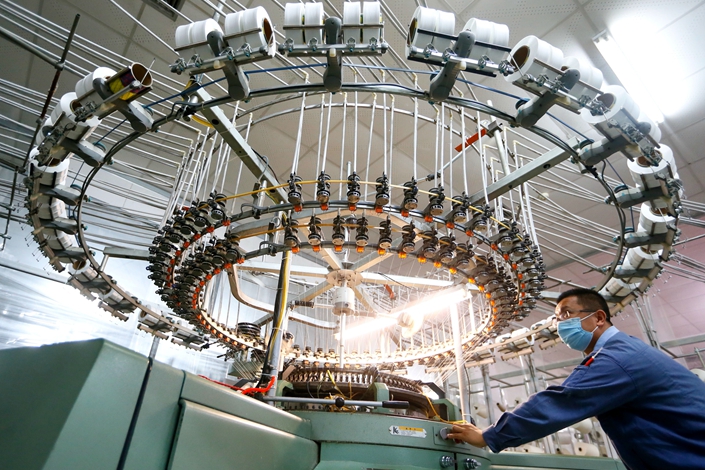

Manufacturing activity expands at fastest pace in almost three years: Caixin survey

The rate at which China’s manufacturing activity is growing rose to its highest point in nearly three years in November, driven by rising stocks of purchased items and stronger job creation, a Caixin-sponsored survey showed Monday.

The Caixin China General Manufacturing PMI rose further to 51.8 in November from 51.7 in the previous month. Though the rate was only marginally higher, it marks the strongest expansion since December 2016. Readings higher than 50 indicate expansion.

The gauge of new export orders recorded its first back-to-back monthly growth since early 2018. Coupled with rising domestic demand, total new orders rose strongly in November “with a number of firms citing firmer underlying demand conditions,” according to the survey. The reading dipped slightly from October when the growth rate was the highest in nearly six years.

FINANCE & ECONOMICS

|

China issues guidelines to regulate the credit ratings industry in a bid to better curb misconduct. Photo: VCG |

Policy /

Regulators unveil new rules to clean up credit ratings

China unveiled new regulations to tighten oversight and scrutiny of the credit ratings industry in the wake of a corruption scandal at one of the country’s largest providers of corporate rankings and a series of bond defaults by highly rated companies.

The measures, which will take effect Dec. 26, stipulate the responsibilities of credit ratings companies, what types of activities are banned – such as soliciting bribes or providing consulting services to bond issuers – and give details of punishments and fines that could amount to 50% of income received for a particular project or rating that is found to violate regulations.

Personnel /

Deputy Jiangsu governor to be named Bank of China president

Shanghai- and Hong Kong-listed Bank of China Ltd., one of China’s “Big Five” state-owned commercial banks, will name a deputy governor of Jiangsu province as its president, we've learned, filling a position which has been vacant for nearly half a year.

Wang Jiang has been a deputy governor of the wealthy eastern province since July 2017. Before taking on that role he was an executive vice president of Bank of Communications Co. Ltd., another one of the country’s big five lenders, for about two years.

Foreign firms /

World’s most famous hedge funds battle for recognition in China

BlackRock Inc., Man Group PLC and 20 other foreign firms licensed to run Chinese hedge funds — or private securities funds, as they’re known locally — amassed around 5.8 billion yuan ($825 million) of assets as a group till August, according to data compiled by Shenzhen PaiPaiWang Investment & Management Co. The meager haul — amounting to 0.2% of hedge fund assets in China — reflects a host of challenges.

International names like BlackRock don’t resonate much in China’s crowded market of close to 9,000 hedge funds, which has its own set of local stars. The limited name recognition is compounded by distribution hurdles. It all suggests a long wait before China turns into a meaningful source of profit for international money managers, which are desperate for new avenues of growth as clients in developed markets shift toward low-fee investments.

Financial easing /

PBOC signals policy to stay cautious amid uncertain data

China’s central bank governor sounded a cautious tone on the health of the global economy while signaling that the nation’s monetary policymakers will continue to refrain from large-scale easing steps.

Policy should be prepared for a “mid- and long-distance race” and stick to a conventional approach as long as possible, according to an article by Governor Yi Gang published Sunday on the WeChat account of Qiushi, the Communist Party’s flagship magazine. The comments were published a day after a factory gauge showed an unexpectedly strong improvement in November on a rebound in new orders.

Quick hits /

Is China’s once-booming P2P sector facing a dead end?

Caixin New Economy Index dips on drop in tech inputs

Exclusive: ICBC to name new supervisory board chairman

China’s regulator revises rules on banks’ capital replenishment tools

Overseas deposits pour into Singapore’s banks

China Postal Savings Bank listing draws lowest retail demand since 2015

China’s VC firm Bluerun Ventures raises $498 million for new fund

Varoufakis: The limits of Lagarde

BUSINESS & TECH

|

| Photo: VCG |

Surveillance /

China begins facial-recognition ID checks for SIM card buyers

Guidelines that require Chinese telecom carriers to use facial recognition technology on buyers of SIM cards kicked in Sunday as part of the country's efforts to curb scams, prevent terrorism and promote cybersecurity, according to the Ministry of Industry and Information (MIIT).

Companies should use AI or other measures on buyers to ensure they match the identification provided to purchase the SIM cards, according to a notice issued in September by the MIIT. Telecoms must also ensure that the SIM cards aren’t resold and that they are bought from legitimate businesses.

Personnel /

Xiaomi reshuffles top management as China market share shrinks

Chinese smartphone giant Xiaomi Corp. reshuffled its management team, the company said Friday in a letter to employees. Xiaomi co-founder and CEO Lei Jun said he will hand over the reins of president of the China region to Lu Weibing, who will also remain general manager of Xiaomi’s lower-end Redmi brand.

Lei took the position just seven months ago. Lu is charged with reversing Xiaomi’s sluggish smartphone sales in China. Xiaomi’s domestic sales fell 30.5% YOY in the third quarter, with the company’s market share dropping to 9.8%, according to industry tracker IDC. Other role changes include Lin Bin’s promotion to vice chairman from president of the company’s smartphone division and current Chief Financial Officer Chew Shou Zi’s appointment as president of the company’s international market.

SOEs /

Sinopec Group slims down amid push to reinvigorate state firms

China Petrochemical Corp., better known as Sinopec Group, plans to streamline its corporate structure by cutting its main business divisions to four from five, as the central government continues its push to make SOEs leaner and meaner.

For its reorganization, Sinopec Group plans to consolidate its five major business divisions into four: capital finance and support, refining and sales, chemical engineering, and oil, gas and new energy, according to an announcement on its website. It also decided to reduce the number of smaller divisions, such as mining area management, from 30 to 20.

Auto /

BMW wins approval for China electric-vehicle joint venture

BMW AG’s plan to produce electric vehicles in China won approval from the nation’s state planner, the company’s joint-venture partner said, as the massive 5.1 billion yuan ($725 million) project awaits another key approval before actual production can begin.

The Jiangsu branch of the National Development and Reform Commission approved the project Nov. 21, paving the way for construction to begin next year, according to a Friday announcement from Great Wall Motor Co. Ltd. Great Wall’s 50-50 joint venture with BMW, Spotlight Automotive Ltd., is developing the project and will be based in Zhangjiagang, East China’s Jiangsu province.

Quick hits /

China Unicom sets up Cambodian subsidiary

China Inc.’s growing presence in Singapore

China’s pet owners get into weirder wildlife

Beijing outlines plans for Yangtze Delta tech hub

Bytedance-backed gaming company to go public in Hong Kong

Shanghai lets tech firms apply for loans by pledging patent rights

Yangtze fishing ban leaves communities high and dry

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas