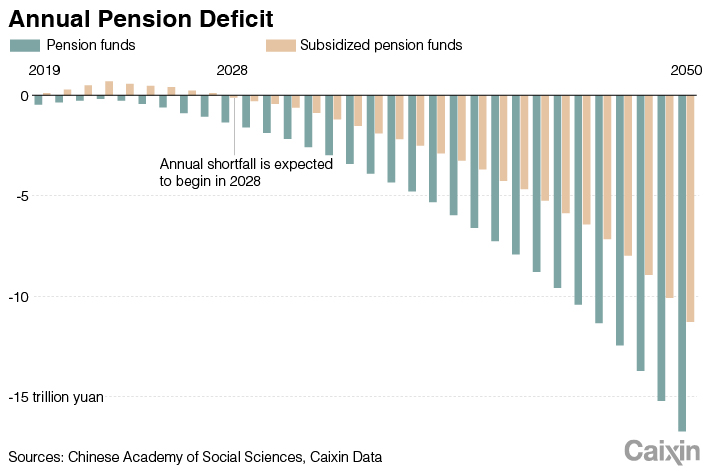

CX Daily: China's Looming Pension Shortfall, Visualized

China’s pension system is out of whack

Money that accumulated in China’s pension funds will fall to zero in 2035 after peaking in 2027 at 6.99 trillion yuan ($1.04 trillion), according to a report released by the Chinese Academy of Social Sciences (CASS).

|

FINANCE & ECONOMICS

Trade /

r'r

WTO rules against China on agriculture trade restrictions

China “regrets” that the WTO ruled against China in its dispute with the U.S. over grain import restrictions, the Ministry of Commerce said in a statement Friday. The international trade organization a day earlier found that China’s administration of tariff rate quotas isn’t consistent with its obligations to act fairly, predictably and transparently.

“China has always respected the WTO’s rules,” the ministry said, adding that the country will “properly handle (the issue) according to the WTO’s dispute settlement procedures and actively maintain the stability of the multilateral trading system.”

BRI /

Date of second Belt and Road Forum confirmed

China will host the second Belt and Road Forum April 25-27 in Beijing, Minister of Foreign Affairs Wang Yi said at a media briefing Friday.

President Xi Jinping will give the opening speech at the forum, and 37 top overseas government officials have confirmed their attendance, Wang said.

Default /

Bond defaulter’s troubles deepen as creditors circle

The debt crisis at laminating film manufacturer Kangde Xin Composite Material Group deepened Friday after its overseas subsidiary failed to honor a March commitment to pay $9 million of interest on a U.S. dollar bond traded in Hong Kong. Creditors who are owed more than 1 billion yuan ($149 million) are lining up to sue the company to recover their money.

Kangde Xin, based in eastern China’s Jiangsu province, said the unit couldn’t raise sufficient funds to make the payment, putting it formally in breach of contract, according to a statement filed with the Shenzhen Stock Exchange. The three-year, $300 million bond matures in March 2020, but interest is paid every six months.

SOE /

State firm takes over disgraced credit rating agency Dagong

Dagong Global Credit Rating Co. Ltd., a Chinese credit rating agency that has been banned from rating debt since August, has brought in a new strategic investor to help it reorganize.

After the investment, state-controlled China Reform Holdings Corp. Ltd. will hold 58% of Dagong, turning it from a privately owned company into a state-owned enterprise. China Reform Holdings will take over the restructuring of the credit rating company, the two companies said Thursday in a statement.

Quick hits /

Opinion: China in the new multipolar world

China needs to fight nonfinancial money laundering, global body finds

BUSINESS & TECH

Guangzhou, the capital of China’s Guangdong province and home to 100 A-share listed companies.

Pledged-share crisis /

Guangzhou is launching $3 billion bailout fund for private enterprises

The government of Guangzhou plans to set up a 20 billion yuan ($3 billion) bailout fund to help beleaguered publicly listed private enterprises mired in the country’s pledged-share crisis, becoming the latest local government to do so.

Local Chinese governments and financial institutions have set up rescue funds since October at the urging of the central government as part of a campaign to help stabilize the stock market. As of the end of November, local governments had rolled out special bailout funds totaling 170 billion yuan. In addition, financial institutions including brokerage firms, insurers and asset management companies launched bailout funds and bonds worth about 120 billion yuan.

Gaming /

Nintendo soars as Tencent wins Switch game approval in China

Nintendo Co. shares jumped after China’s Tencent Holdings Ltd. won approval to distribute one of the company’s games for its Switch console, a sign the Japanese company may benefit from growth in the world’s largest games market.

Tencent received approval for the test version of “New Super Mario Bros. U Deluxe” for the device, according to a notice on the website of China’s Guangdong provincial culture and tourism department. A Nintendo spokesman confirmed that Tencent has also applied for the sale of Switch hardware, without elaborating. Nintendo’s stock surged as much as 15%, the most on an intraday basis since September 2016.

Consumption /

China weighs new subsidies to spur home-appliance sales

The National Development and Reform Commission, China's top industry policy-setting body, outlined potential subsidies to encourage household purchases of home appliances as part of a policy package designed to expand domestic consumption.

The subsidies would apply to purchases of certain home appliances when certain energy-consumption, environmental and technology criteria are met. Discounts for a single item would be as much as 13% of a product’s price tag but no more than 800 yuan ($120) per item, according to a document we reviewed.

Consumption /

China's hog crisis is driving up global pork prices

Pork chops, chorizo and bratwurst could be more expensive in coming months as pork prices soar because of a virus that’s ravaging China’s hog industry.

Meat processors around the world are selling more pork to China to make up for shortages caused by an outbreak of African swine fever. The consequence is tighter supplies in the U.S. and Europe, which is pushing up prices. The trend is likely to continue as the disease quickly spreads throughout China, the world’s largest producer and consumer of pork.

Quick hits /

‘Avengers: Endgame’ has made 400 million yuan in China – and it’s not even out yet

Education services provider Gaosi raises $140 million

China stock photo giant fined for trying to copyright black hole

Huawei takes second crack at Brazilian smartphone market

WuXi Apptec gobbles up subsidiary for small molecule drug push

Thanks for reading. If you haven't already, click here to subscribe.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas