Year in Review: China’s Financial Market in 2020 — More Opening, More Regulation

Efforts to bring China’s financial risk under control have been a focal point of reforms in the last few years. Regulators have been resolute, adopting a wide range of new rules and exerting stricter oversight of previously neglected areas.

But in order to avoid a significant shock to the economy, they have taken a cautious approach, allowing long grace periods before implementing the most important changes such as the asset management overhaul.

The new Foreign Investment Law, together with its implementation rules and related Supreme People’s Court interpretation, came into force in January. The underlying legislative intent is to allow foreign investors to enjoy pre-establishment national treatment in China. Notably, the law emphasizes the protection of foreign investors’ rights and interests, especially intellectual property.

Read more

In Depth: New Foreign Investment Law Goes on Fast Track

A slew of detailed regulations have also come out to address various concerns of foreign investors, including a new regulation issued in October 2019 to improve business environment and new rules issued in 2020 to handle foreign investment complaints.

China will continue reform and opening up domestically as well as improving market access and investment scope for foreign investors.

More financial opening can be done, particularly opening of financial accounts and moving to full convertibility of the capital account, but such changes will take longer to execute than others.

Financial opening-up

In April 2018, President Xi Jinping reiterated that the country’s financial sector would be opened up to foreign investors, promising change would come “as soon as possible.” The pace of financial opening-up has accelerated since then, and regulators released a timetable for the implementation.

• It was announced in 2019 that limits on foreign ownership of Chinese financial institutions would eliminated. This includes banks, life insurance and asset management companies, as well as securities, funds and futures companies.

• The QFII and RQFII investment quota limits were abolished in 2019, followed by the integration of the two schemes this year.

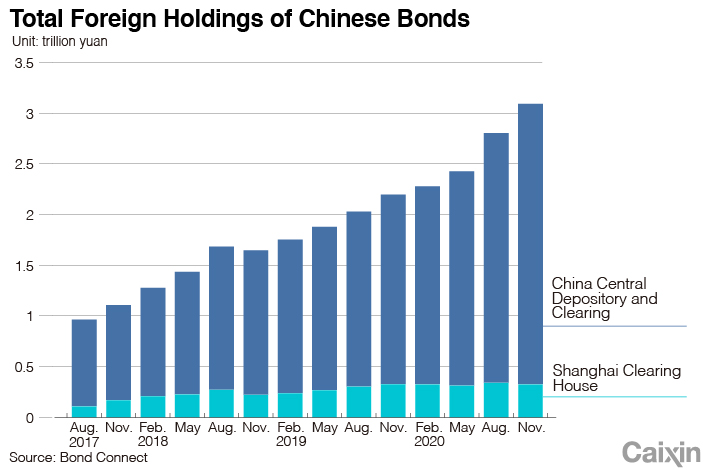

• Foreign investors were also permitted access to a wider investment scope including interbank bonds, credit rating and underwriting business in 2019.

• Foreign investors operating in the domestic bond market were exempted from corporate tax and value-added tax in 2018.

• The quota of the Stock Connect, a scheme linking the A-share market and the Hong Kong Stock Exchange, was quadrupled in 2018.

The moves were welcomed by foreign investors and regarded as steps in the right direction. Goldman Sachs took control of its Chinese securities joint ventures with a 51% stake, Blackrock got a wholly-owned fund license, and Standard & Poor’s started to conduct credit rating activities in China.

As a result of concrete operational enhancements, China experienced significant and high-profile index inclusions in both the equity and debt markets in the last three years. All major international index providers, including MSCI, FTSE Russell and S&P, have begun inclusion of China domestic stocks and bonds on their global indexes, bringing robust foreign inflows, mostly from passively managed funds, into the country’s financial market.

|

Read more

In Depth: Progress and Pitfalls for Foreign Investors in China’s Capital Markets

By gradually opening up to foreign players, the structure and quality of China’s financial market will be optimized. Local financial institutions, especially brokerages, are striving to consolidate and become stronger. And the transition from overreliance on retail investors to professional institutions can increase the market’s efficiency.

Registration-based IPO reform

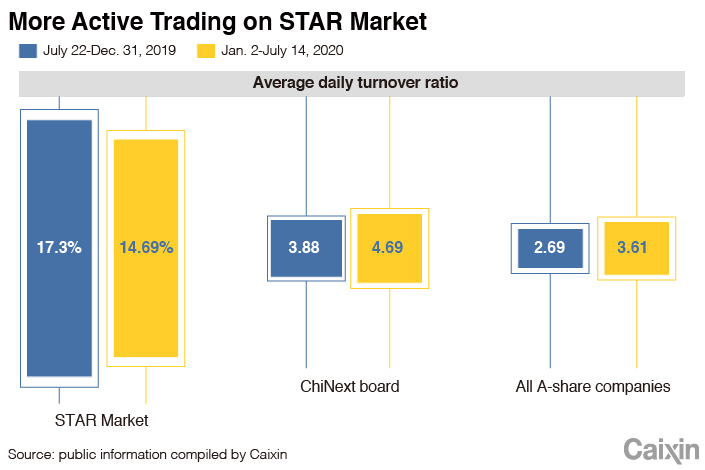

Registration-based IPO system reform was announced by President Xi in November 2018, along with the launch of a “technology innovation board” in Shanghai. A market-based registration system for new listings aims to resolve shortcomings in the lengthy and bureaucratic IPO process.

|

Read more

In Depth: ChiNext Tests Expanding Registration-Based IPOs to Overall Market

In 2019, the STAR Market high-tech board officially opened for business. In 2020, China extended its registration-based rules to the ChiNext startup board in Shenzhen. And reform is expected to steadily expand to the main board in the coming years.

Regulating fintech

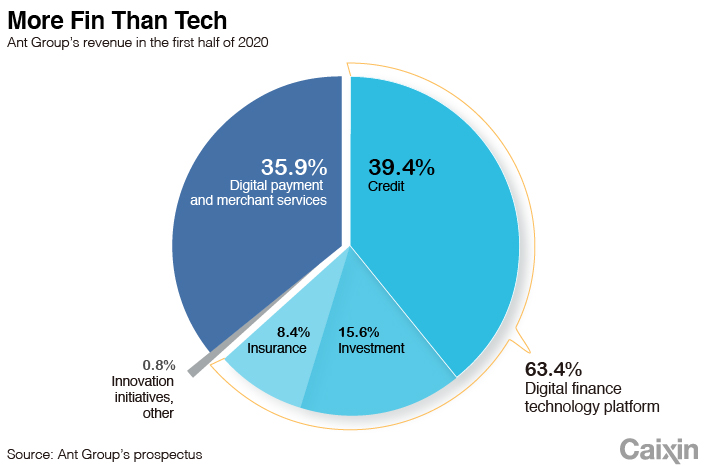

China has a leading role in the adoption of technology-led solutions for financial markets. While trying to strike a balance between innovation and risk control, regulatory agencies seem determined to supervise fintech companies as financial companies, and mitigate the risks they bring.

|

In November, fintech giant Ant Group’s would-be record initial public offering was suspended by regulators. Ant was asked to adapt to new microlending regulations, and would be subject to the same capital adequacy and leverage requirements as traditional financial institutions.

Jasper Liu is a senior analyst of Caixin Global Intelligence, the research arm of Caixin Global (cgi@caixin.com)

Contact editor Joshua Dummer (joshuadummer@caixin.com)

This article is part of a 10-part series. You can find links to the others below.

Year in Review: China’s Economy Gets Back on Track, but Faces Long Road Ahead

Year in Review: Finance in China in a Word — Deleveraging

Year in Review: China’s Careful Exit From Pandemic’s Fiscal and Monetary Policy

Year in Review: China’s Diplomacy in 2020 ― ‘Wolf Warriors’ in Action

Year in Review: 2020 Exposes Gray Rhino Risks in China’s Financial Sector

Year in Review: Once Darlings, China Tech Giants Face Growing Scrutiny at Home and Abroad

Year in Review: The Year Covid-19 Changed Everything

Year in Review: Drive to Overturn Wrongful Convictions Gains Momentum

- PODCAST

- MOST POPULAR