CX Daily: The Dizzying Speed of China's Foreign Investment Law Update

China fast-tracks new Foreign Investment Law

On March 8, the NPC — China’s top legislature — held the third and final reading of the new draft Foreign Investment Law, considered one of the most important items on this year’s legislative agenda. A vote on the bill is set for March 15.

China's first new foreign investment law in decades is a sweeping measure, intended to replace and update three existing statutes. It would legally establish the principle of equal treatment for foreign and domestic investors and stresses the barring of forced technology transfers, a focal point of trade tensions with the U.S.

At the same time, policymakers are pushing the measure through China’s legislative process at breakneck speed. Some academic experts and foreign business groups have voiced concerns that the draft law lacks crucial detail on national security reviews of foreign investment, that it would still impose excessive document-filing requirements with multiple layers of government, that local authorities would still have too much power over foreign investments and that it doesn’t go far enough to prohibit forced technology transfer.

In our deep-dive, we look back on the law's decades-long history, sudden acceleration and contentious outlook.

FINANCE & ECONOMICS

|

The 13th National People's Congress in Beijing, March 8, 2019. Photo: VCG |

Question /

Should local governments be allowed to set foreign investment policy?

A key question left over by China's upcoming landmark new foreign investment law is whether local governments should be allowed to set their own policies to promote foreign investment, which was the focus of much debate at a meeting Saturday of the CPPCC.

According to the latest version of the draft law, “local governments at or above the county level may formulate policies and measures to promote and facilitate foreign investment within their statutory authority.” However, some argue that allowing local governments to set preferential policies may result in a “race to the bottom” that would harm the public interest in the long run, and risks giving foreign companies better treatment than domestic firms.

How should the national law balance regional differences? Send us your take by hitting "reply."

MSCI /

Foreign investors will get more tools to bet on Chinese stocks

Plans are afoot to give international investors trading stocks in China the ability to hedge their risks and better manage their exposure to the mainland equity market by introducing futures contracts on the MSCI China A Index, which represents the A-share portion of MSCI’s flagship Emerging Markets Index.

The operator of the Hong Kong Stock Exchange said Monday it has signed a license agreement with the global index provider, to introduce futures contracts on the index, which will by November comprise 421 large- and mid-cap A-shares which are available to foreign investors through the Stock Connect programs that link mainland and Hong Kong markets. The new contracts, which will be listed and traded in Hong Kong, will enable investors to bet on or against the A-share market and protect them from adverse price movements.

Trade war /

Beijing wants enforcement mechanism in U.S. trade deal to work both ways

China remains positive on the outlook for a deal that would de-escalate the trade war with the United States, but any enforcement mechanism included in the agreement must be binding on both sides, Vice Commerce Minister Wang Shouwen said Saturday.

China and the U.S. are reported to be close to an accord that would end their nine-month trade dispute. But the U.S. is pushing China to accept as a condition of the deal a mechanism to allow Washington to regularly review Beijing’s compliance with terms of the agreement and put tariffs back in place should it fail the verification.

Price indexes /

Consumer inflation dips for fourth straight month in February

Consumer inflation in China weakened for the fourth straight month in February, government figures showed Saturday, led by lower pork prices. The consumer price index rose 1.5% last month from a year ago, down from an increase of 1.7% in January, according to official data. It has not been this low since January 2018.

Meanwhile, the producer price index rose an anemic 0.1% in February from a year ago, the same rate as in January, official figures show. Weak pricing power will put pressure on corporate earnings, hampering the ability of firms to hire and invest.

Liquidity /

Credit growth slows following January’s record high

China’s total social financing (TSF), the country's broadest measure of credit, grew by a net 703 billion yuan ($104.6 billion) in February, central bank data showed, well below the record high increase of 4.64 trillion yuan in the previous month, which central bank officials said was partly due to seasonal factors.

Judging from the data for the first two months of 2019, the previous TSF slowdown seen last year has been halted, PBOC governor Yi Gang said at a Sunday press briefing.

Quick hits /

• Legislator admits some governments’ unofficial debt exceeds limit on official borrowing

• China drafting property tax law, NPC to consider ‘when time ripe’

• China to overtake U.S. as largest insurance market by mid-2030s

• Central bank says still room for reserve ratio cut but less than before

BUSINESS & TECH

|

People walk past wreckage of Ethiopian Airlines Flight ET 302 on Sunday near the town of Bishoftu, about 60 kilometers southeast of Addis Ababa, Ethiopia. Photo: VCG |

Ethiopia crash /

China grounds Boeing 737 Max 8 planes after deadly crash

China’s Civil Aviation Administration ordered airlines across the country to ground all Boeing 737 Max 8 aircraft by 6 p.m. Monday, after a jet plane of that model crashed in Ethiopia killing more than 150 people.

Investigators were still working to determine the cause of the Sunday crash, the second suffered by that jetliner model in less than six months. Of a total of 355 Boeing 737 Max 8 flights set to take off today from airports around China, at least 29 had been canceled by mid-afternoon, and 256 had been transferred to a different model of aircraft, according to industry data provider VariFlight.

Earnings /

Meituan Dianping’s adjusted loss was nearly 200% wider in 2018

Hong Kong-listed food delivery giant Meituan Dianping’s adjusted loss was 8.52 billion yuan ($1.27 billion) as of the end of the year, a 198.6% YOY surge.

Meituan’s annual revenue for the same period increased 92.3% to 65.23 billion yuan while its unadjusted loss was 115.49 billion yuan. Since Meituan’s purchase of bike-rental company Mobike in April, the business resulted in a loss of 4.55 billion yuan.

More Meituan woes /

Mobike shuts down operations in ‘some Asian countries’

Mobike will shut its operations in “some Asian countries,” the shared-bike giant’s parent company Meituan Dianping said Monday, without specifying which ones.

According to the statement, the changes are intended to improve the business’s overall efficiency. Prior to Meituan’s announcement, Chinese media had reported that Mobike was considering closing all global businesses, echoing similar moves by rival Ofo. Beyond affecting more than 10 staffers, Meituan and Mobike declined to provide further details.

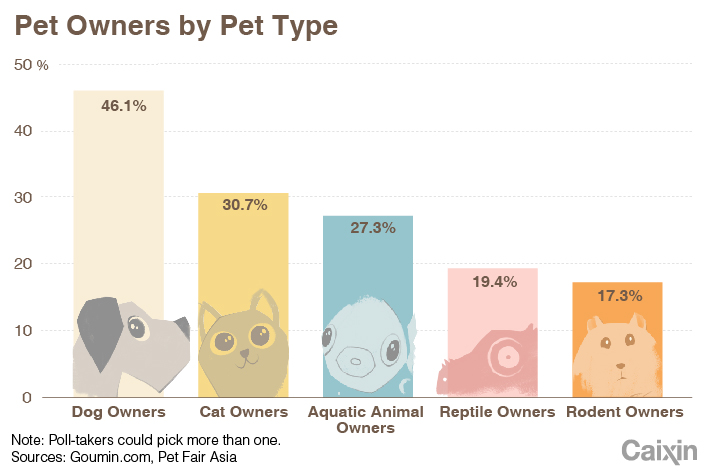

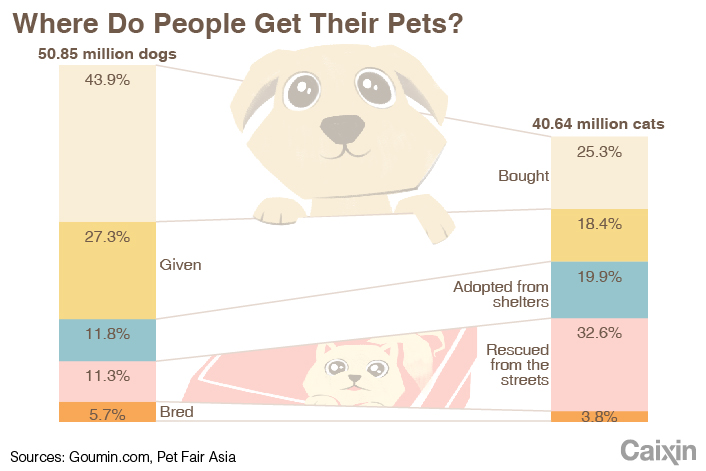

Cats vs. dogs /

China’s pet market fetched 27% more in 2018

The value of the country’s pet market reached 170.8 billion yuan ($25.4 billion) in 2018, up 27% from the previous year, a report from pet information provider Goumin.com said.

|

|

Last year, pet owners spent an average of 5,016 yuan ($746) per pet, up 15% from 2017, the report said. Pooches are particularly pampered. The report shows that on average about 5,580 yuan were spent on each pet dog annually, compared with 4,311 yuan on each cat.

Quantum race /

China's quantum-powered satellite is ready for encrypted communication

China’s first quantum-powered communication satellite Micius, also known as Mozi, can now satisfy the “basic needs” of ultra-secure communication, the satellite’s leading architect Pan Jianwei said during a CPPCC press conference.

The satellite's communications are enabled by developments in quantum mechanics, which would allow two parties to exchange messages via encrypted "quantum keys" secured by a special quantum state. The satellite was launched in 2016, and China hopes the probe can perform more long-distance quantum-secured communication trials soon.

Quick hits /

• Biotech firm seeks $96.6 million listing on new high-tech board

• Legislator worries that chemicals industry, independent oil refiners won’t mix

• Slashing Beijing-Shanghai line’s registered capital was 'technical move,' operator says

• China's demand for tea is boiling over

• Alibaba continues to invest in delivery with purchase of stake in logistics leader

Thanks for reading. If you haven't already, click here to subscribe.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 4Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas