CX Daily: China’s New Lending Interest Rate Reform May Benefit Only Some

Interest rates /

Lending rate reform could benefit big borrowers most, analysts say

Analysts are skeptical as to whether China's reforms to lending interest rates to make them more market-oriented will actually lower them. Economists at Nomura said “the new LPR (Loan Prime Rates) regime and the PBOC quasi-policy rate cuts could favor big state-owned borrowers while delivering few benefits to small and medium-sized enterprises (SMEs),” as looming growth headwinds and financial risks have been making banks more risk averse.

Similarly, economists at China Merchants Securities said that if the implicit floor on lending rates is eliminated, the borrowing costs of big companies will probably decline substantially. But more policies will be needed to lower the borrowing costs of SMEs, which are relatively high risk and have little bargaining power.

China's central bank announced over the weekend that the benchmark lending rates set by the bank will be replaced with new national LPRs — which will be based on the interest rates that a basket of 18 commercial banks charge their more creditworthy borrowers — as a new reference point for lending.

FINANCE & ECONOMICS

|

Ping An Finance Center, a landmark in Shenzhen, China, Nov. 5, 2018. Photo: VCG |

State planning /

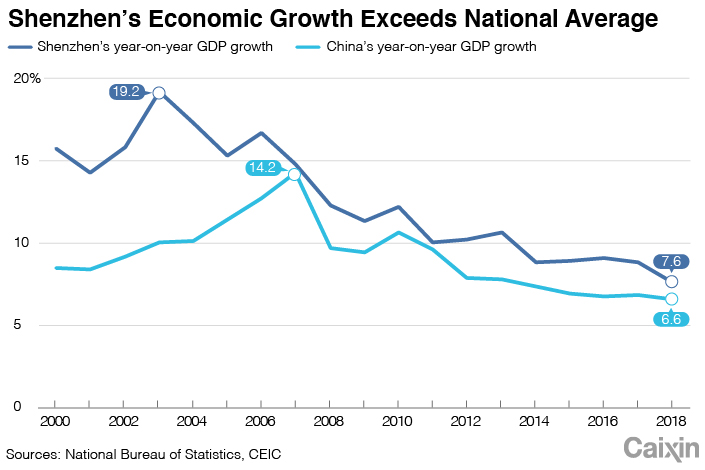

China wants to make Shenzhen an example to the world

China wants to build Shenzhen into a city with world-class economic competitiveness and innovation to support its creation of the Greater Bay Area, even as Hong Kong slashed its 2019 growth forecast last week to 0% to 1% in face of a global slowdown, the trade war and mass protests.

|

The goal is to make Shenzhen one of the top global cities in terms of its economy and research and development capabilities by 2025, according to a document issued by the Communist Party of China and the State Council, the official Xinhua News Agency reported Sunday. By midcentury, the government wants Shenzhen to serve as an example for all other cities in the world in terms of its economic competitiveness, influence and innovation capabilities.

Oil / Venezuela

PetroChina pulls back from Venezuela oil as U.S. sanctions tighten

China National Petroleum Corp. (CNPC), China’s biggest energy company, has canceled plans to load about 5 million barrels worth of Venezuelan oil onto ships this month after the Trump administration tightened sanctions against the South American nation, according to people with knowledge of the situation who asked not to be identified.

CNPC joins Turkey’s largest bank, Ziraat Bank, which severed its relationship with Venezuela’s Central Bank following sanctions. The moves represent a setback for Venezuelan President Nicolas Maduro, who has been counting on both China and Russia to keep the country going amid a humanitarian crisis, food shortages and hyperinflation.

HSBC /

Ping An Insurance defends investment in HSBC

Chinese insurance giant Ping An Insurance (Group) Co. of China defended its investment in HSBC Holdings as a “pure financial investment” as the surprise exit of two senior executives at Europe’s biggest bank raised speculation.

“We know the company very well, and it pays a high dividend,” Ping An Co-CEO Li Yuanxiang told investors Friday while discussing first-half results. Ping An is the biggest shareholder in HSBC, holding 7.01% as of November 2018, according to HSBC’s first-half financial report. HSBC pays an annual dividend of about 6.2% of its share price, which matches the insurer’s long-term liabilities, and has a sound business, Li said on why the bank was chosen.

Quick hits /

Prime minister says Singapore wants to stay good friends with China and U.S.

Standardized notes aim to boost liquidity for smaller financial institutions

Businessman gets probation for surrogacy bribe

Regulator penalizes 22 at Kangmei for $12.6 billion of overstatements

BUSINESS & TECH

|

A Fedex van in Hangzhou, East China's Zhejiang province, on July 26, 2019. Photo: VCG |

U.S.-China /

FedEx package contained handgun: Official media

A Xinhua article describing the discovery of a handgun in a FedEx package in Fujian province is the latest development that threatens to complicate an ongoing investigation into the logistics company's conduct in China.

The incident occurred in the city of Fuzhou, where the gun was found in a delivery from a U.S. client destined for a sporting goods company, according to the article. The development was reported by the public security bureau in the provincial capital’s Jin’an district. The gun was seized by Fuzhou police, according to the report, which did not provide further details.

Huawei /

Sanctions-hit Huawei to open new R&D centers in Russia: Reports

Huawei reportedly plans to recruit some 1,500 people for new R&D centers in Russia, a move that hints that the world’s largest telecom company is pivoting toward other markets as it faces down sanctions and suspicion from many Western countries.

Huawei intends to recruit 500 people by the end of 2019 and attract a further 1,000 new specialists over a period of five years, the influential Moscow-based business daily Vedemosti reported Thursday, citing an unnamed Huawei representative. If true, the move would nearly quadruple Huawei’s total R&D personnel in Russia. The company currently has two R&D centers in Russia, in Moscow and in St. Petersburg.

Misconduct /

Former steel boss expelled from Communist Party

A former top official at a state-owned steel heavyweight that went bankrupt after massive accounting fraud was exposed has been expelled from the Communist Party of China following an anti-graft investigation.

Zhao Mingyuan, former president and party chief of Dongbei Special Steel Group Co., will now be transferred to prosecutors to determine possible charges. The move follows a half-year investigation that found Zhao had committed a “series of violations of discipline and law,” according to the commission for discipline inspection of Liaoning province. Zhao could face charges related to falsified accounting involving a listed company, as well as taking bribes.

Huawei /

Trump says Apple’s Cook concerned about losing edge to Samsung with tariffs

President Donald Trump said Apple Inc. Chief Executive Officer Tim Cook voiced concerns about chief competitor Samsung Electronics getting an edge because its products, unlike Apple’s, won’t be subject to tariffs when imported by the U.S.

Trump described his Friday conversation with Cook to reporters, saying that Cook made a “good case” about the difficulty in competing with Samsung if Apple products are subject to import tariffs. Levies on the iPhone, iPad, and Apple laptops have been pushed back to Dec. 15, but a 10% tariff hit on the Apple Watch, AirPods, and many accessories is still planned for Sept. 1.

Quick hits /

Cathay Pacific CEO Hogg resigns amid Hong Kong protests

After Huawei announcement, Chinese firms get keen on smart screens

Xiaomi, Oppo, Vivo to launch ‘AirDrop’

Oppo to unveil new smartphone with 20x zoom

Ninebot’s new scooter can drive itself back to charging stations

Alibaba-backed streaming site’s period drama gamble pays off

The mere mortals behind China’s ‘god song’ industry

As China rolls out commercial 5G, experts are split on take-up speed

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas